There’s an unspoken opponent in every sales deal. Whether the buyer tells you or not, they are always looking at competing products, and it’s on you to say the right things to win the buyer over.

That’s where sales battle cards come in.

The sales battle card, often just a laminated sheet of paper or a web document, might just be the lowest-tech sales tool around. But when its boxes are filled with competitive intelligence, marketing messaging and product research, it can be a handy cheat sheet on sales calls, said Anita Nielsen, who runs the sales enablement consulting firm LDK Advisory.

“They just love to have it,” Nielsen said. “It’s almost like Linus’ blankie. It’s something they can glance down at if a call starts to get bad or look at before they walk into a customer meeting.”

The best battle cards are crammed with up-to-date information distilled into bite-size blurbs and easy-to-navigate boxes that salespeople can quickly reference on a call. They give salespeople an edge to overcome objections and close deals.

“It’s almost like Linus’ blankie. It’s something they can glance down at if a call starts to get bad or look at before they walk into a customer meeting.”

It can be a tricky balance for sales leaders, marketing and sales enablement to strike. If any of the information is out-of-date or smacks of marketing speak, the sheet will quickly find itself tossed aside.

We spoke with Nielsen, InterVision Systems Director of Cloud Marketing Chris Cruz and Crayon SVP of Sales John Judge about how to put together a useful battle card.

8 Tips For Effective Sales Battle Cards

- Figure out where the sales team struggles in the process. Make those areas a priority in the battle card.

- Make battle cards relevant to each team. A BDR doesn’t need as much detail as an account executive.

- Search Google, company websites, webinars and review sites for competitor intel.

- Equip reps with “kill lines,” which emphasize features competitors can’t match.

- Keep it simple. Avoid flowery language and marketing speak that reps wouldn’t normally use on calls.

- Incorporate boxes, text formatting and color to make it easier for sales reps to navigate the card.

- Update the battle card often and send notices about the updates.

- Collect data on win-loss rates to measure the battle card’s effectiveness.

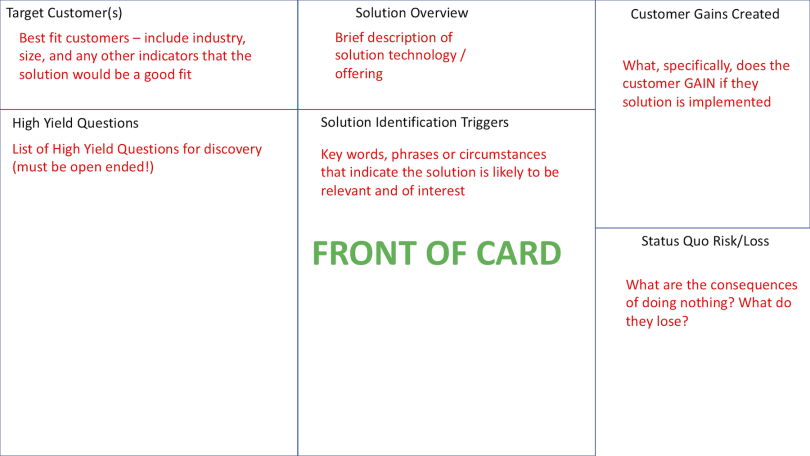

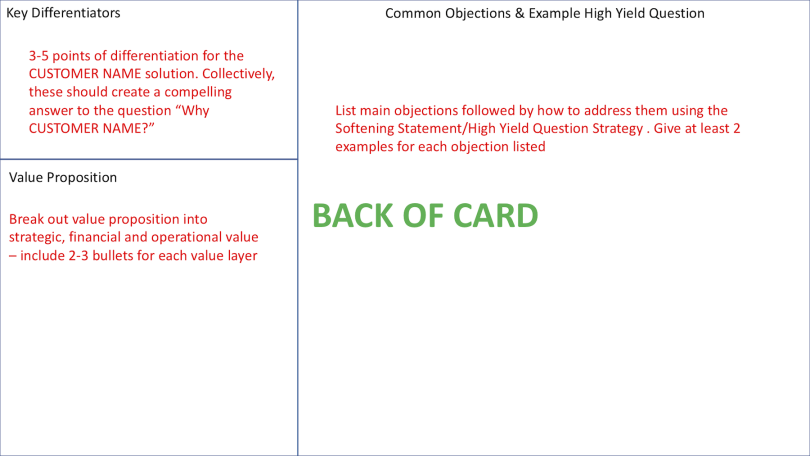

Before diving into the nitty gritty of what to include, it’s worth taking a moment to consider the format. This template, which LDK Advisory provides to its clients, should give you a pretty good sense of how much information you can fit:

Figure Out What the Sales Team Struggles With

Whenever Nielsen works with a sales team on its battle card, the first thing she does is talk to the top-performing rep and the lowest-performing reps.

