In March, Americans sheltered in place amid the coronavirus pandemic, and we started watching more TV to pass the time. Specifically, we started streaming more TV.

The coronavirus “is an accelerator of trends that we are already seeing,” Jordan Rost, director of ad marketing at Roku, told Built In. “People were already shifting to streaming ... but it really accelerated the scale of that shift.”

Before reopening proceedings began, Roku users hit a streaming-first benchmark, Rost said — for the first time, “cord-cutters,” a.k.a. people who do not have cable or satellite TV packages, made up more than half of its audience.

It made sense. While Americans sheltered in place, unemployment reached historic highs. Cord-cutting saved cash-strapped TV viewers money; streaming subscriptions tend to cost less than cable.

Why is that? Well, users “pay” for streaming in money, but also in rich behavioral data that allows every piece of the streaming ecosystem — including the operating system on Roku’s streaming devices — to sell targeted, personalized ads.

This is relatively new for TV. So-called “linear TV,” from legacy networks and cable channels, can attract huge audiences — the 2019 Super Bowl, for instance, drew about 98 million viewers. But it’s hard to know who, exactly, the people in those audiences are. What else do they watch? What do they get up to on the internet?

Nielsen, which calculates most TV ratings, has only a gestural idea. The company doesn’t actually conduct headcounts of viewers during live shows like the Super Bowl; instead, as of 2016, the company tracked viewing activity in 41,000 households — so, on about .03 percent of U.S. televisions — and approximated audience size based on that sample.

“I think television has always operated very distinctly from the realm of digital advertising,” Rost said.

TV advertising has historically been about delivering broadly appealing messages to massive audiences. In recent years, the ad-buying process for linear TV has been automated, to a certain extent, but personalization remains a challenge.

Not so with ad-buying for Roku. Unlike Nielsen, the company tracks viewing behavior on internet-connected devices on a granular, household-by-household level. On its streaming players, Roku tracks which channels a given household streams, what they search for in Roku’s search bar and more. Roku also powers one in three smart TVs, Rost said — which in some cases give Roku a window into linear TV viewing patterns too.

Recently, Roku’s capacity to target ads and measure their impact grew even more sophisticated. In early 2020, the company rolled out an advertising platform that allows for something new: programmatic Roku ad buys.

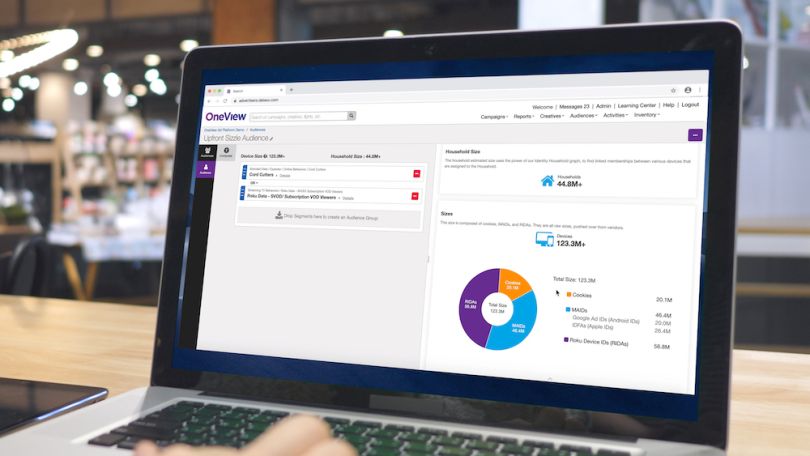

A Bird’s Eye View of OneView

To the untrained eye, OneView — the ad platform Roku launched in May — might look like a traditional demand-side platform (DSP). It’s a self-service portal where ad buyers can purchase campaigns spanning “most major ad exchanges” and “any device that’s programmatically accessible,” Rost said.

Those devices include laptops, phones, digital billboards, Amazon Fire devices and — here’s where things get interesting! — Roku devices. This opens up a world of new ad-placement options. Buyers can programmatically purchase ad space on a Roku’s home screen, or on Roku’s free, ad-supported streaming channel, The Roku Channel.

“We’ve experimented with formats where if you pause [an] actual stream ... a brand might be a part of that pause screen.”

“We’ve experimented with formats where if you pause [an] actual stream ... a brand might be a part of that pause screen,” Rost added.

OneViews allows for new types of ad targeting too. Most DSPs already have vast libraries of third-party targeting data, which allow buyers to address niche demographics, but OneView has rolled data from Roku devices into that mix.

That means buyers can target streaming video ads based on a user’s web browsing activity, or web and mobile ads based on a user’s streaming habits. In other words, you could target a Roku ad for REI to people who recently searched the web for “rock climbing gear” — or, conversely, you could target a Facebook ad for REI climbing gear, complete with a “Buy now” link, to someone who just saw an REI ad on Roku.

This second option comes in especially handy, because when people see ads on TV, they can’t buy the product on display without first switching devices — which creates friction. OneView, though, allows ad buyers to retarget viewers who’ve seen TV ads, serving them lower-funnel, conversion-friendly ads on their phones and desktops. This one-two punch can boost campaign conversion rates by more than 300 percent.

The “spine” of Roku’s ad targeting (and retargeting) efforts, according to Rost, is deterministic data. The company doesn’t have to “guess who [a user] is based on stitching together cookies,” he said. “We have the account information,” which users give the company voluntarily.

Though Roku lets ad buyers layer third-party data and inference into their OneView targeting efforts, a “direct relationship” with TV viewers grounds all its advertising offerings — and always has.

