When COVID-19 reached the United States in March of 2020, Cortex Health realized it would need to scale — and fast.

Cortex — a provider of software and services that streamline follow-ups for the healthcare industry — was well suited to provide states with hotline support for COVID testing. But in order to do that, the company would have to upsize from a team of 10 full-time employees at its Utah headquarters and a network of contractors, to a team of 450 employees across 45 states.

“In our naiveté, we thought we’d just convert a bunch of our independent contractors to employees.”

To Josh Albrechtsen, the company’s president and co-founder, it seemed easy at first. All he had to do was convert the company’s contractors — nurses hired on a part-time basis to make patient follow-up calls on behalf of its clients — into full-time employees, and then keep hiring. He didn’t care where they lived; he just registered their work address as Cortex Health’s in Utah and assumed that was that.

“In our naiveté, we thought we’d just convert a bunch of our independent contractors to employees,” Albrechtsen recalled. “We didn’t really care where they lived; we’d figure that out later.”

Thankfully, the company’s tax adviser caught the issue before it was too late.

See how your employer brand is performing in AI tools like ChatGPT and Google.

Remote employees need to be registered in their states of residence, which meant the company also needed to register its presence in those states. It opened up “a whole can of worms with taxes,” Albrechtsen said.

For each state in which he had hired an employee, he had to navigate its various tax laws and jump through countless portals. In some states it took weeks to fully register an employee.

Cortex Health is far from the only company navigating the nuances of remote work and tax compliance right now. As offices shut down during the pandemic, workers scattered across the country. Some left their city apartments for rural locations, some moved back home with their parents, and some took the opportunity to move from state to state.

“That was a real signal that this is going to be a big shift in which companies and how many companies were going to offer remote work.”

Along the way, many tech companies that were once office-dependent started to embrace remote work and the opportunity to hire talent from anywhere in the country. The share of remote-enabled job postings on Built In, for example, has increased from 20 percent remote-enabled in October of 2020 to 37 percent in June of 2021.

FlexJobs, a job posting website specifically for remote roles, reported a 76 percent increase in long-term remote job listings in 2020 over 2019, according to Brie Reynolds, its career development manager.

“That was a real signal that this is going to be a big shift in which companies — and how many companies — were going to offer remote work,” Reynolds said.

Even as offices reopen, it appears remote work is here to stay. More employees than ever before are requesting to work from home. A Built In study found that one in five Americans relocated during 2020, and that one in two people won’t return to jobs that don’t offer remote work.

Meanwhile, an Upwork report on the future of work projects that 22 percent of workers will be remote by 2025.

But as Albrechtsen discovered, hiring across state lines isn’t easy. Employers will now have to weigh tax obligations and talent needs to decide just how remote their teams can be. And the location of remote employees matters too, since each state comes with its own set of advantages and drawbacks.

Tax Considerations

Whenever Jim Pickett, a tax principal, worked with a company during the pandemic, the first question he’d ask was: “Do you know where your employees are?”

Pickett works as Deloitte’s U.S. and global employment services market leader, helping companies navigate state and international tax laws. Most employers didn’t have an answer to his question, he said — and that’s a big problem.

“This means you could end up with a significant tax bill if you have extensive sales or other operations in any one state.”

The geographic distribution of your remote staff can have a large influence on your financial obligations. Whenever you have at least one remote worker in a state, it typically creates what’s known as a “tax nexus” to that state, which means you have to register with that state for taxes. You may also have to pay sales and use taxes, income taxes and franchise taxes too, depending on the state.

“This means you could end up with a significant tax bill if you have extensive sales or other operations in any one state,” said Brandon Le Du, a payroll compliance manager at Gusto, which provides a cloud-based payroll, benefits and HR platform. Le Du has spent much of the last year helping Gusto’s clients make the transition to a remote workforce.