During the course of those discovery conversations, her goal is to figure out which parts of the sales process are most difficult, and what information they’re missing that would help them close more deals. Those insights help her whittle down the trove of sales and marketing information to build a two-page battle card.

Figuring out what information to include in a battle card, and what to exclude, is often the toughest part for a sales leader, Nielsen said. The cards should only be two or three pages long and read like CliffsNotes of the sales process.

“To think there’s a standard battle card that every company can use — it’s foolishness.”

That’s why Nielsen recommends focusing on where the reps struggle and building cards to address information gaps.

If most reps struggle to articulate the financial value of the product, there should be a box with pointers on that subject. Likewise, if the team aces discovery, it may not be useful to waste precious space listing potential questions.

Other topics Nielsen has found useful include competitive differentiators, answers to common objections and the product’s value to the customer. Ultimately, each company’s card will cover different topics. After seven years of working with sales teams on battle cards, she has yet to duplicate a card from one customer to another.

“To think there’s a standard battle card that every company can use — it’s foolishness,” Nielsen said. “It sets them up for missing out on things that they should have, or saying things that are total nonsense. The more you can customize and personalize it, the better.”

Build Battle Cards Specific to Each Team

Another common mistake is building one card for the entire sales organization.

While a universal sales battle card can be useful for sales enablement teams or leadership as a source of knowledge, only a fraction of the document will be relevant to each sales team. In order to avoid overloading reps with information, Judge suggests creating separate cards for each role.

Crayon’s sales organization maintains about a dozen different battle cards. Each is structured around the five “whys” of the sales process, aiming to convince buyers why they should listen, why they should care, why they should change, why they should do it with you and why they should do it now. But each card is tailored to the role the rep plays in the sales process.

“You don’t want to overwhelm people with information.”

A business development rep’s job is to get a buyer to listen and care enough to set up a meeting, so their card is reduced to the information they need to accomplish those goals. It’s also important to customize cards based on the territories and products a rep sells.

“You don’t want to overwhelm people with information,” Judge said.

Research Competitors to Find Differentiators

No battle card is complete without competitor information. After all, getting prospects to pick you over the competition is the battle.

But what competitor information should a card include? And how many competitors should a rep be prepared to sell against?

To answer those questions, Cruz starts where every buyer begins their search: Google. Searching common phrases that people use to find InterVision Systems, he’ll see what other companies pop up in the results. Those form the company’s digital competitors.

But not every company has a strong search engine presence, so Cruz will also poll the sales team to find out which companies often come up during sales calls. From that list, Cruz will focus on the top two or three competitors in the card to keep it manageable.

The key to providing useful opposition research is in having an objective understanding of your product’s strengths and weaknesses, as well as those of your competitors. Fortunately, most of that information is easy to find online. It just requires knowing where to look, Cruz said.

Cruz often draws intel from competitor landing pages, spec sheets and webinars. While those resources are meant to highlight the company’s strengths, they can also reveal weaknesses. Based on how the company positions itself and the kinds of information it doesn’t include, Cruz can figure out where InterVision Systems has an edge. It could be in service, product quality or ease of onboarding.

“Everyone is positioning their product to be the be-all and end-all,” Cruz said. “But when you peel back the layers on things they can and can’t do, that’s where you can put landmines out there for your competition. You’re just stating facts.”

Review websites and field intelligence from reps can also be helpful resources for finding competitive advantages.

Write Kill Lines to Highlight Where You Beat the Competition

Opposition intel plays a valuable role in shaping the way the product is positioned on a battle card. It can also give a rep the edge they need to win a deal.

At Crayon, the fruits of opposition research are referred to as “kill lines.” Kill lines are phrases that a rep can use to counter a competitor’s offering that will resonate with the customer, Judge said.

“You don’t need a lot because, in the end, when you hold yourself to the standard of those three pillars, there’s only going to be a few killer lines.”

In order for a kill line to work, it must contain information that’s relevant to the prospect, touch on something unique to the product the rep is offering, and be provable. This gives reps a value edge, which is more effective than getting into a compare-and-contrast conversation, Judge said.

