It’s November, which might sound like an inopportune time to discuss budgets, yet at many mid to large organizations, budgeting discussions are already well underway. So how do you get it right this time?

First, let’s think about how marketing budgets will work differently for different companies. A company’s growth stage often defines how an organization approaches its budget.

Phases of Budgeting Maturity

Infancy

In their infancy, businesses are constrained primarily by cash flow and fundraising. Investments are gated by cash, even when proven profitable on a near-term window. Product-market fit might not be nailed down, so the concept of LTV (lifetime value) remains limited. Budgeting is generally ad-hoc and finance teams manage cash flow carefully.

Growth Stage/Adolescence

Companies have cash flow. There’s an understanding of LTV (hopefully at a granular level) and the luxury to optimize to some point on the LTV curve. At this stage, primary organizational cash constraints are more tied to planning than infancy-stage constraints. There’s a loose annual budgeting processes. Organizations can be opportunistic with select investments.

Mature

At this stage, organizations have defined annual budgeting processes and goals. Cash flow isn’t generally a constraint, but organizational alignment, expectation management and finance sign-off is often necessary to make incremental investments.

The relationship between a company’s growth stage and their budgeting maturity often demands organizations marry top-down assumptions with bottom-up channel level models developed by the marketing team.

The process usually looks something like this:

-

Leadership sets top-down targets — usually hero metrics such as revenue, customers and/or CAC (customer acquisition cost).

-

Marketing develops scenarios within these constraints, demonstrating opportunities at different investment levels and LTV/CAC levels.

-

Negotiations occur. Leadership and marketing teams land on monthly budgets within tolerable full-year CAC levels.

Many marketers are familiar with baking in LTV at a granular level, diminishing returns and seasonality, but still fail to payback optimize their approach, thereby leaving money on the table.

The Value of Payback Optimization

Most mature organizations fail to properly consider the ability of payback window optimization to extend from infancy organizations (where such optimization is a matter of organizational survival) to growth and mature-stage organizations. A dollar of revenue today is worth far more than a dollar tomorrow.

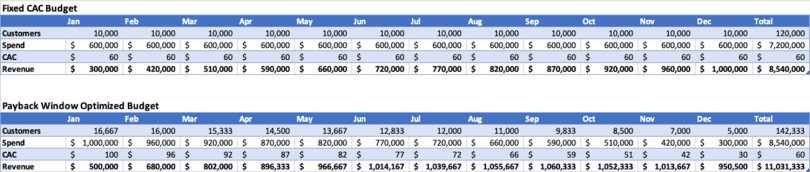

Let’s look at a scenario where a company with a $200 three-year LTV realizes half that value in year one, and in that first twelve months the $100 is divided as follows:

For the sake of simplicity, we’ll assume linear elasticity: 30 percent more in spend drives 30 percent more volume. In other words, when we re-flight budgets (i.e. allocate your dollars to ensure maximum exposure during optimal periods) to boost in-year cash flow at the same total CAC, we gain that 30 percent back in revenue.

Even if you assume moderate marginal returns curves, the payback optimized budget drives more in-year revenue — by double-digits!

In addition to helping an organization maximize in-year revenue, there are other benefits to this approach.

Benefits of Payback Optimization for Marketing Budgets

- Companies beginning their fiscal year in January can take advantage of a Q1 media rate lull, compounding the benefits of a higher tolerable CPA (cost per action).

- This approach de-risks total year budget plans by front-loading value, while reserving the option to be opportunistic in back-half spend if needed.

- Payback optimizing your approach better ties media to in-year impact, directly positioning marketing as a demand driver vs. a cost center.

Don’t like leaving opportunities on the table in Q4? That’s fine; accept a slightly higher full-year CPA and spend to the target average in Q4.

Averages are evil, and getting caught up in total annual averages or flighting spend and demand based on historical patterns leaves money on the table. Instead, a thoughtful partnership with finance and your leadership team will allow for more productive partnership and ultimately stronger business outcomes (or at least stronger reported outcomes).

If you’re not already doing so, think about incorporating payback optimization into your budgeting process. Your CFO will thank you.

This article was originally published on Mark Fiske’s blog. Republished with permission.