At Northwestern Mutual, we are strong, innovative and growing. We invest in our people. We care and make a positive difference.

Summary:

As the Assistant Director - Field Policy, you will support the administration, evolution, and maintenance of our Field Policies. You will serve as an escalation point, lead technical resource, and advisor to the Field Function and the broader field.

Key responsibilities include:

- Subject Matter Expert: Acting as a subject matter expert on distribution policy, addressing related matters and independently resolving inquiries.

- Consultation: Providing primary consultation on field policies for issues across the enterprise, offering guidance to home office stakeholders, field leaders, financial representatives, and their teams on unique and unprecedented policy issues.

- Project Leadership: Leading project or program management efforts related to Field Policy to identify gaps, best practices, and proactive solutions to business challenges.

This role requires comfort in navigating ambiguous environments, strong consultation skills, decisiveness, the ability to manage initiatives, and the ability to take a proactive approach to enhancing field policy administration.

Primary Duties & Responsibilities:

- Support the development and revision of field policies in collaboration with cross-functional partners.

- Work closely with enterprise partners to build alignment on escalations and lead the development and implementation of recommended solutions. You will serve as the escalation lead for complex, sensitive, and non-standard field policy-related matters.

- Lead or participate in departmental business and/or enterprise projects as required.

- As a registered securities principal, oversee the work of non-registered staff members.

- Demonstrate broad decision-making and problem-solving latitude, creativity, and accountability to address non-standard situations, promote adherence to and apply policies, and grant approval in non-standard scenarios to Company and NMIS policy.

- Provide counsel and recommendations to field management, Field Performance teams, and business leaders on escalated issues.

- Support the development and/or improvement, implementation and oversight of new processes or enhancements to existing processes to address changes in our business direction or regulatory requirements.

Qualifications:

- Series 7, Series 24 required

- Bachelor's degree and a minimum of 7 years of professional experience in the insurance industry with risk and investment products and additional experiences in the areas of broker-dealer supervision, law, or compliance.

- Demonstrated ability in independent and collaborative problem solving, critical thinking and assessment skills, navigating ambiguity, influencing without authority, project management, implementation, and decision-making.

- In-depth knowledge of the culture and structure of the Company and its field force as well as experience working directly with the field.

- Superior oral and written communication skills. Experience delivering difficult messages and working to consensus across departments and interests.

- Proven ability to build rapport and exercise tact, diplomacy, and resourcefulness in dealing with external and internal customers. Cultural competence, interpersonal savvy and emotional intelligence are a must.

- Ability to lead projects across department lines and negotiate/influencing others.

- Comfortable working in an ever-changing environment, with an ability to identify key issues, prioritize their impact, provide recommendations and implement timely solutions.

This position has been classified as a Registered Representative under NMIS guidelines and requires fingerprinting.

Required Certifications:

Series 24 - FINRA, Series 7 - FINRA

Compensation Range:

Pay Range - Start:

$92,750.00

Pay Range - End:

$172,250.00

Northwestern Mutual pays on a geographic-specific salary structure and placement in the salary range for this position will be determined by a number of factors including the skills, education, training, credentials and experience of the candidate; the scope, complexity as well as the cost of labor in the market; and other conditions of employment. At Northwestern Mutual, it is not typical for an individual to be hired at or near the top of the range for their role and compensation decisions are dependent on the facts and circumstances of each case. Please note that the salary range listed in the posting is the standard pay structure. Positions in certain locations (such as California) may provide an increase on the standard pay structure based on the location. Please click here for additional information relating to location-based pay structures.

Grow your career with a best-in-class company that puts our client's interests at the center of all we do. Get started now!

We are an equal opportunity/affirmative action employer and all qualified applicants will receive consideration for employment without regard to race, color, religion, gender identity or expression, sexual orientation, national origin, disability, age or status as a protected veteran, or any other characteristic protected by law.

If you work or would be working in California, Colorado, New York City, Washington or outside of a Corporate location, please click here for information pertaining to compensation and benefits.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and our commitment to a culture of belonging.

- Flexible work schedules

- Concierge service

- Comprehensive benefits

- Employee resource groups

What We Do

You’ll Like It Here

At Northwestern Mutual, we believe that our lives and our work matter. And that doing what’s right is good for everyone. We follow through by designing tech that improves the community and cultivating creative ways to make finance accessible anywhere. These guiding principles have allowed our company to grow for more than 160 years.

Here, you’ll be with a team who emphasizes integrity and prioritizes security to design experiences that better everyone. You’ll work in cross functional teams to create optimal solutions that are rooted in innovative strategy and thoughtful execution. And you’re provided development tools and opportunities to become a leader all with the support of a collaborative team. You’ll be surrounded in a culture that values innovation and works to always evolve to stay ahead of trends and client needs.

We are intentional in seeking out team members who will challenge us. Our employees choose us for the career opportunities, commitment to philanthropy and desire to have a meaningful impact in the lives of our clients. You have career passions and goals. We have ambition and opportunity for you to grow your future in tech. Discover today: https://careers.northwesternmutual.com/

Why Work With Us

We invest in our people. We know careers are about choices, so we provide intentional opportunity. Here you can build creative ways to make finance accessible anywhere and revolutionize traditional processes. As a mutual company, our focus is our people — whether professional development or investments in the community.

Gallery

Northwestern Mutual Teams

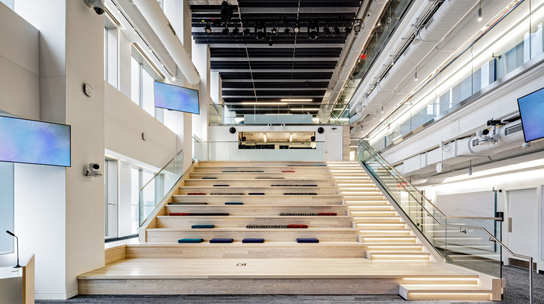

Northwestern Mutual Offices

Hybrid Workspace

Employees engage in a combination of remote and on-site work.

We offer a flexible, hybrid approach for our employees . Teams are in the office a few days a week and work from home the others.