No matter their size, businesses are foremost measured by their profitability. Managing revenue is an item that is always at the top of the agenda whether someone is running a local shop or a nationwide corporation. When it comes to keeping track of payments between businesses, companies have additional facets to monitor and hitting snags during the process can be costly to a business’s bottomline.

Rather than depending on information from scattered spreadsheets and Slack messages, Growfin launched a SaaS solution that works to connect everyone involved with an invoice payment, provide them with real-time payment status insights and enable businesses to convert booked revenues into cash. The customer relationship management (CRM) platform uses AI to automate accounts receivables for B2B companies, helping finance, sales and customer success teams collect revenue faster and more efficiently.

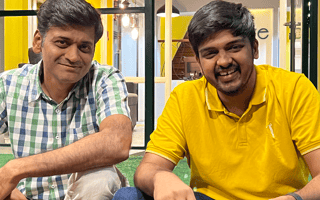

The company was born from the minds of Aravind Gopalan and Raja Jayaraman, formerly of enterprise software company Freshworks. While building SaaS platforms at scale, the two noticed that managing receivables became increasingly challenging as the business grew. After conducting research with several finance companies, they learned that the tools those businesses were using were useful for processing invoice creation, delivering invoices and providing payment options, but the systems had poor overall efficiency at managing receivables.

“Growfin is squarely aimed at solving AR challenges by creating transparency in the payments journey with a one-stop solution,” Gopalan, the company’s CEO and co-founder, told Built In via email. “At a product level, collections strategy in the Growfin platform allows businesses to automate personalization at scale. The built-in collections CRM allows each stakeholder to manage customer relationships at an individual level. Growfin’s Health Score can help enterprises proactively identify delays in payments and begin a dialogue in advance to ensure payments arrive on time.”

Today, the company provides B2B businesses with tools to automate their revenue collection strategies, streamline cross-team collaboration, track revenue collections and measure their collection performance. Its customer base includes names like Intercom, Darwinbox, Airmeet, Locus.sh, Whatfix and MonetizeMore.

Going forward, Growfin hopes to increase its customer base by 10x over the course of a year, according to the company, and it raised $1.4 million in funding to do so. The company’s seed round came by way of 3one4 Capital and angel investors. The funding will go toward gaining early traction and making the product fit for the market, Gopalan said.

Along the way, Marietta-based Growfin is hiring additions to its team of 20 with a focus on expanding its product and go-to-market teams.

“Since we are seeing signals of product-market fit with finance CRM, the next immediate milestone we are anticipating is to expand our customer base and see hyper growth from being a finance CRM to an integrated receivables platform,” Gopalan said. “[Our goal in the] far future is to be the intelligence center for cash flow and credit data for customers.”