Three million employees enter the workforce with an average of $40,000 in student loan debt every year. In total, 47 million Americans owe more than $1.7 trillion in student loan debt, a figure that is expected to skyrocket in just the next few years with the U.S. expected to add over $1 trillion in additional student loan debt by 2028.

Surging student loan debt, along with its often overwhelming impact on employees, has led many startups to reevaluate their benefits offerings to meet the evolving needs and shifting demographics of today’s workforce. Increasingly, that means adding a student loan assistance benefit.

Congress gave employers a big incentive to offer a student loan pay-down benefit in December. The Consolidated Appropriations Act of 2021 includes a tax provision that allows employers to make tax-free payments of up to $5,250 per year to their employees’ student debt, without those payments being included in the employees’ taxable income.

See how your employer brand is performing in AI tools like ChatGPT and Google.

This tax incentive makes it easier than ever for companies to repay their workers’ student loans. For employees, the help can’t come fast enough. The average employee spends $5,000 each year repaying their student loans. Education debt has a tremendous impact on employees’ ability to save for retirement, get married and start a family. Financial stress has been shown to negatively impact performance in the workplace and lead to absenteeism and lower levels of employee engagement.

As startups face intense competition for top talent, they are increasingly turning to student loan assistance benefits as a recruiting and retention tool as well as a means of supporting diversity, equity and inclusion efforts.

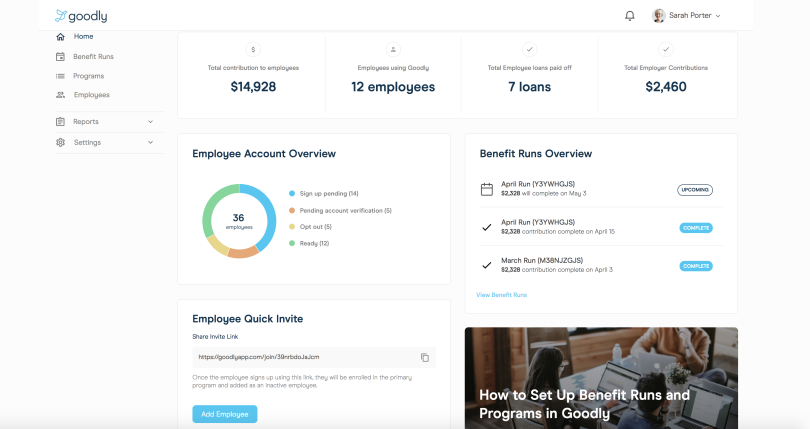

At Goodly, we work with startups and tech companies to help them provide tax-free student loan repayment as an employee benefit. Across all of the startups we work with, we’ve seen a wide range of employer contributions. Some startups offer smaller employer contributions of $25 or $50 per month while others maximize the tax-free limit of $5,250 per year by contributing $437.50 per month. Across all of Goodly’s startup clients, the most frequent employer contribution is $100 per month, which makes student loan pay-down a relatively inexpensive benefit to fund.

Here’s how four Built In companies are using Goodly to help repay their employees’ student loans.

GumGum, a Santa Monica, California-based technology and artificial intelligence company, offers a student loan pay-down program that is based on seniority: Employees who have been at the company for fewer than two years receive $50 each month; those who have two to four years of experience get $100, and, above that, the contribution maxes out at $200 per month until the loan is paid off.

ConsejoSano is a multicultural patient-engagement company and implemented a student loan assistance benefit to support Consejo’s core values around reducing economic inequalities among diverse populations and to help Consejo prioritize their diversity, equity and inclusion goals. Like GumGum, Consejo also offers employer contributions based on tenure. Student loan payments start at $50 per month and increase until being capped at $400 per month following three years of employment.

Camelot Illinois is a Chicago-based e-commerce and gaming startup with just over 100 employees. With student loan borrowers in Illinois owing an average balance of $36,531 — the sixth-highest in the nation — Camelot was looking for a benefit to support the financial wellness of their employees. Based on tenure, and following three months of service to the company, Camelot will pay between $50 to $125 per month toward their workers’ student loan debt. More than 30 percent of Camelot’s employees have signed up for the student loan pay-down program.

I’d be remiss if I didn’t share how we’re dogfooding our own product, right? Goodly is a leading provider of student loan and college savings benefits. Based in the heart of Silicon Valley in downtown San Francisco, we offer a generous student loan repayment benefit to our employees, in which workers are eligible for monthly payments of $437.50 toward their student debt. By contributing $437.50 per month, we can maximize the annual limit of $5,250 in tax-free, employer-sponsored student loan repayment.

Whether you opt to contribute the maximum amount or start with a modest offering, the impact on your employees’ financial (and mental) health can be massive. With a debt crisis looming, what better way to not only attract top talent — while letting them know you’ve got their backs?