A useful format is to mention something that’s important to the customer and then explain why they can only get that value from your company — and then prove it with research, Judge said. The lines can be incorporated into specific segments of the battle card where comparisons crop up. Those could be within the overall company description, professional services and product section or even the financial terms category.

“You don’t need a lot because, in the end, when you hold yourself to the standard of those three pillars, there’s only going to be a few killer lines,” Judge said.

Write How the Sales Team Speaks

The moment Nielsen sees words like “leverage” in a battle card, she knows salespeople won’t use it. That’s because it doesn’t reflect how salespeople talk.

The battle card is one of the rare sales resources built with marketing’s input that isn’t designed to convince customers. Instead, it needs to make the case to salespeople that it’s a useful document, Nielsen said. The best way to do that is to limit the marketing lingo and keep the writing simple and straightforward.

“The battle card needs to speak to the salesperson, in terms of how they tell the right story to the customer.”

“The battle card needs to speak to the salesperson, in terms of how they tell the right story to the customer,” Nielsen said. “It should be based on what can you say to make the salesperson remember why this information matters to the customer.”

If a card includes too much marketing jargon, there’s a risk the rep will either read it like a script on a call and sound insincere, or never refer to it at all. Nielsen also recommends limiting the amount of data on a card, which can be hard to naturally weave into a conversation.

There are times where including an excerpt on marketing that speaks to the product can provide value. In those situations, Nielsen suggests including a disclaimer warning salespeople not to read it verbatim on a call.

Ultimately, the card should serve as temporary training wheels. Over time, the information should become so ingrained in the salesperson’s process that they never have to look at it again — until there’s an update.

Create a Feedback Loop Between Sales and Marketing

One of the quickest ways to lose a sales rep’s trust in the battle card is to include out-of-date information.

