You’ve probably heard the question before: “On a scale of 0 to 10, how likely are you to recommend us to a friend or colleague?”

A company’s customer success team may email this question to customers when it wants to get a general sense of how they perceive its brand. It uses the answers to calculate a net promoter score (NPS).

What Is Net Promoter Score?

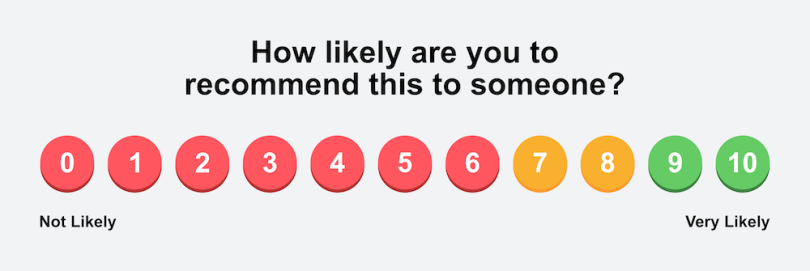

When a user responds to the question with a numerical rating, you put their answer in one of three buckets:

• Ratings from 0 to 6 are detractors.

• Ratings from 7 to 8 are passives.

• Ratings from 9 to 10 are promoters.

Then you’re ready to calculate NPS.

How to Calculate Net Promoter Score

To calculate NPS, you take the percentage of promoters and subtract from it the percentage of detractors.

NPS = % Promoters - % Detractors

Say you ask customers how likely they are to recommend your company to a friend or colleague. If 100 respond, and 40 of them are promoters, 50 are passives and 10 are detractors, then your NPS would be 30. (Because 40 - 10 = 30.)

NPS scores inevitably fluctuate over time. Many believe that the direction of the score provides a general sense of how the company is trending in the minds of its customers — if the NPS goes up, that’s good; if it goes down, the company ought to investigate.

What’s a good NPS score? That depends. The number is relative across industries. NPS Data is widely available, though, so companies can find relevant benchmarks and compare themselves to competitors.

Net Promoter Score: Four Perspectives

Frederick Reichheld, a partner at Bain & Company, introduced the NPS metric in 2003 after he became convinced that the single survey question — and the resulting score — could be an accurate predictor of company growth. Since then, NPS has become the default metric that many companies use to get a quick pulse read on how customers feel about them.

But in recent years, the accuracy and usefulness of NPS has been hotly debated.

Built In asked industry experts to share their perspective on net promoter score. The panel includes Christine Rimer, vice president of customer experience and advocacy at SurveyMonkey; Dave Blake, founder and chief executive officer at ClientSuccess; Christina Stahlkopf, associate director of research and analytics at C Space; and Chris Hicken, co-founder and chief executive officer at ‘nuffsaid.

Their responses have been edited for length and clarity.

NPS Is One Helpful Metric Among Many

Christine Rimer, VP of customer experience and advocacy at SurveyMonkey

There are a few reasons that I see tech organizations, in particular B2B, using relational NPS.

There are a few reasons that I see tech organizations, in particular B2B, using relational NPS.

One is the fact that it has been around for 20 years. You can benchmark against peers and competitors. Two, you can compare yourself over time. Three, we have evidence of NPS being associated with growth.

We have done that research ourselves at SurveyMonkey. We know that promoters are renewing at 15 points higher than our detractors on our self-service survey business. I can join that with financial data and see that customer experience is good for growth.

Why NPS? Most organizations I know have some type of company value like, “Listen to customers,” “Be customer obsessed.” And when you talk about how you understand whether your organization is living up to that value, net promoter is the best we’ve got.

I do hear naysayers out there. I know folks who have dropped their net promoter programs. But then when I talk to them about what they’ve replaced it with, they’re like: “Well, we were skeptical. We were not sure how to take action. We read articles that called it outdated.” I have yet to find an organization that then said, “And so we replaced it with this.”

The limitation of NPS has always been, “How do I get insights that will help drive action?”

Integrating NPS into your system and joining it with additional data and measuring impact are ways in which we see top CX leaders driving action.

We recommend a cross-functional, holistic feedback program. Relational net promoter is one way you’re getting that feedback. I’m also checking with my support team to make sure they are seeing and hearing the same thing from customers who write to support. I check in with our product team, which is running experiments, and asking for feedback there. My marketing team is also measuring the digital side and gathering feedback after events, after someone reads a white paper, after a transaction.

“Integrating NPS into your system and joining it with additional data and measuring impact are ways in which we see top CX leaders driving action.”

Anytime I hear skepticism, I hear things like, “What does a score mean?” “What about those who didn’t answer?” NPS shouldn’t be the only source of data. But not asking the question, not asking for feedback, and thinking you know better by not asking — to me, that makes no sense.

