When I came to Eventbrite as CPO, I had already been advising the company for about two years. As a result, I had a lot of comfort with the CEO and many of the executives before ever starting the role. This is an underrated way to start new roles for senior people because you can de-risk the culture fit and alignment issues that plague many new executives. When I started advising Eventbrite, the company had a business unit structure, so it didn’t even have a CPO role, but instead had product leaders embedded into different business units. The company reorganized functionally, created this role and asked me to consider it.

What Is a CPO?

What Does a CPO Actually Do?

The most important question a product leader needs to ask when they get started is: “What type of job is this?” There’s frequently a misalignment between vision and execution roles. There may also be a misconception of what type of product work the company actually needs. In other words, what should the product strategy actually be? In the Reforge product strategy course, we teach there are four different types of product work:

4 Types of Product Work According to Reforge

- Feature development: adding new things to the product that improve value proposition (e.g. Uber’s split fare functionality).

- Product-market fit expansion: adding totally new products that create new value propositions (e.g. Uber Eats).

- Growth: tuning the product experience so more people can connect to the current product’s value proposition (e.g. Uber improving driver onboarding).

- Scaling work: tuning the underlying technologies or process to help the product and team continue to be effective (e.g. Uber rearchitecting its data pipelines).

Old school product leaders would just do their preferred product work even if it wasn’t what the company needed or maybe adopt a primitive portfolio approach to the four types of work even if part of the portfolio was wasted work (e.g. building a ton of features for a network effects business or doing a lot of growth work for a pre-product-market fit product). As a modern product leader, it’s important to understand what type of product work has leverage based on the company and its lifecycle. These crude tactics are usually not the best approach.

The best place to start is looking at what the company is working on right now. In Eventbrite’s case, the company was:

- Integrating the acquisition of Ticketfly to move upmarket in a specific vertical and build an enterprise sales motion

- Building a consumer marketplace to drive incremental ticket sales to event creators

- Paying down technical debt with duplicate versions of “checkout” and “create”

- Launching a developer platform so external developers can add more features for Eventbrite’s broad base of event creators

- Launching new SaaS products with its incubation arm

In addition, Julia Hartz, our CEO, told me she wanted me to focus on growing the self-service business faster.

So, first off, you should notice that there were too many things going on for a company of Eventbrite’s size (less than 1,000 people). In other words, the product strategy lacked focus. I had to spend my first few months understanding these different initiatives to determine on which ones we should focus. I gathered as much information as I could about these different strategic initiatives, and dug into the core self-service business.

Your Product Strategy Isn’t That Innovative

One dirty secret behind the work of many executives and product leaders is that our strategies aren’t that innovative. There are a few playbooks we generally run to improve performance in companies depending on the business situation after we’ve gathered the right insight. You can run through them and rule most of them out quite quickly.

The new Eventbrite strategy was a combo of two common strategic playbooks. The first part of the strategy is what Chris Zook calls “profiting from the core”:

“The greatest strategic error stems from an inaccurate understanding of the core and its full potential.”

-Chris Zook, Author of Profit from the Core

If you’re an Arrested Development fan, you might call it the “there’s always money in the banana stand” strategy.

The idea is that, as they scale, many companies pursue too many expansion strategies and leave behind growth that’s closer to their initial core business, plays more to their core competencies, and requires less work and risk to execute. Eventbrite was pursuing expansions in verticals (music), business model expansion (SaaS) and value propositions (driving demand) while ignoring improvements that could help the growth of the core product (features for small, frequent creators). At Pinterest, VP Product Jack Chou ran a version of this he called “make the basics great.”

The other component of the strategy has been popularized by current Snowflake and former ServiceNow CEO Frank Slootman. In Amp It Up, Frank Slootman basically divides up his strategy into three elements:

- Improving velocity

- Raising standards

- Narrowing the focus

Personally, I would flip the order and revise the language to be more software specific:

- Improve focus

- Raise the bar for quality

- Reduce tech and design debt (usually the biggest hurdle for velocity inside software companies)

Recently, Etsy has run this same strategy combo to grow its market cap from $2 billion to $25 billion in four years after many years of no market cap growth at all.

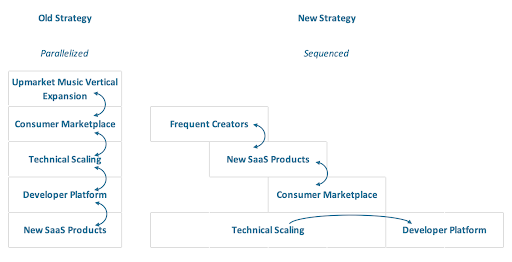

There is one other element to Eventbrite’s strategy, and that is presented by the table below: sequencing vs. parallelizing.

There’s a reason Eventbrite started to pursue a lot of these adjacent opportunities in the first place: fear the core business could not grow itself fast enough. In trying to pursue multiple adjacencies at the same time, it not only failed to make the progress it wanted on any of them, but many were not set up for success because they would gain from other strategic elements of the plan already having been completed.

The goal of this article is not to geek out on all the generic strategies, though I could do that all day, but to give a sense of the work new product leaders need to do to understand strategy and make it explicit to the organization.

