Markets can change quickly. One day, an account can be healthy and thriving with all signs pointing towards expansion. The next day, the economy has turned and suddenly that business is laying off employees and cutting costs. No longer in business development mode, you’re now all-hands-on-deck to prevent churn.

What’s happening to the technology sector right now is reminiscent of conversations our team had in March 2020 when the pandemic was first upon us. At the time, I was an account manager at Ada, a brand interaction platform used by fast-growing companies to automate customer interactions, reduce operating costs, and improve the quality of their customer experience. We were having a hard time determining which of our accounts might be at risk, and where we should focus our efforts to maintain our business. It wasn’t as simple as “all e-commerce brands are going to take off” because it depended on what they were selling. Plus, our idea of “essential goods” was rapidly changing — remember how toilet paper became the new currency?

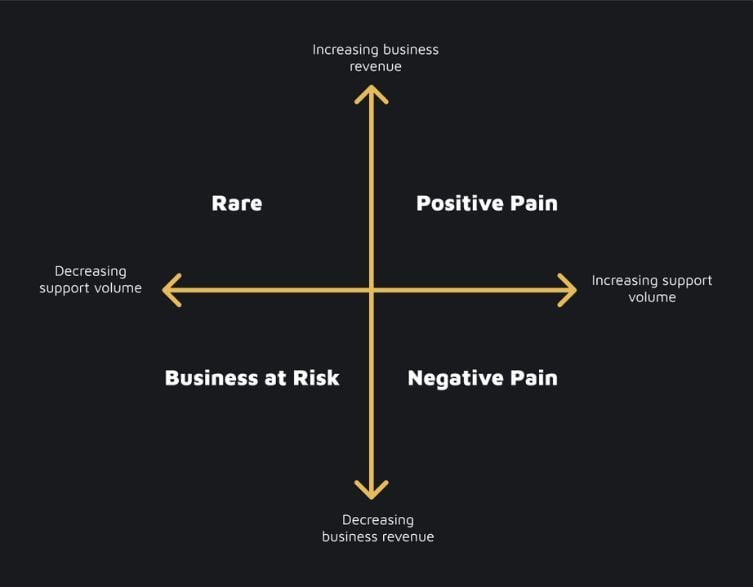

So we came up with a model that considered two factors: demand for the brand’s product/service and demand for customer support. (As you can see below, the graph took the familiar shape of a double-axis or dual-continuum diagram, like the infamous Political Compass or the infamous-for-a-different-reason Approval Matrix). The idea was that the vertical axis, business revenue, would tell us who could afford our solution, while the horizontal axis, support volume, told us who could benefit from our solution. We plotted our accounts into these four quadrants, then developed different account management and marketing strategies for each.

4-Quadrant Analysis for Managing Accounts in an Unstable Economy

We broke our accounts into four groups: the rare anomaly, at risk, positive pain, and negative pain.

The 4 Types of Account in Our Quadrant Analysis

- Rare anomaly

- At risk

- Negative pain

- Positive pain

1. The Rare Anomaly

It was (and still is) rare for any business to be in the top-left quadrant — increasing demand for product/service, yet decreasing demand for support. This is the goal of any organization, especially in today’s economy: growing the business while scaling operations to reduce costs and increase margin. If we came across a business like this in the wild, they would be able to afford our solution but wouldn’t need us. None of our accounts fell into this quadrant, and we didn’t prospect into industries we felt would land here either. It was an obvious waste of our time.

2. At Risk

Some of our accounts landed in the bottom-left quadrant. Demand for their product/service went down, as did customer demand for support. This included a number of lending companies, retail stores, and travel businesses that rely on tourism. These brands were very much at risk. How long could they continue to operate during the pandemic with such a marked decrease in revenue? These were companies with whom we re-negotiated contracts to help them ride out the pandemic, and help them scale their operations back up as the pandemic (hopefully) abated.

For example, we were working with a European company that helped arrange shuttles between airports, hotels, and cruise ports. Their revenues were way down as tourism waned and customers canceled their trips en masse. Many people’s jobs were on the line. We offered to reduce their contract spending for a period of time so they could continue to operate, which earned us trust and gratitude. As travel and tourism have returned, this particular business is now in a much better financial position and they have been relying on our product to help them scale back up. They have since returned to their pre-pandemic spending with us and see us as a long-term partner.