You should be using NPS just like you use your financial data, behavioral data, your customer attributes. You should use it as an input. And we are joining it with other data and coming together as a cross-functional team and saying, “So, what does this mean?”

My friend said she uses surveys to point a flashlight on the areas where they need to go deeper. Relational NPS can shine a flashlight. I can’t go fix it. I need to work with other leaders and understand where the opportunity is.

NPS Has Its Place, but a Health Score Is Better

Dave Blake, founder and CEO of ClientSuccess

A lot of people say they hate NPS and they should get rid of it. Other people rely heavily on it and say it’s the best metric. I’m neither. I feel like it’s a good metric, in context with many other metrics.

A lot of people say they hate NPS and they should get rid of it. Other people rely heavily on it and say it’s the best metric. I’m neither. I feel like it’s a good metric, in context with many other metrics.

Part of the challenge with NPS is that someone may have, for example, come across a bug in your product or had a one-time frustrating experience. And then they happen to get an NPS question, and they may give you an answer in a moment of frustration, even though they may be a happy, loyal customer overall. I think that’s an example of a kind of a flaw within the NPS framework, and why you should only put it into context alongside a lot of other information.

NPS will give you a good perspective of that person’s sentiment at that moment in time. But NPS feedback from customers is fairly perishable. If I were to ask a customer to provide their NPS and they say they’re a promoter today, and I rely on that, the renewal may be nine months from now. If I rely on a promoter score that’s nine months old, there are a lot of things that can happen that can change that sentiment. If I were to ask them now, they could be a detractor.

Yes, it’s valuable, it’s insightful about the customer’s perception of their experience they’re getting from your product at the moment. It’s actionable in the moment, and it can be a piece of information that you can use to understand the holistic sentiment of the company.

It’s also all about the direction, not the exact score. For an individual, if they gave me a 6 six months ago and an 8 today, that’s fantastic. Or, as a company, if I was at 23 six months ago, and I’m a 43 now, that’s fantastic. If you can connect the dots over time, it’s really looking at the direction in which you’re going — and then the ways to improve that direction.

There are a lot of different signals that you look at to understand customer health and overall sentiment, like product usage and adoption. There’s engagement with the customer — is the customer taking your calls? Skipping them? Paying their bills? There are general C-SAT questions. The best companies bring those together to have a holistic view of customer happiness and sentiment.

“There are a lot of different signals that you look at to understand customer health and overall sentiment.”

A big aspect of our platform is to be able to measure all these different signals, and to bring them in and create a health score, which we call a success score.

The success score brings in all kinds of diverse data. We have our own native NPS solution. We also use product usage data, support ticket data and customer engagement information as signals to formulate a health score.

And we actually believe there’s another one that’s out there. And that’s human feedback from your team.

A lot of people will take a very data-driven approach to health scores. And in my experience, if you do a data-only version of a health score, you can get a lot of false positives and false negatives. One way to have a stronger and balanced score is to get feedback from the team as to what the customer sentiment is based on their experience — their daily calls and interactions with the customer.

NPS Generates Too Much Noise. Try an Earned Advocacy Score Instead.

Christina Stahlkopf, associate director of research and analytics at C Space

I am not a huge fan of NPS. But I acknowledge that it’s a business metric that is very embedded culturally and that many people are very deeply invested in, despite its flaws.

I am not a huge fan of NPS. But I acknowledge that it’s a business metric that is very embedded culturally and that many people are very deeply invested in, despite its flaws.

In some sense, it’s good because everybody uses it. If you’re a major company, everyone in your industry will be using that metric, and you can use it to see whether you’re doing better or worse than your competitors.

But I don’t think it’s actually measuring what it says it’s measuring.

There’s a lot of noise generated in the metric. The fundamental premise is that a person is either a recommender or a detractor and that they can’t be both. But that’s just not true.

My 7 might not be the same as your 7. So even though we’re both rating it 7, I might think it’s great and you think it’s terrible. And the company just takes it as this number.

NPS is a 10,000-foot metric. It’s going to point you, maybe, roughly, 51 percent in the right direction. But it’s used very diagnostically: “We’ve got these detractors, and we want to know why, and we’re going to move our score by two points.” And the metric as it’s designed just doesn’t align with that usage.

“I don’t think it’s actually measuring what it says it’s measuring.”

If you layer an earned advocacy metric underneath NPS, you can then pair the two together and get a sense of what’s actually happening around where people are recommending and where people are discouraging.

The earned advocacy score is found by asking, “Have you recommended? Have you discouraged?” It’s a percentage of discouragers subtracted from the percentage of recommenders. It helps you unpack NPS if you are really interested in keeping it.