Failing to keep up with a state’s tax regulations can result in significant fines and penalties. Since corporate and payroll taxes are a significant revenue source for states, they’re becoming more strict about collecting from out-of-state employees and from companies creating a presence within states through hiring, Pickett said. In short, those obligations can’t be ignored.

As you look into hiring a distributed workforce, there are several important tax issues to consider.

5 Tax Considerations to Keep an Eye On

- State tax registration processes

- Higher corporate income tax rates

- State-specific benefit requirements

- Convenience of employer states

- States with tax reciprocities

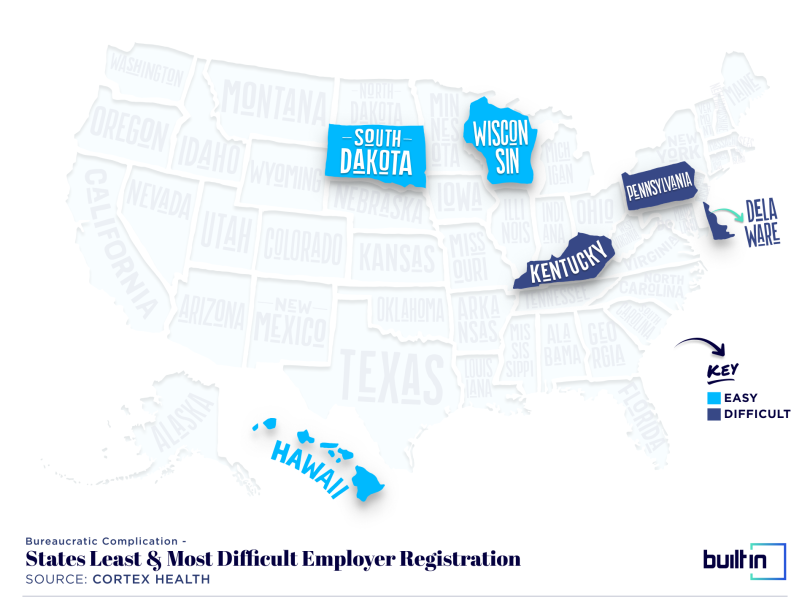

Some States Make Tax Registration Easy. Others, Not So Much.

Before you commit to hiring in a new state, it’s important to consider what it will take to register your company there. While this may seem like a simple formality, it can be an overwhelming process — especially for smaller companies with employees scattered across the country.

Will Lopez, head of the accountant community at Gusto, said tax registration is an issue a lot of companies struggle with. State websites can be difficult to navigate, and it’s not always clear what you need to do to reach compliance in a particular state. For some small-business owners, tax registration becomes an “emotional blocker” because they don’t even know where to start, he said.

Albrechtsen still remembers the hurdles he had to jump through to register an employee in Iowa. It was his first time registering an employee in a new state, and he was shocked at how much work it took to reach compliance — a process that included things like setting up a tax presence, unemployment registration, registering for workers’ compensation and beyond.

“There were 10 steps, and I was like: ‘Oh my goodness. We have to do this in 50 states?’” Albrechtsen said.

Some states had multiple web portals he had to navigate to submit different documents, while others required him to fax documents. Some locations required tax registration at both the state and township level. It became so time consuming that Albrechtsen had to seek help from a colleague at the company to register everyone.

The worst culprits were Pennsylvania, Kentucky and Delaware, he said. Each of those states had city or township registration requirements in addition to the state-level requirements. This meant they had to work with the employee to figure out exactly which township they belonged to. Pennsylvania, in particular, proved challenging to pin down, as its townships aren’t clear cut, Albrechtsen said. (The list of cities, boroughs and townships on the state’s official website has 2,560 entries.)

“We would have hired more people in those states if this had been easier.”

On the flip side, states like Hawaii, Wisconsin and South Dakota all had a streamlined registration process. He was able to hire someone and register the company in those states all within the same day.

Ultimately, a state’s registration process ended up influencing his hiring choices more than he thought it would.