Not all of our accounts in this at-risk category were able to sustain operations and experience recovery, but we felt it was important for our brand reputation to act as true partners and support these companies through challenging times.

3. Negative Pain

A number of our accounts fell into negative pain territory. These are companies like airlines, cruise lines, and travel aggregators whose businesses dried up while customer support was inundated with extraordinary demand. We invested deeply with these accounts to make sure our product was doing everything possible to help these companies scale their customer support. Simultaneously, we re-negotiated contract terms on a case-by-case basis to give these brands some spending relief during their toughest quarters ever. We were an operational lifeline for these companies. Driving maximum value and getting creative with our contracts during the pandemic has earned us a permanent place in their tech stack.

As far as new business went, negative pain companies desperately needed our product and services, but couldn’t afford them. We halted marketing efforts to these companies, knowing that they weren’t in a financial position to buy our product despite needing it very badly. We did, however, continue to invest in broader brand awareness in these industries to make sure that we would be top of mind when they started to recover. For example, we had webinars and marketing materials pointed at airlines to educate them about our solution and showcase our success with Airasia. But we didn’t attend airline events or outbound into target accounts at that time. Instead, we re-oriented our direct marketing dollars to target the industries we knew to be experiencing positive pain — those who needed our solution and could afford it.

4. Positive Pain

And yet, a number of industries were clearly experiencing positive pain. Customer support volumes were skyrocketing because demand for these brands’ products/services was also on a sharp incline. This included video conferencing platforms, health and wellness e-commerce shops, healthcare software, meal delivery services, and so on. These were companies that — if they didn’t yet have some kind of automation in place — needed it as soon as possible and could absolutely afford to buy it. We focused our marketing efforts on these types of businesses, knowing we’d get the most bang for our buck on those investments.

We doubled down on our existing accounts experiencing positive pain, again ensuring our team and product were doing everything possible to help them scale. In many cases our contract values grew in this segment as these brands needed more of our product and could afford to invest.

Applying Our Quadrant Analysis to the Present Moment

So how does this model relate to the current economic situation? Well, one thing for sure is that any economic downturn does not last forever. Many of the previously at-risk and negative pain brands have recovered and are thriving (like the aforementioned shuttle company). What’s important to know is that markets operate in cycles. As Heidi Klum so famously said about fashion, “One day you’re in, and the next, you’re out.” By the same token, you could also be out and then suddenly back in. So while today’s economy may look dire, rest assured that there will be a recovery eventually.

However, the timing of that recovery won’t be the same across industries. This phenomenon is depicted in a recent McKinsey article, which maps out the historical timing of decline and recovery in different sectors. For example, while consumer discretionary spending is often first to go down, it’s also one of the fastest segments to recover. Compare that to energy companies who are slower to experience a downturn and even slower to recover from a recession.

For the account managers and CSMs who are held responsible for the retention and growth of existing business — hang in there, this won’t last forever. Plus, some segments are experiencing positive pain even today. For example, credit unions and some discretionary spending (like online gambling) tend to hold up much better than other industries during a bear market.

How to Do Your Own 4-Quadrant Analysis

The best thing you can do to focus your time and drive impact is to develop your own positive pain model by following these steps:

- Draw out a graph and note business revenue on the vertical axis.

- Update the horizontal axis with a business pain for which your product/service solves.

- Plot your accounts on the diagram and identify trends in industry, geography, segment, etc.

- Share your mapping within your CS team and compare notes. As a team, align on the strategy to service accounts depending on their quadrant and the timing of their industry’s historical recovery after a recession.

- Share your findings with your sales and marketing leaders. Your book of business is the best indicator of the broader market. Everyone in your organization can benefit from understanding these trends to decide where they ought to dedicate their time, attention, and dollars.

For those brands heading towards some tough months ahead — those whose focus has pivoted to reducing costs and increasing efficiency (I’m looking at you, big tech) — this period of stress is a moment in time. Be aware of how your industry has historically recovered from a recession and in what time frame so you can plan ahead for eventual recovery. While it may seem far-off today, there will come a time when you’ll start to see the demand for your product/service pick back up, which means demand for support won’t be far behind. Be prepared to recover gracefully by investing today in the systems, processes, people and technology you will need to be successful tomorrow.