We try to not emphasize the score too much. People like to look at the number and see it go up or see it go down or how they compare to others. But I think it’s really understanding what’s behind the number that then becomes actionable for the company.

It’s like, “My earned advocacy score is 65.” Well, OK. You can break it down and say, you’ve got this percentage of recommenders, this percentage of detractors, this percentage of both. Then you go in and you look at the comments, and you can see if maybe everyone is discouraging about one thing. You can delineate different pockets of people, and maybe see that you’ve got three issues that it’s falling into.

It’s digging into what’s happening underneath that’s most diagnostic for a company.

NPS Is a Vanity Metric

Chris Hicken, co-founder and CEO of ‘nuffsaid

After eight years as president at UserTesting, I developed the opinion that NPS is not a useful tool for managing and running a business.

After eight years as president at UserTesting, I developed the opinion that NPS is not a useful tool for managing and running a business.

It’s been used so heavily over the last five or 10 years that people are starting to get NPS fatigue. They are much less likely to respond to surveys, which means you only end up attracting the happiest people or the most-pissed-off people. And when you’re only getting the ends, you miss all the feedback in the middle, which is probably the feedback that’s driving your business. If you’re missing everything in the middle, you’re artificially inflating or deflating your actual NPS.

NPS tends to be just a brief snapshot in time. So you might get a lot of negative feedback from people who had a recent bad experience — maybe you had a recent product glitch or the website was down — and so your NPS score is hurt dramatically. So you might see big dips or swings upwards and you don’t know what happened.

And a lot of people know how NPS is calculated. So when they are asked to rate their experience, they could be thinking: “Hmmm. Am I going to be a detractor? Neutral? Or am I going to be a promoter today?” And so that hurts the quality of the response.

We talked to a lot of VPs of customer success and chief customer officers in B2B. The general sentiment that I’m hearing is that NPS is not highly correlative to overall retention rates. They’re using NPS as an early indicator of whether or not an account will churn, and it turns out that there is no strong correlation.

There are other factors that are much better indicators of the risk that exist on your account. How is the product being used? What’s your champion coverage on the account? How well integrated is the product into the customer’s business processes? How severe of a problem does the customer think that this product is solving for them? I think all of those are very strong indicators of risk. I’m not saying that NPS is useless. It’s mostly useless. But if you want to use it as one factor out of 10, you could say, OK, well, it’s the least important of 10 factors.

Every touchpoint with the customer is precious, so why burn one of those precious touchpoints on a survey that’s going to give you such little useful information?

“Every touchpoint with the customer is precious, so why burn one on a survey that’s going to give you such little useful information?”

You can collect feedback via one-on-one interviews with customers, and record them and transcribe them. You can get great feedback from usability testing on the product side when you’re trying to diagnose product problems. And it’s important to have some kind of social media monitoring product, where you’re scanning for the sentiment of your customers on LinkedIn, Twitter and Facebook. So you understand what kind of real sentiment is going on in places where people are sharing information.

What actually happens in the boardroom is people say, like: “Oh, wow, look that the NPS dropped from 45 to 37. What happened? Well, we made five or six changes this last quarter, it could have been any of them. Let’s wait and see what happens next quarter.”

That’s literally it. That’s what happens at the board level. Everyone expects fluctuations in the NPS score. When it fluctuates, no one’s really paying attention to those changes. And so it doesn’t actually change or influence how the business is run. And for that reason, I would call it a vanity metric. Because it’s not helping you do anything different or better.

If I’m an investor, though, I probably like the NPS number, because it helps me get a general sense of like, our customers at this snapshot in time, are they pissed off? Are they happy? So that might help me make a decision, but it’s not going to help the operators in the company run a better business.

If you’re going to jettison NPS, is there a replacement that you could put in place that would be more valuable? Right now, there is no universal replacement. And I think that that will be the biggest reason why NPS will not be dropped anytime soon. Even though I think it’s terrible.

Frequently Asked Questions

What is a net promoter score?

Net promoter score (NPS) is a customer experience metric that measures customer satisfaction and loyalty toward a company based on their response to the question: “On a scale of 0 to 10, how likely are you to recommend our company to a friend or coworker?”

Depending on how they answer an NPS question, customers are grouped into one of three categories:

- Detractors (answer 0 to 6)

- Passives (answer 7 to 8)

- Promoters (answer 9 to 10)

What is a good NPS score?

Generally, an NPS score above 0 is considered good, above 30 is considered great and above 70 is considered excellent. However, NPS benchmarks will vary by industry and scores must be compared to related competitors to determine if it is "good" for a company.

How is an NPS score calculated?

To calculate an NPS score, subtract the percentage of detractors (customers who answer 0 to 6) from the percentage of promoters (customers who answer 9 to 10).

Net promoter score (NPS) = total % of promoters - total % of detractors