Get the job you really want.

Maximum of 25 job preferences reached.

Top Remote Tax Manager Jobs

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage the insurance tax team, assist in client relationships and business development, oversee tax compliance, and support tax strategies.

Top Skills:

AccountingInsurance TaxTax Compliance

AdTech • Artificial Intelligence • Big Data • Machine Learning • Marketing Tech • Mobile • Software

The Senior International Tax Manager will lead global tax strategy, oversee international tax compliance, provide strategic guidance on tax issues, and identify automation opportunities in tax processes.

Top Skills:

Data WorkflowsTax ComplianceTechnology-Driven Tax Solutions

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage tax compliance engagements for high net worth clients, lead a team, and ensure timely communication and service delivery.

Top Skills:

AccountingCpa

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

The Tax Manager will lead corporate income tax return preparation for C-Corps, oversee ASC 740 calculations, ensure tax compliance, and mentor junior staff.

Top Skills:

Asc 740C-Corporation Tax Accounting

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage tax compliance engagements, communicate with clients, review tax work, provide training, and maintain technical expertise in tax areas.

Top Skills:

AdobeCasewareExcelGo File RoomPowerPointTax Preparation Software (Axcess)Tax Research Software (Ria)Word

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage tax compliance and advisory work, review tax returns, build client relationships, research tax matters, and mentor staff.

Top Skills:

AccountingCpaTax Compliance

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage complex tax returns and consulting for partnerships, mentor staff, and develop tax planning strategies while ensuring compliance with tax regulations.

Top Skills:

Internal Revenue CodeIrs RegulationsTax-Related Software

AdTech • Big Data • Digital Media • Marketing Tech • Software • Big Data Analytics

The Tax Manager oversees domestic and international tax compliance, manages external partners, ensures proper filing, and supports global expansion initiatives.

Top Skills:

AvalaraExcelNetSuite

Fintech • Professional Services • Financial Services

The Tax Manager leads tax return preparation, research, client relationships, and staff mentoring while ensuring quality tax services.

Top Skills:

Cch Tax SoftwareMS Office

Marketing Tech • News + Entertainment • Software

The US Tax Manager will oversee tax compliance processes, provide strategic tax advice, manage tax audits, and collaborate with various teams. Requires 5+ years of experience in taxation, preferably with international exposure.

Top Skills:

Excel

Cloud • Fintech • Software • Business Intelligence • Consulting • Financial Services

Manage a team of insurance tax professionals, grow client relationships, perform tax research, and ensure compliance for insurance clients' tax matters.

Top Skills:

AccountingCpaTax Research

Beauty

The Corporate Tax Manager will manage income tax provision and compliance, prepare tax-related entries, support tax legislation research, and collaborate with corporate finance.

Top Skills:

MS Office

New

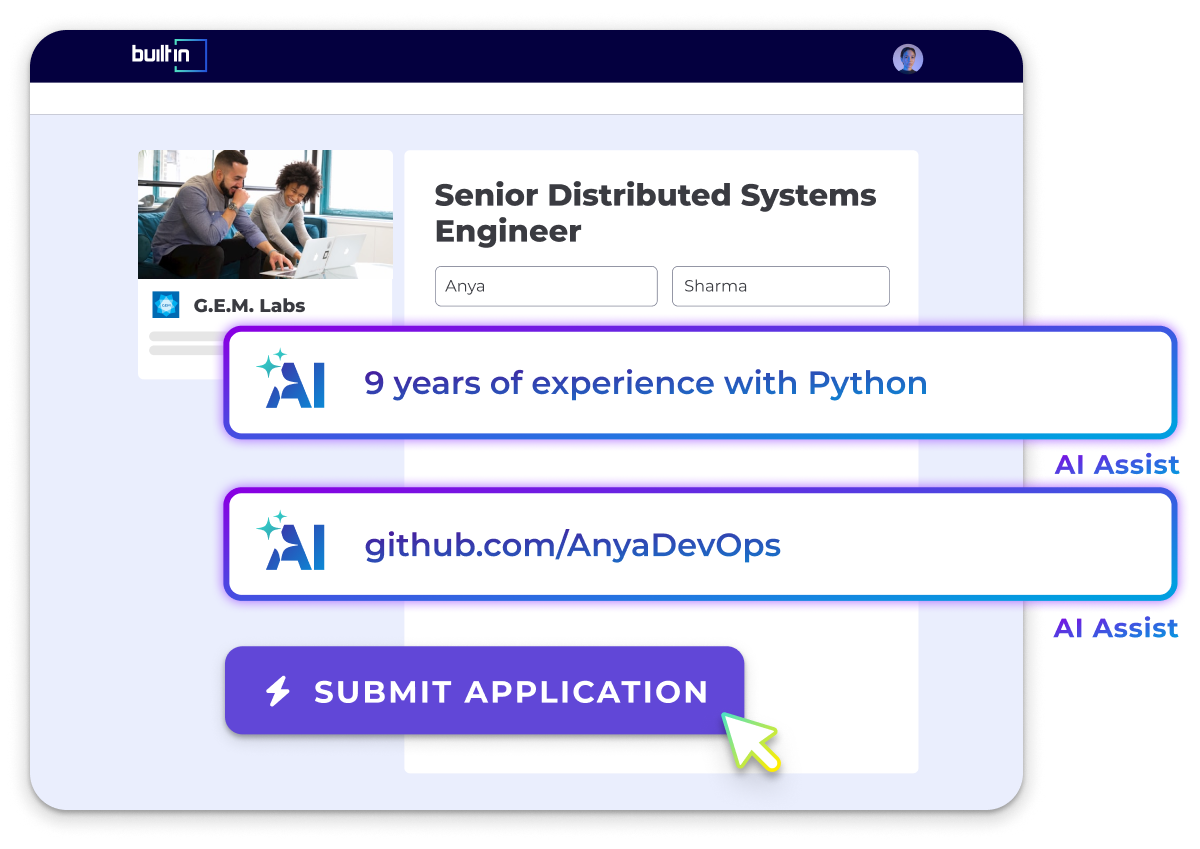

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Blockchain • Cryptocurrency

The Product Tax Lead will manage tax requirements in product lifecycles, ensuring compliance and collaboration between Tax, Product, and Engineering teams.

Top Skills:

AIIndirect Tax SoftwareMachine LearningTax Engines

Cloud • Fintech • Financial Services

Oversee tax compliance and planning for clients, manage a team, mentor staff, provide feedback, and ensure accuracy in tax submissions.

Top Skills:

KarbonLacerteQuickbooks Online

Fintech • Software

Manage US and EU indirect tax compliance, prepare tax returns, assist on audits, maintain internal tax positions, and collaborate with teams on tax-related matters.

Top Skills:

AnrokAvalaraFonoaGoogle SuiteExcelS&U Tax Software

Financial Services

This role involves applying machine learning techniques to investment management strategies, leading initiatives to bring these strategies to investors.

Top Skills:

FinanceMachine Learning

Consulting

The Senior Tax Manager manages client portfolios, provides tax compliance services, mentors teams, and enhances service delivery through innovation. They tackle complex tax issues and contribute to business development efforts.

Top Skills:

Accounting SoftwareCch AxcessQuickbooksTax Preparation Software

Consulting

The Tax Manager will manage a client portfolio, provide tax provision preparation, ensure compliance, enhance efficiency, and contribute to business development while mentoring team members.

Top Skills:

Cch AxcessQuickbooks

Edtech

The Tax Manager leads tax compliance, manages income tax provisions, oversees federal and state compliance, and supports global tax initiatives, mentoring staff.

Top Skills:

Cch AnswerconnectExcelNetSuiteOnesource Tax ProvisionPower BIVertex

Business Intelligence • Consulting

As a Tax Manager, you will lead tax services, manage client relationships, ensure compliance, and oversee tax project outcomes. You will mentor staff and maintain client satisfaction through effective tax planning and consulting.

Top Skills:

Accounting SoftwareC CorporationsCompliance ManagementCorporate TaxationPartnerships TaxationS CorporationsTax Services

Information Technology • Financial Services

Seeking experienced Remote Tax Managers for tax planning, research, and review of tax returns to provide recommendations and savings opportunities.

Top Skills:

CpaEa

Professional Services • Business Intelligence

Manage complex tax engagements for wineries, oversee client relationships, provide tax planning, and mentor staff in winery-specific tax topics.

Top Skills:

Cloud-Based Accounting SoftwareDigital Collaboration ToolsTax Software

Fintech • Professional Services • Software • Financial Services

The Tax Manager will lead engagements related to R&D tax credits, conduct accounting method reviews, provide client consulting, and drive business development initiatives.

Top Skills:

Cch Tax And Accounting SoftwareExcelMicrosoft PowerpointMicrosoft WordPdf Tools

Blockchain • Consumer Web • Fintech • Software • Cryptocurrency

As a Crypto Tax Analyst, you'll ensure the accuracy of CoinTracker’s tax engine, audit operations, and review tax-related content while leading the US tax efforts.

Top Skills:

Cryptocurrency FundamentalsUs Tax Regulations

Fintech • Professional Services • Software • Financial Services

Seeking a Tax Manager to prepare and review tax returns for various entities, provide strategic tax advice, and manage compliance with tax laws.

Top Skills:

Cch AxcessDrake TaxLacerteProseriesProsystem FxUltratax

Top Companies Hiring Remote Tax Managers

See AllPopular Job Searches

All Remote Finance Jobs

Remote Accountant Jobs

Remote Accounting Jobs

Remote Accounting Manager Jobs

Remote Accounts Receivable Jobs

Remote Assistant Controller Jobs

Remote CFO Jobs

Remote Controller Jobs

Remote Finance Director Jobs

Remote Finance Manager Jobs

Remote Financial Analyst Jobs

Remote Payroll Jobs

Remote Payroll Specialist Jobs

Remote Revenue Accountant Jobs

Remote Staff Accountant Jobs

Remote Tax Manager Jobs

Remote VP of Finance Jobs

Remote Senior Accountant Jobs

Remote Senior Accounting Manager Jobs

Remote Senior Financial Analyst Jobs

All Filters

Total selected ()

No Results

No Results