How to Determine Product Strategy Priorities

The core self-service business was growing steadily at significant scale and was profitable. Most of the sales clients we brought in stressed our product-market fit, which we compensated for with manual services at no charge, thereby straining margins. We didn’t have a good sense of who our self-serve customers were, how we acquired them or what retention looked like. As we dug into these questions, we found that Eventbrite’s product-market fit was strongest when it came to hosting a single event, the bulk of our growth and profit was coming from frequent creators hosting small events very often.

So, while the product roadmap was scaling for size of event, the market was scaling with frequency of event. The product did not handle this frequency very well, causing these event creators to hack the product to get what they needed, ultimately resulting in a higher churn rate over time as those hacks proved problematic to execute. The gaps in our product to strengthen product-market fit for these creators didn’t seem insurmountable, but none of them were actually on the roadmap.

We were able to get a clear picture of the core competencies and competitive advantages of the Eventbrite product. The fact that Eventbrite supported events of all types and wasn’t focused on one vertical (e.g. industry conferences) meant the company had a scale of data no other company had. Secondly, the self-service acquisition model meant the product had very low acquisition costs overall. That model was also a good fit for many different types of creators. Lastly, the company leveraged its scale of events to drive consumer demand through channels like SEO, emails to previous ticket buyers and distribution partnerships with companies like Facebook and Spotify.

Get Feedback From Your Product Team

As I talked with the team about the state of the product and what they were actually working on, let’s just say the team had a lot to say. Let’s break it down by project.

Upmarket Music Vertical Expansion

We tried to integrate music customers too quickly into the Eventbrite platform and we are much further away from product-market fit with the more traditional enterprise approach than we previously thought. The space is low growth and low margin while relying on enterprise sales, relationships and high-touch customer service, which don’t match our self-service capabilities.

Consumer Marketplace

Frequent creators drive most of the inventory consumers are interested in and if frequent creators’ efficiency tools on Eventbrite don’t work for them, they will leave the platform even if they sell extra tickets because of the platform. This is an interesting strategy, but needs to be sequenced after we have a great product experience for frequent creators.

Technical Scaling

Internal developer productivity is incredibly low due to low level of investment in developer tools. Our infrastructure is rickety and frequently has stability problems during big “on sale” events. Multiple versions of every feature make it hard to build new things quickly and at a high quality. We never delete features because some sales clients use them and would complain. Everything we build is an MVP, and we rarely iterate.

Developer Platform

While the strategy of leveraging external developers to build specific features for a large array of customers with different needs makes sense at Eventbrite’s scale, we internally lacked the capability to service our own engineers well, much less external developers.

New SaaS Products

Many of these products are very far away from product-market fit and do not have a path to scalability. There is one partnership related to creator marketing tools being run out of this program which is doing well though, and it has been easier to talk with creators about that than our marketplace demand.

How to Develop a New Product Strategy

Strategy is about making choices among many options that optimize across a few key dimensions like:

- Company Focus

- Business Model

- Target Customer and Market

- Competition

- Core Competencies and Competitive Advantages

- Consequences & Risk

- Sequencing

Eventbrite failed to make a lot of hard choices with its product strategy when I arrived, so it was time to make some tough calls on where to put our focus. I have no simple answers, but in evaluating the initial strategy, it became clear we should do the following.

Upmarket Music Vertical Expansion

We are too far away from product-market fit trying to rebuild the Ticketfly model and there is little margin or growth to be had once we get there. There is a lot of competition and the go-to market approach leans out of our core competencies. It feels like we are trying to win the music industry’s last war instead of building a more technology-forward experience many up-and-coming music venues would appreciate. We need to focus our music creators towards a self-service experience like the rest of our product, and if that means that some of the less tech-savvy customers won’t come with us on that journey, that’s okay.

Consumer Marketplace

The product needs to have a good experience for frequent creators before they will value our demand and we should probably help them improve their efforts to drive their own demand first. Sequence to this strategy when frequent creators are in a good state.

Technical Scaling

Developer velocity is the purest form of leverage in a software company. We should be investing more in this area so we can increase our strategic appetite over time.

Developer Platform

If we are not providing a positive experience for our own developers to build great features, we are even less likely to provide a great experience for external developers. Pause this initiative until our technical infrastructure is in a much better place.

New SaaS Products

Creators drive the majority of ticket sales through their own marketing efforts and they are not expert marketers. Our knowledge can help them improve and automate their efforts. Cancel everything else in this area.

Core Self-Service Growth

Make the product experience great for frequent creators of small events as they drive most of the profit for the core business. We are not far away from a strong product-market fit here.

The new product strategy is remarkably simple and becomes more sequenced over time:

- Frequent creator investment will be measured by improved frequent creator retention.

- Technical scaling will be measured by internal developer velocity and our say/do ratio.

- Marketing tools and consumer marketplace will both be measured by revenue from those sources.

So, going back to my question, “What type of job is this?”: My initial directive would have made this product leadership role primarily about growth. Instead, the focus became scaling with some product-market fit expansion.

Frequently, there is a mismatch between what the customer or business needs and what the team is working on today. Usually, by talking to the team, your customers and looking at the data, you can identify the mismatch and position the team toward a product strategy that is more likely to be successful. Product leaders can then move to the meat of the role, which is building and optimizing the structure and processes of the team to execute against that strategy more effectively over time, or adjusting to changing market dynamics *cough* pandemic *cough*.