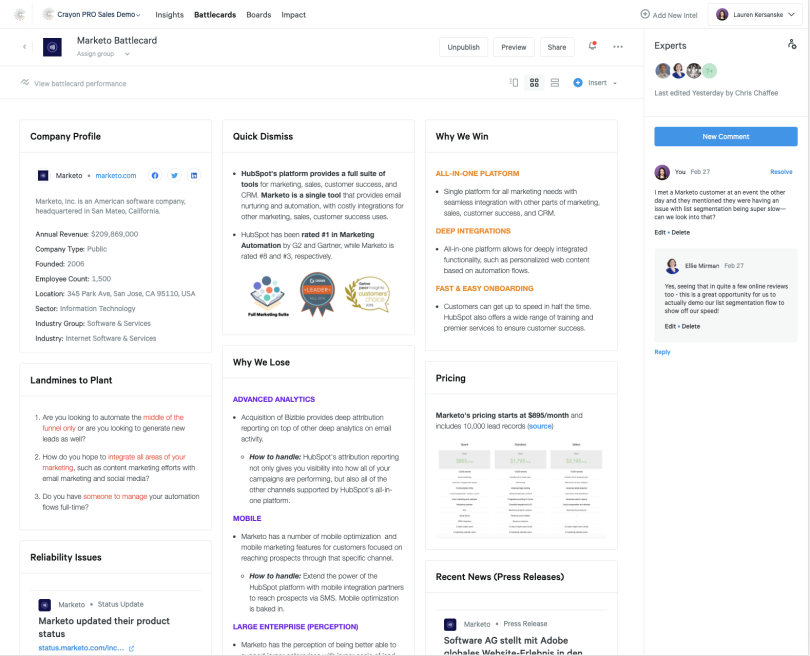

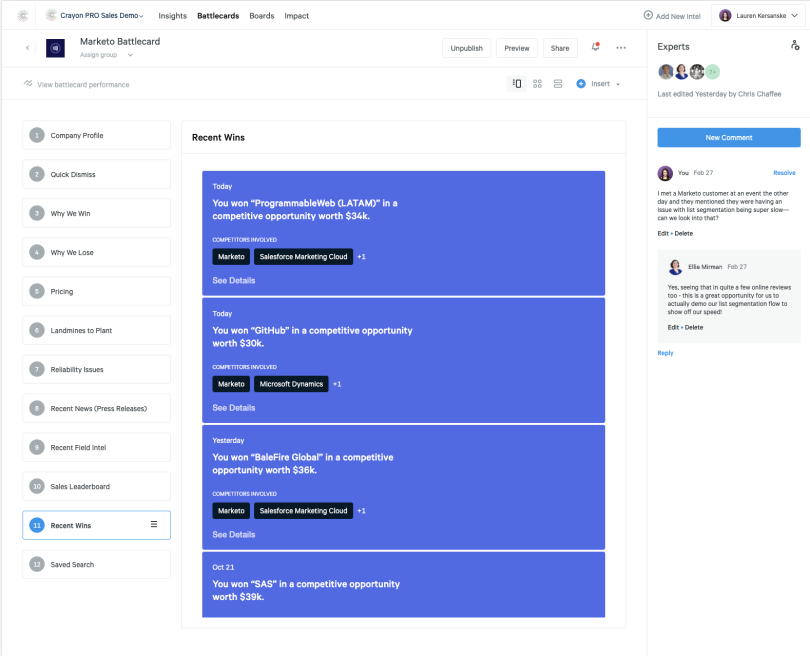

Modern sales battle cards need to be living, breathing documents to reflect the constantly evolving competitive marketplace, Judge said. Crayon provides a competitive intelligence platform that can sync with the battle card, but there are other ways to keep the intel up to date.

For starters, there needs to be a feedback loop between sales and marketing. Sales reps often gather valuable competitor insights through conversations with customers. They know what works and what doesn’t work, along with what customers are saying about competitors. Meanwhile, marketing is frequently collecting research and data on competitors.

“It’s not that hard to ask reps, ‘Can I join this call?’”

The two teams need to share their intel, which should then be verified and updated in the battle card, Judge said. Crayon sends a weekly email and Slack message with the latest battle card updates for reps to use.

As a director of marketing responsible for building battle cards, Cruz finds that it can be helpful to take the time to listen in on sales calls. Those conversations help him figure out what messaging works and what doesn’t.

“It’s not that hard to ask reps, ‘Can I join this call?’” Cruz said. “I guarantee you’re going to learn a lot from that. Sometimes it’s intimidating, but it’s essential.”

He’ll then maintain a master battle card on the company’s intranet. The document acts as a single source of truth for reps. Any updates to the card are also sent in an email notification to the reps.

Use Boxes and Color-Coding to Make It Easy to Follow

Design matters in a battle card. It doesn’t need to be flashy, but a well-thought out format can make the difference between a useful card and a useless one.

Nielsen suggests dividing the card up into boxes for each category. The number of boxes vary, but her cards typically include no more than six sections per side to provide enough room for the necessary information without overloading the rep. Bullet points and text formatting can also go a long way toward drawing a rep’s attention to the most important information.

“I don’t care how good your battle card is — you’ve got to have a few different communication channels to get your sales team to engage with it.”

In some cases, Nielsen will color code information to indicate the different situations in which certain information should be deployed. Her goal is to make it as easy as possible for reps to pull out the card and find what they need to know at a moment’s notice.

Tables and matrices are also useful when it comes to conveying competitive differentiators, Cruz said.

As technology starts to play a larger role in the sales process, it can also be valuable to integrate the information into the platforms reps visit the most. In addition to providing a virtual document, Crayon syncs that information with its CRM, Judge said.

That way, when a salesperson is on a call with a prospect and they mention a competitor, the rep has several different outlets they can visit to get the information they need.

“I don’t care how good your battle card is — you’ve got to have a few different communication channels to get your sales team to engage with it,” Judge said. “Our data shows that only 30 to 40 percent of salespeople are regularly looking at battle cards.”

Measure the Battle Card’s Effectiveness

At the end of the day, the battle card should be a resource to help sales reps win deals against their most frequent competitors.

That’s why Crayon ties the value of its battle cards to sales win rates. In order to evaluate the card’s effectiveness, sales teams need to first start tracking wins and losses in the CRM, along with the competitor brought up in the deal, Judge said. This forms the baseline win-rate on the team.

“You’ve got to have a way to measure impact. You’ve got to be able to say, ‘Is this thing helping us win more competitive deals?’”

From there, sales teams should track whether they used the battle card or not within a deal. At Crayon, the card is linked to the CRM, so anytime a rep looks at it during a call that activity is tracked, Judge said.

This data allows sales leaders to determine how useful a battle card is. Since success is tied to the card, reps can share what information they’ve found most helpful. Likewise, if some information isn’t useful, they can let sales enablement or marketing know it doesn’t resonate with customers.

Crayon also has a Slack channel dedicated to competitive wins and losses, where the latest battle card intel and victories are shared.

“You’ve got to have a way to measure impact. You’ve got to be able to say, ‘Is this thing helping us win more competitive deals?’” Judge said. “‘Are we winning more business because we’ve gone through this effort?’ If you have, then a marketeer gets something they rarely get, which is proof of ROI.”