“I doubt the states will read my comments, but I wish they would,” Albrechtsen said. “We would have hired more people in those states if this had been easier.”

Employee Roles and Seniority Affect Your Tax Exposure

Beware the state tax nexus.

Whenever you have an employee move from one state to another, they will create a nexus in that state. A state tax nexus means that the new state has the right to tax a portion of the corporate income that the employee generates there. The percentage is determined by the state’s corporate income tax rate, and the income is calculated in part based on the employee’s role and seniority.

“If you have people throughout the U.S., now you might not even know what corporate filings you have and whether one state is going to give you a credit for the taxes paid for that other state.”

That’s why it’s important to pay attention to each state’s corporate tax rate when you allow employees to work from anywhere.

“It can actually be incredibly complex too,” Pickett said. “If you have people throughout the U.S., now you might not even know what corporate filings you have and whether one state is going to give you a credit for the taxes paid for that other state. So your potential liability could potentially have gone up.”

Still, each company will have to do its own corporate tax calculation before deciding which states they should hire in. For example, a sales executive who’s responsible for a significant portion of company revenue will create a bigger tax exposure if they move to a state with a high tax rate than a lower-level employee might, Pickett said.

It can also help to centralize the remote workforce in a few states to establish a more predictable tax obligation, he added.

Some States Require Specific Kinds of Benefits

Payroll tax withholding requirements aren’t the only thing employers need to know about when they register in a new state. Each state also has its own rules around employee benefits like disability, unemployment pay, vacation days, minimum wage and more.

Deloitte Consulting Managing Director Naomi Bradley recommends employers do a deep dive into tax and benefit requirements before they hire in a new state.

For example, earned vacation days never expire for employees in California, which may not match with a company’s current PTO policy. In Washington, D.C., minimum wage will increase to $15.20 starting July 1. Other states like Arizona, California, Maryland and Massachusetts, among others, require businesses to offer paid sick leave.

These benefits are designed to make workers’ lives better, and it’s important to make sure your own policies match those requirements to avoid fines or penalties.

Another requirement to keep an eye on is workers’ compensation insurance, which helps support an employee if they get injured while at work. Each state regulates this insurance, and some require you to pay into a state fund rather than a third-party insurance company. All of this means that what you provide in your company’s home state may not be enough when you hire an employee in a new state.

Overlooking this step can open the company and its leaders up to steep fines, or even jail time. States with the most severe penalties include California, Illinois, New York and Pennsylvania, according to business insurance firm Insureon.

Here’s what you can face if you fail to provide the proper workers’ insurance in these states, according to Insureon:

- California: Uninsured employers can face up to $100,000 in fines and a year in jail.

- Illinois: If an employer doesn’t provide the insurance when required, they can face a $500 fine for each day of noncompliance and a minimum fine of $10,000.

- New York: Illegally uninsured employers can be charged with a misdemeanor or felony and fines ranging from $1,000 to $50,000.

- Pennsylvania: Intentional noncompliance can result in jail time and fines of up to $15,000.

Beware Double-Taxation From Convenience of Employer States

States aren’t just interested in collecting taxes from companies. Employees who decide to work from different states or who permanently live in a different state than their employer may face double the tax obligations in some states.

“It’s up to the employer looking for talent to offset those not-tax-friendly items for the employee and to take cost of living into consideration when you’re offering an employee to join the team.”

This is called the convenience of employer rule. Seven states deploy this law, and each has different rules and stipulations for how it works, Pickett said. In general, these laws hold that, if a person works in a different state than their employer — and that the person does so by choice, not because their job requires them to — the employer’s state has the right to tax them. So if you have an employee who works out of Illinois and your company is based in New York, you may be required to withhold taxes from their paycheck in both New York and Illinois.

If your company is in one of those seven states, it’s important to research what those rules are and check with either your payroll or tax adviser to make sure you and the employee understand the full scope of the law.

