Get the job you really want.

Maximum of 25 job preferences reached.

Top Payroll Specialist Jobs

Information Technology • Insurance • Professional Services • Software • Cybersecurity

The Senior Payroll Specialist will optimize payroll processes, ensure compliance with multi-state regulations, manage payroll operations, and support audit requests, enhancing internal controls.

Top Skills:

Financial SystemsPayroll Software

Biotech

The Payroll Specialist manages end-to-end payroll processing for a multi-state employee population, ensuring compliance with wage laws and supporting stock administration.

Top Skills:

Adp Workforce NowCartaE*TradePaylocityTrinetWorkdayZenefits

Fintech • Payments • Financial Services

The Payroll & Transaction Specialist will handle payroll submissions, process distributions, prepare census files, manage contributions, and assist in office projects.

New

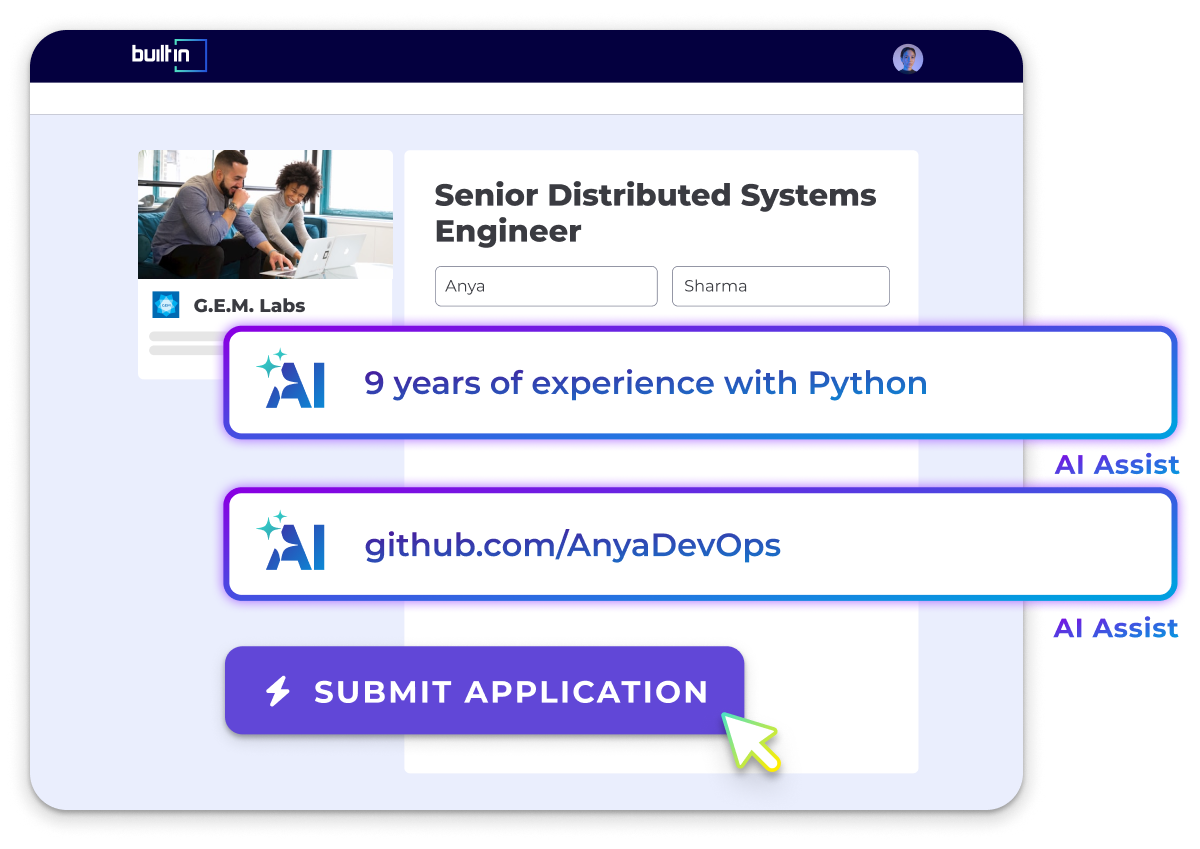

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Top Companies Hiring Payroll Specialists

See AllPopular Job Searches

All Filters

Total selected ()

No Results

No Results