Professed as a one-size-fits-all solution, surveys are often touted as the answer to your churn problems. But are they actually that helpful in preventing churn?

The short answer is yes. Surveys are an effective tool for convincing your customers that you care about them, that you’re working to better the product, and that you’re taking their answers seriously.

The long answer is: it depends. Every business case has its own quirks, and every survey is consequently different. Whether or not surveys help prevent churn comes down to survey placement, the questions you ask, how personalized each survey is, and the methodology behind that survey.

Here are some elements to consider so that your surveys do actually reduce churn.

1. Writing the Survey Questions

The wording of a survey question is critical for expressing its meaning and intent and ensuring that all respondents interpret it the same way.

You’ll need to choose between closed and open-ended questions:

- If you’re using closed questions, make sure the list of answers you provide is exhaustive (or let users add their own answers) and that the response categories don’t overlap (response options should be mutually exclusive).

- For open-ended questions, make sure the respondents know what type of response you expect from them (an issue or problem, a month, number of days).

Closed questions usually get higher response rates because they require less effort on the user’s part. Also, it’s easier to statistically analyze the answers because they’re uniform, which is why they’re perfect for quantitative surveys.

However, closed questions stop the conversation — you only get the answers you expect. So, if your goal is to find out more than what you already know, open-ended questions are a better option. Open-ended questions get you qualitative insights.

Let’s say you want to survey customers about a specific feature. If you use the closed question “Is this feature easy to use?” with a yes or no answer, you’ll only be able to determine that a certain percentage of your customers find using that feature difficult. But you don’t know why.

Instead, you can rephrase that question as an open-ended one (“What’s most confusing about this feature?”) or follow up with an open-ended question only for the customers that responded “yes.” This way you’ll find out exactly what you need to improve.

This poll conducted by the Pew Research Center after the U.S. presidential election in 2008 is a great example of how responses differed greatly when the same question is presented as closed, with fixed answers, versus when respondents can add their answers.

So, if you’re asking closed questions, keep in mind that the choice of options provided, the description of each option, the number of response options offered, and the order of the options can all influence how people respond. For this reason, whenever possible, try to randomize the answers and/or the order in which they appear and always ask users for additional input.

When gathering feedback to prevent churn, these are some of the best questions you can ask:

- What is the main reason you decided to discontinue using our product? For this question, usually, the most common answers are low usage and switching to a competitor. But for more specific or in-depth explanations, you should let your users add their own responses.

- How influential was each of the following aspects in your decision to discontinue using our product? Usually, for this type of question, businesses provide a list of the most common reasons for customer churn (low product quality, low quality of support, high prices, limited range of features). A good tip would be to ask users to rate how important each aspect is to them.

- Could you give us more details? Let’s say most responses indicate support issues — but what is truly the problem? Are your support representatives not giving the right answers? Is the response time too long? You’ll never know how to address the issue unless you ask users for additional details.

- Do you have other feedback for us? The exact questions you need to ask in a feedback survey differ from product to product. However, you can never be too sure that you’ve covered everything, which is why it’s always a good idea to let users add their own input. Many will probably skip this question, but those who won’t will provide you with the most enlightening insights.

2. Deciding on Survey Placement

Survey data is crucial for highlighting customer pain points, improving customer connections, and thus, prioritizing initiatives. But for best results, surveys should be precisely targeted and opportunely placed.

Placement options you can choose from include feedback links, buttons/icons, on-exit surveys, and badges.

Feedback links are one of the most common ways to gather feedback from users, and they are best suited for quick feedback before continuing the flow. Feedback links are usually placed in emails or at the top or bottom of pages of interest. Here’s an example of a feedback link in an automated email from Small Improvements, a performance management platform:

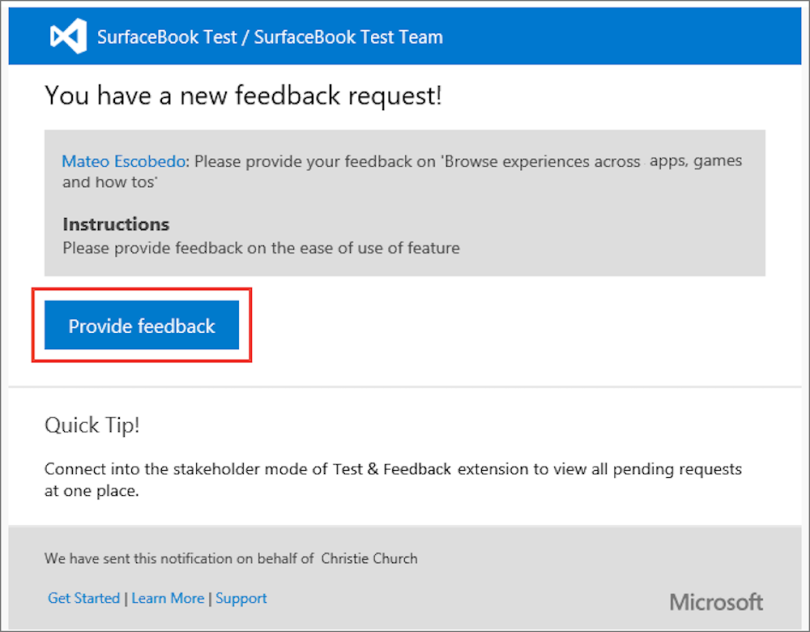

Buttons or icons are usually used to capture feedback on particular pages or regarding specific experiences. They are best placed above the fold. Something to keep in mind here is that the more unique or premium content you have on those pages, the more likely users are to complete the survey with their honest thoughts. Here’s an example of how Microsoft uses feedback buttons:

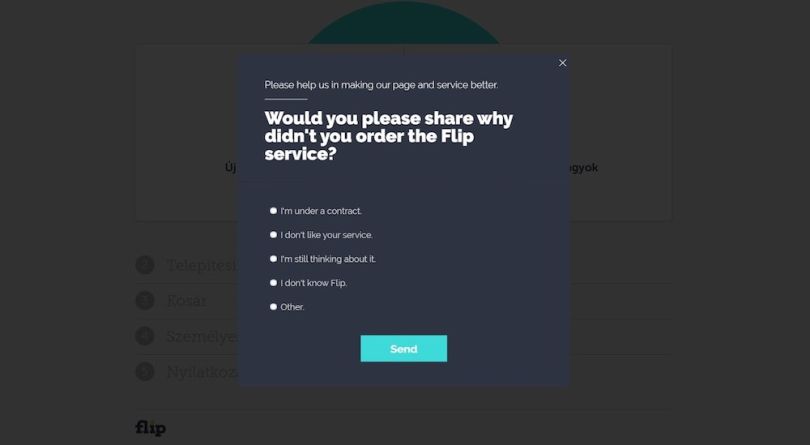

On-exit surveys: By asking users to give you feedback at the end of their session, not only do you make sure you’re not distracting or interrupting them from the task at hand, but you also ensure their response reflects their experience during the entire interaction with your product. This type of survey is particularly useful when you want to learn more about a specific phase in the customer journey. Here’s an example from OptiMonk, a conversion optimization platform:

Badges are a more dynamic way of gathering feedback. Because you can embed them into your product or site and keep them visible at all times, the user can reach out to you whenever they have something to say. This enables you to gather feedback in the moment and act before the situation has a chance to escalate and become a reason to churn. Here’s a great example from marketing software platform SEMrush:

3. Deciding on Methodology

No matter how you decide to run your survey, consistency is key. This means you won’t change your questions or the survey’s placement while it’s still running. Also, if you want to run a follow-up survey and compare results, you should keep it for the same period. For example, if you ran your first survey for a week, the second one should be displayed for a week also.

Being consistent with your surveys will ensure that you actually compare apples to apples. Many businesses tweak their surveys while they’re still running, based on the responses they gathered so far, and that can have a negative effect on the results.

4. Using the Survey Results to Improve

Now that you’ve spent so much time gathering insightful responses from your users, you don’t want to make them feel like you forgot about their replies. If issues are easy to fix, address them immediately; if not, come up with a timeline for when you’ll be able to fix them.

What you should keep in mind is that communication is key. Keep users in the loop about your progress and let them know whenever you solve an issue. Most of your users won’t expect you to solve complex problems overnight, so it’s also OK to reach out to them and let them know there’s no fix yet, but you’re working on one. Either way, they’ll know their feedback matters.

6. Reaching Back to Survey Respondents

Many businesses assume that once a customer is lost (churned), they’re lost forever. That is wrong, and by believing this, you miss a great opportunity to win customers back. Through reactivation campaigns, you can reach out to survey respondents, let them know the issues they’ve pointed out have been fixed, and the product has been improved.

Customers love to know they are part of the product development process (think of the last time you’ve implemented a feature requested by a user) and, most of the time, they’ll be happy to come back. But the timing has to be right, meaning the product needs to be significantly improved. If you try to bring them in prematurely and the experience you offer doesn’t meet their expectations, you’ll likely frustrate them even more, and you’ll lose your chance to win them back forever.

So... Do Surveys Really Help Prevent Churn?

Absolutely. Feedback surveys are a powerful tool that you can use to reduce churn. But in order for them to work, you need to make sure you ask the right questions and gather as much information as possible. Superficial responses lead to a superficial customer experience, so always try to go as in-depth as you can to get to the root of the problem.

By implementing a regular practice of gathering customer feedback (make it a point to run surveys every month or every quarter), you’ll be able to identify your product’s shortcomings and be better equipped to anticipate and address customer needs. Once identified and solved, it will help you retain customers with greater success, which means you won’t need to acquire new customers simply to replace your churned ones.