It’s important to consider any additional tax burden placed on any remote employees you hire or any employees who choose to work from anywhere. In order to compete for talent, you may need to find ways to reduce that burden with a higher salary or additional benefits, Lopez said.

“It’s up to the employer looking for talent to offset those not-tax-friendly items for the employee and to take cost of living into consideration when you’re offering an employee to join the team,” Lopez added.

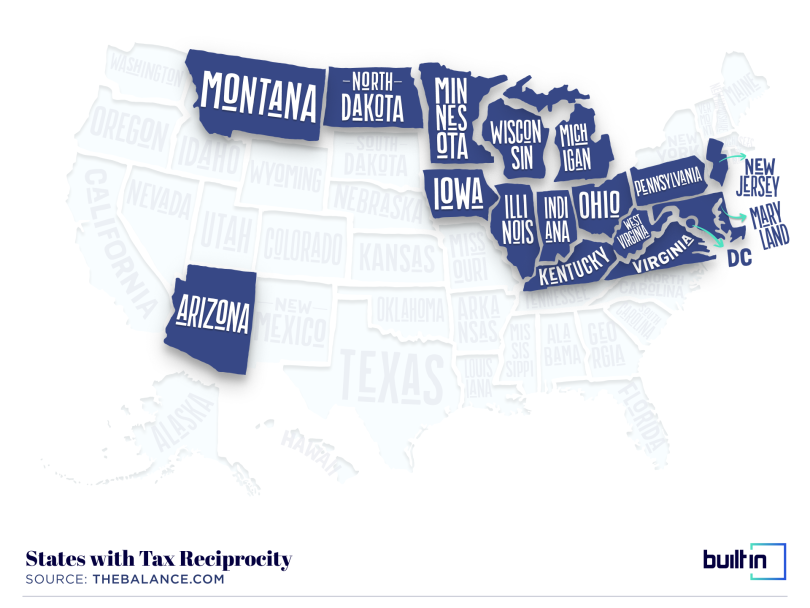

States With Tax Reciprocity

While states generally will do whatever they can to collect taxes from remote employees, there is an exception to the rule, Le Du said.

If you plan to have employees commute to the office at least part time, it may be worth it to expand your talent pool to employees in neighboring states.

An employee who lives in one state and works for a company based in another with which their home state has a reciprocity agreement only has to pay taxes for their home state. For example, an employee who lives in Wisconsin but works for a company based in Illinois would only have to pay income taxes in Wisconsin, thanks to the states’ tax agreement.

This reduces the tax burden for employees — effectively the same as increasing their incomes, which can be a helpful consideration when hiring remote talent.

In all, 17 states have a reciprocal agreement with at least one other state, and most of these agreements are between states that border each other. Arizona is an exception to that rule, however — it has reciprocal agreements with Indiana, Oregon and Virginia, in addition to California.

Whatever you do, though, just make sure employees fill out the appropriate forms, Le Du said.

Go Where the Talent Is

Eight years ago, Dell became one of the biggest companies to commit to remote work with a plan to have 50 percent of its workforce remote by 2020.

Dell proved to be more of an outlier than the norm in the years that followed. While laptops and software like Zoom and Slack made remote work more accessible, most people still remained tethered to their offices.

Now that people have acclimated to working from home, however, the opportunity to work remotely has become an expectation. In fact, many people are looking specifically for remote jobs, and are leaving their current employers if that option isn’t made available to them, Reynolds said.

As a result, taxes aren’t the only consideration a company needs to take into account when hiring and managing a distributed workforce. It’s also about finding and retaining the best talent. Lopez recommends employers sort out the geography of their teams to ask themselves which states seem most conducive to finding the talent they’re looking for.

Here are some things to consider to help you identify those states:

3 Talent Considerations to Note

- Quality of the state’s remote work environment

- Financial incentive offerings to remote workers in rural states

- States with high unemployment rates

The Best and Worst States to Work From Home In

Not every state is equal when it comes to supporting remote workers.

