Blockchain is one of the biggest buzzwords in tech.

That’s in large part because of its most buzzworthy application, cryptocurrency. The rise in value of Bitcoin, Litecoin, Ethereum and other cryptocurrencies has rocketed blockchain into the public consciousness. As time has passed and economies around the world have yet to do business in Dogecoin, that initial hype could well be cooling.

But cryptocurrency is not the sole application of blockchain, as companies with vested interests in the technology will point out.

“The sensationalism that media has brought to blockchain is beginning to burn off,” said Deborah Barta, SVP of innovation and startup engagement at Mastercard Labs. “The people who have been focused on blockchain from the beginning — not as a savior but as a technology — are now focused on the practical applications of the technology.”

Mastercard may not be a company many people associate with blockchain, but it serves as a solid example of companies investing in applications of blockchain outside of the crypto scene. It has quietly staked a claim as a blockchain R&D leader — Mastercard has the third-most blockchain patents in the world (Alibaba and IBM lead the way). While it’s not uncommon for companies to follow fads, Mastercard has been investing in the myriad applications of the technology since before the first Bitcoin billionaire was minted.

“We built our own blockchain about five or six years ago,” said Barta. “We needed it to mirror the tenants of our payments network in terms of resilience, security, scale and throughput, and that simply wasn’t available at the time with open-source blockchains.”

Who is behind Mastercard's Blockchain?

Labs, the company’s R&D outfit, was launched in 2010 to help accelerate innovation through internal programs and partnerships with enterprise companies and startups alike. In the nine years since its launch, Labs has grown to 11 offices worldwide and its headquarters, located in the Dublin suburb of Leopardstown, will soon be home to almost 600 employees.

“We have dedicated engineering teams and product-minded folks working at all stages of the product life cycle. There’s a commercial model to sustain, so we’re not just playing in a vacuum. We want to make sure that what we build can actually be scaled,” said Barta.

Barta joined Labs in 2012 and helped shepherd the development of Mastercard’s blockchain. Since then, the company has been in the weeds investigating a full spectrum of blockchain applications, both conventional and out of the box.

Money on the move

Not surprisingly, Mastercard has spent a fair amount of time exploring applications of blockchain that complement its existing business offerings.

Take international money transfers. Anyone who has sent money abroad knows it’s neither cheap nor simple. That’s because money doesn’t just move from one bank to another. Usually, at least one intermediary bank is needed to complete international transactions. These banks serve as middlemen, bridging the gap between banks that don’t have shared accounts and collecting fees for their services. Blockchain eliminates the need for intermediaries, as it establishes a direct connection between banks and verifies the existence of the funds being transferred. Mastercard has pursued this application of blockchain technology since late 2017.

Mastercard’s blockchain is permissioned, which means that details are only shared and accessible by those that participated in the transaction. Companies and banks can apply to access its blockchain APIs and use them to build or augment their own cross-border payment platforms. Mastercard doesn’t process any transactions using its own blockchain and no money is actually sent over it. While the technology is new, the potential is big given the fact that Mastercard’s existing settlement network consists of over 22,000 banks.

“We always say that we don’t just play. We’re playing with a purpose, which is pinpoint-driven.”

The company is also investigating consumer-facing applications of blockchain in the payments space. Barta said her team is developing blockchain-based loyalty solutions and hinted that news will hit on those developments soon, although she declined to dive into specifics.

Although Mastercard’s blockchain doesn’t yet offer support for cryptocurrencies, recent news and job postings indicate that could soon change. The company has partnered with enterprise blockchain technology company R3 on an international, B2B payments project. In that initiative, Mastercard is lending its payments network, not its blockchain, to the effort.

From Luxury Fashion to Salmon

It makes sense for Mastercard to lend its weight to blockchain-based payments solutions. But the company is also testing out blockchain applications in more unconventional waters.

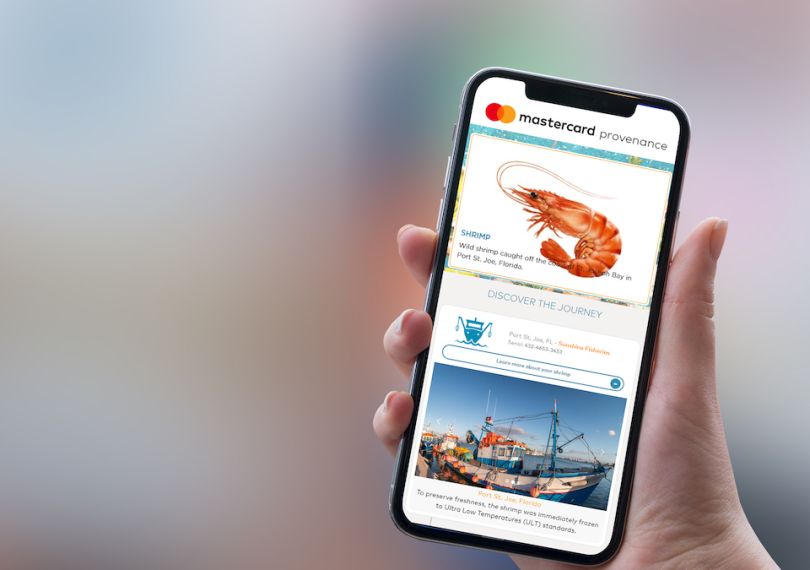

Provenance is Mastercard’s blockchain-based solution for supply chain visibility. The idea is that the same benefits blockchain brings to financial transactions — a complete and immutable record of an asset’s journey — can also be applied to consumer goods, from luxury fashion to salmon.

The Provenance solution has so far seen two public pilot programs. The first was this past summer with retailer Fred Segal and American fashion brand Rodarte. For two weeks in August, Rodarte sold pieces from a limited-edition collection at Fred Segal’s Sunset Boulevard location. Each piece featured a QR code that, when scanned by a smartphone, confirmed the garment’s authenticity by documenting its journey to the store shelf.

Mastercard also brought its Provenance solution to grocery stores through a partnership with a consumer supply chain visibility company called Envisible. The two have built technology that’s designed to let shoppers at supermarket chain Food City follow its seafood’s wholesale journey, from the fishing lines and nets to processing to store delivery, all by scanning a QR code on the packaging.

“You may not inherently assume Mastercard and seafood are a natural fit,” said Barta. “But the reality is it makes a ton of sense. If we have visibility across the supply chain, we can offer better enhancements and more efficient operational solutions. We can enable B2B payments between suppliers and buyers and things like artificial intelligence to power predictive analytics.”

In addition to giving companies greater insights into their supply chains, blockchain enables consumers to make more informed purchases. Instead of taking a company at their word and trusting that their handbags are ethically sourced or that their food comes from a sustainable farm, consumers can see for themselves and choose to spend their money elsewhere if a brand isn’t meeting their standards.

Regardless of the application, Barta said her team makes a conscious effort to ensure that the work they do with blockchain serves more than just a business purpose.

“We always say that we don’t just play,” said Barta. “We’re playing with a purpose, which is pinpoint-driven. We’re trying to change the world for the better.”