The Evolution of Roku Advertising

OneView isn’t Roku’s first foray into selling advertising. The enterprise began at Roku years ago, Rost said, and the company started simple: It advertised streaming publishers to Roku users. Users that converted and subscribed did so on the same device — Roku — where they’d seen the ad in the first place, which meant that these early ads were the rare TV ads with measurable conversion rates.

“If a publisher came to us with a dollar, we might be able to probably say, ‘We’re going to deliver $4 of value in return,’” Rost said.

The publisher ads were, and continue to be, a hit for Roku. Recently, Roku ads played an “instrumental” role in the wildly successful Disney+ launch, Rost said. Within six months of launch, the channel had racked up 50 million subscribers.

But in 2015, Roku began expanding its ad efforts. The company opened up its ad space to brands beyond streaming publishers, who sought it out as a source of “incremental reach,” Rost explained. In other words: Through Roku, these brands could reach an audience of cord-cutters they couldn’t access through linear TV marketing.

Roku could also offer advertisers more detailed targeting options and behavioral data than linear TV channels could.

But in one respect, Roku was a lot like linear TV: its ad-buying process was manual and difficult to integrate with programmatic digital marketing efforts.

Then, in 2019, Roku bought Dataxu for $150 million. Dataxu, a Boston-based martech company, made a DSP that allowed for programmatic buying across TV and web; the company also made an identity management platform that, much like an identity graph, bundled users’ various devices together into holistic profiles.

Roku merged Dataxu’s products with its massive cache of first-party streaming data, and OneView was born.

“Now we can connect your TV advertising with your mobile advertising in a much more cohesive way.”

Though it’s only two months old, Rost sees major potential for the platform. “OneView makes [performance and targeting data] much more accessible,” he said — especially on the TV side of things.

“It just delivers far more scale.... Now we can connect your TV advertising with your mobile advertising in a much more cohesive way.”

Next up: more in-TV conversions. Through Roku Pay, users can already sign up for new paid channels and manage existing paid subscriptions. One day, Rost explained, users might be able to use that same payment system to buy anything — including the sneakers modeled in a Roku ad.

“Today, people [already] pay for lots of things on their Roku devices,” he said. We’re close to “true television-based commerce.”

So… What Does This All Mean for Linear TV?

At this point, does advertising on linear TV look hopelessly outdated compared to streaming advertising? Could the Super Bowl lose its status as the biggest moment of the year for football and TV advertising?

Not necessarily, Rost said. For one thing, Roku has already developed the technology to enhance linear TV ads on smart TVs.

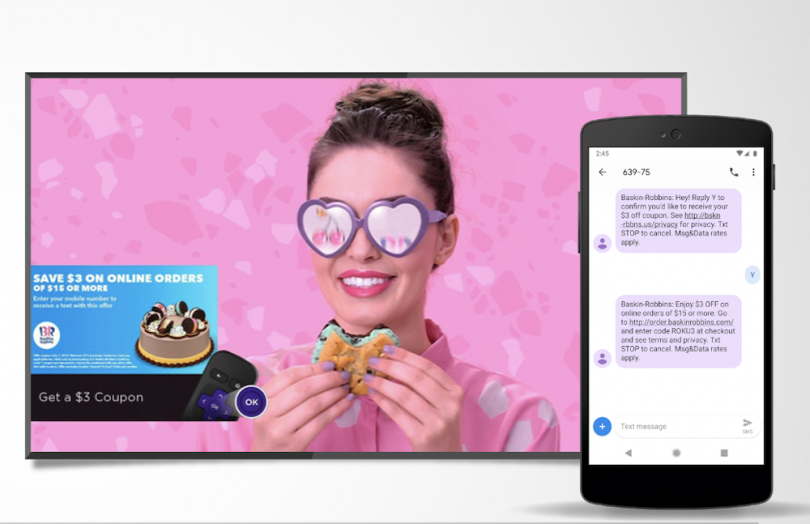

“We ... have the ability to detect when someone’s ad is running on traditional television, and overlay an interactive element,” Rost said.

That might be an overlaid button linking to a personalized special offer — something ice cream merchant Baskin-Robbins recently tried out. When viewers pressed the button with their Roku remotes during a linear ice cream ad, Baskin-Robbins texted them geo-targeted coupon codes valid at local stores. The campaign drove a 46-percent increase in purchase intent, Roku found.

Through smart TVs, Roku can also add skins to linear TV ads that improve timeliness; while Americans sheltered in place, many brands added overlays to their pre-planned ads, highlighting curbside pick-up or delivery options.

So linear TV won’t necessarily lose steam. And Rost doesn’t see the Super Bowl losing its marketing clout anytime soon.

“I still think big seminal moments are important” in TV advertising, he said.

It’s unclear how many of them we’ll see this year, though. The coronavirus pandemic has created a lot of uncertainty around major sporting events. March Madness, another seminal sporting event, got canceled this past March; the NBA went on hiatus that month too. If the 2020 NBA season recommences, it’s unlikely fans will be allowed in the stadiums, and it’s unclear what the broadcasts will look like.

If the 2021 Super Bowl gets canceled, or lacks mass appeal without a roaring crowd, “the question becomes, can you find that audience, can you understand them wherever they are?” Rost said.

“Can you find that audience, can you understand them wherever they are?”

Using OneView and Roku data, advertisers can do just that.

“People have moved from live sports into fitness content,” Rost reported. “I’ll speak for myself — I’m taking yoga classes on my Roku.”

It’s not that Roku’s new ad platform will make linear TV advertising obsolete. It just might make it more interactive and flexible — like web advertising has been for years already.