Some states offer more affordable rent, larger living spaces and better internet than others. Other states have a larger share of people in professions conducive to remote work like engineering, administration and sales, making it a natural destination for companies looking to find remote talent.

Financial website WalletHub conducted a report in 2020 to analyze both the quality of working conditions and living conditions in each state to identify the best states for remote work.

WalletHub evaluated each state on 12 metrics categorized as either working conditions or living conditions. Working condition metrics included a state’s share of workers working from home, household internet access and share of potential telecommuters. Living conditions included things like internet cost, median square footage and the share of detached homes.

Colorado scored highest for work environment, while Georgia placed first in living environment. Overall, Delaware, North Carolina, Georgia, New Hampshire and Tennessee offered the best combination of work and living environment for remote workers, making them ideal states both for remote workers and companies looking for talent.

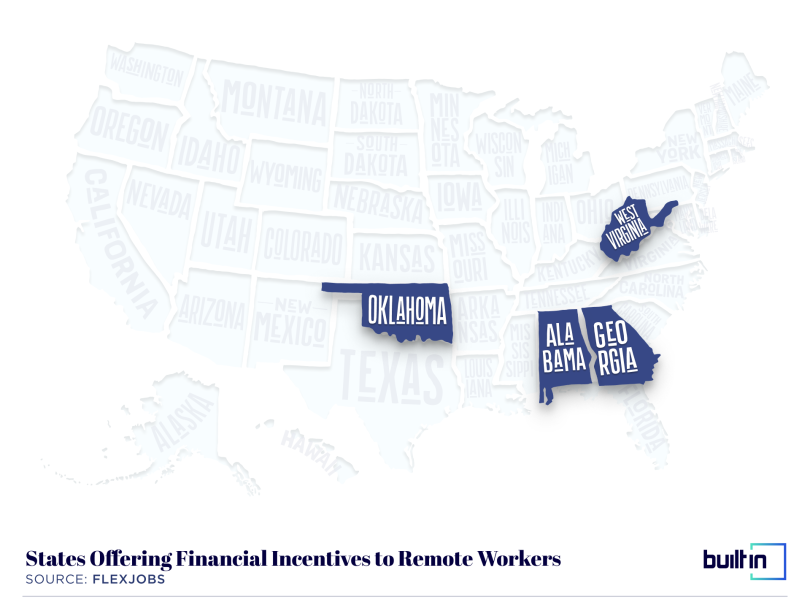

Some States Offer Financial Incentives for Remote Workers

Remote work has created a new opportunity for states that haven’t traditionally been work destinations to change that narrative.

At FlexJobs, Reynolds has seen rural states like Montana, Alabama and West Virginia, among others, tout their tax friendliness to employers to encourage them to recruit in their states. Vermont partnered with Amazon to post remote jobs for people specifically in its state, and other states like Kentucky are in the process of improving their infrastructure to become remote work destinations.

“When the states put the details out and announce these programs, they’re talking about bringing the population back and stopping the brain drain in their states,” Reynolds said.

Meanwhile, Alabama, Georgia, West Virginia and Oklahoma all offer incentives to court remote workers. Bonuses range from reimbursing moving expenses to up to $12,000 in cash grants. For example, anyone who moves to West Virginia will receive $10,000 split across their first 12 months living in the state, and then $2,000 paid during the end of the second year of residence.

“They’re looking to move from a higher cost of living and more stressful situation to a place with lower cost of living and less stress.”

The rural draw seems to be working too. The Tulsa Remote program attracted nearly 1,000 applicants the first day it became available. Reynolds has also noticed a shift in employees moving to rural states without remote work incentives just to be closer to nature during the pandemic.

“When you go from working in a city to working from home in the city, that’s a big increase in work-life balance. ... But some people are looking for a more extreme version of that, where they can get a total lifestyle shift,” Reynolds said. “They’re looking to move from a higher cost of living and more stressful situation to a place with lower cost of living and less stress.”

So, don’t overlook rural states when looking for talent.

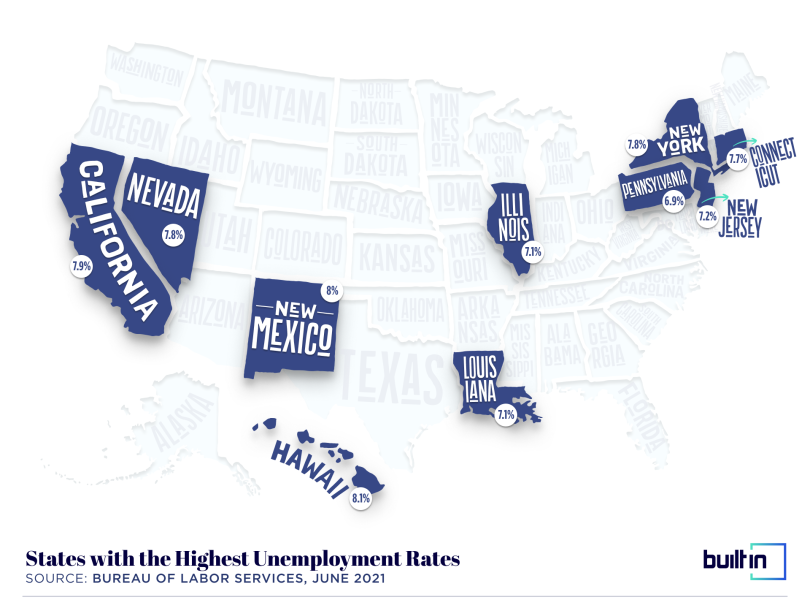

Look to States With High Unemployment

Finding qualified remote talent can sometimes boil down to a case of supply and demand.

“There are still a lot of people looking for employment, and there were many jobs lost during the pandemic.”

If your company was fortunate to be in a state that weathered the pandemic and bounced back quickly, it might be difficult to find applicants to fill roles in your area. Lopez suggests looking at states whose economies were hit harder by the pandemic to find remote talent.

“There are still a lot of people looking for employment, and there were many jobs lost during the pandemic,” Lopez said. “The states that are opening the fastest are driving the supply, so go in the direction of looking at states more affected by unemployment.”

Some of the best areas to start posting remote jobs include coastal states like California, New York and New Jersey, as well as those with higher unemployment rates. Accountants within Gusto’s community have also reported that their companies are looking at those states first for talent, Lopez added.

The Case for Hiring Everywhere

One year after scrambling to hire and register employees across the country, Albrechtsen has no regrets. While he hasn’t run an analysis to calculate Cortex Health’s tax bill yet, he still believes the opportunity to help out during the pandemic made the cost worth it.

The experience has even transformed the way the company looks at hiring.

After years of requiring non-nurse employees to come to the office every day, Cortex Health is fully committed to hiring across state lines. Now, Albrechtsen looks for the best talent available, regardless of location.

“I now feel like the talent pool we have is limitless.”

Of course, it may be some time before most companies take that approach. State tax laws haven’t kept up with the trend of remote work and remain a major barrier to hiring across the country, Reynolds said. Unless a company is willing to either invest the administrative time to hire from any state or works with a payroll and tax adviser, the best state for remote talent might be the company’s own backyard.

“Because most companies are signaling that a hybrid situation is what they’re aiming for — where people work in the office sometimes and at home other times — we will see the majority of remote workers in the same location as their office,” Reynolds said. “We might see companies be more flexible and let people work in an Airbnb over the summer, but the geographic proximity [of employees] will stay close in the near-term.”

Ultimately, there is no one-size fits all approach to hiring remote talent, and no state is perfect. In Albrechtsen’s opinion, however, the value of hiring from anywhere is hard to overstate.

“I now feel like the talent pool we have is limitless.”