Months before the June 21 release of his first non-fungible token, or NFT, collection, Julian Lennon spoke to Paul McCartney for the first time in years. They were on FaceTime, discussing, among other things, items from Lennon’s personal collection of Beatles memorabilia that he planned to sell as digitized images on the NFT marketplace YellowHeart.

The so-called Lennon Connection, now sold out, features images of several Gibson Les Pauls guitars his late father, John Lennon, gifted to Julian, a black cape his father wore in the film Help! and the Afghan coat his father wore on the film set of the Magical Mystery Tour, where Juilian was present as a four-year-old.

What Is NFT Music?

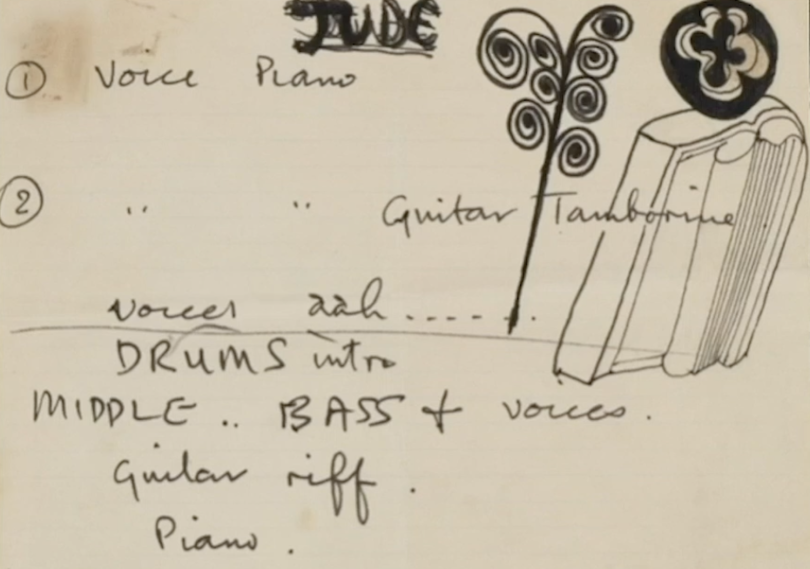

Lennon’s audio narration explaining the significance of these items is minted as part of the NFT collection, and his musings on a digital replica of McCartney’s handwritten notes for “Hey Jude,” which sold for $76,800, are especially poignant. John Lennon divorced his first wife Cynthia Lennon amid a known affair with Yoko Ono. McCartney wrote the song, originally titled “Hey Jules,” to comfort Julian as a child, and it has left a lasting impression on Lennon. His seventh album, JUDE, scheduled for release in late 2022, is at once a tribute to the McCartney song and a story of his artistic coming of age.

“Paul wrote [“Hey Jude”] from an empathetic point of view, thinking about how I was going to live, how I was going to survive, what I was going to do to be strong moving forward,” Lennon said. “I sort of took those words to heart and that’s what I’ve been doing ever since.”

It’s the potential to commemorate such deeply felt moments, while raising funds for the White Feather Foundation — a social and environmental nonprofit Lennon runs — that convinced the filmmaker, songwriter and philanthropist to dip his toes into NFTs, if cautiously.

The same day Lennon released the Lennon Connection, he dropped an NFT capturing his first public performance of his father’s “Imagine.” Recorded on April 8 as part of Global Citizen’s Stand Up for Ukraine social media rally, the performance features Julian’s singing and the guitar work of Portuguese-American musician Nuno Bettencourt.

But this is only one element of the NFT. Altogether, it contains visual artwork, video footage and two digital recordings: one, a naked recording of the performance itself, and the second, a recording overdubbed with audio narration in which Lennon describes why he decided to perform the song.

“Why now after all these years?” he asks over the opening chords of “Imagine” in an audio preview of the NFT on OpenSea. “I had always said that the only time I would ever consider singing ‘Imagine’ would be if it was the end of the world or close to it.”

“The war on Ukraine is an unimaginable tragedy,” he explained. “ As a human and as an artist, I felt compelled to respond in the most significant way that I could.” The rally, along with a pledge event the following day in Poland, raised $10.1 billion for Ukranians displaced by the country’s war with Russia, according to the preview.

But Lennon’s ginger steps into the world of NFTs — which he describes as “a new art form … powering the way forward” — are connected not only to his belief that they can elevate the profile of philanthropic causes, but his own artistic journey, which is deeply entangled in his identity formation and a decades-long struggle to come to terms with a fraught relationship with his father.

In a strange way, NFTs have allowed Lennon to reclaim his personal history on his own terms, taking a sad song, or songs, as it were, and making them better, or at least more accessible to his audience.

What Is NFT Music and Why Are Artists Interested in It?

Lennon is far from alone, of course. A growing number of musicians and talent agencies are turning to NFTs as a way to mint and preserve digital music, album art, memorabilia and concert tickets on the blockchain. Stored as unique and non-interchangeable data units on a digital ledger, these NFTs — essentially smart contracts proving ownership of digital assets — are being used by artists as diverse as John Legend, Big Boi, Grimes, Kings of Leon and Portugal. the Man to share rare and exclusive music with fans, raise money and grow their followings.

Part of the lure is financial. “Essentially, creators are looking for new ways to monetize their content,” said Michael Frisch, a partner at the law firm Croke Fairchild Morgan & Beres who advises clients in digital assets, cryptocurrency and Web3 products.

Artists disillusioned by lopsided royalty agreements or dragged by the spillover fees of record companies, distributors and marketing companies see NFTs as a way to cut out the middle person, said Josh Katz, CEO and founder of YellowHeart.

“I call it the 90/10 rule, where, traditionally, the artist takes home 10 percent of the revenue that they generate and other parties take 90 percent,” Katz said. “With NFTs, the artist takes 90 percent and the platform takes 10 percent.”

Some artists may be perfectly comfortable handing off distribution, marketing and management responsibilities to companies that offer these services. But the opportunity for musicians to retain a greater share of royalty rights and creative control of their music is attractive to many, Katz said, particularly those with loyal, established followings. Plus, NFTs live on blockchain, a publicly accessible and transparent network, making it easier for artists to track sales data and fan profiles on their own.

“You’ve got the ability now for artists to go direct to consumer, which has been around for some time through artist’s platforms, like websites, social media and so forth,” said Saroosh Gull, CEO of the New Jersey-based event management company Eventcombo. “But now, in terms of transactions, you have data tracking that you do not need to rely on a streaming platform for. You don’t need Apple Music to track who’s downloading your music, who’s consuming it, and who’s paying what for it.”

NFT Music Is Much More Than Just Music

With NFTs, as with any contract, the devil is in the details. Several blockchain technology companies offer NFT music, but the way the NFTs are bought and sold on online marketplaces, where they can be accessed and played, and the digital assets and contractual rights they contain, varies widely.

One of the first major records to be released as a limited collection of NFT was Kings of Leon’s album, When You See Yourself. According to Rolling Stone, YellowHeart offered it through three types of tokens: “a special album package,” a second type with “live show perks like front-row seats for life,” and a third type “for exclusive audiovisual art.” Though the album is available everywhere — Spotify, iTunes, Apple Music, Amazon — the most basic NFT token, available for only two weeks and priced at $50, offered a digital download and exclusive perks, such as a rotating album cover and a limited-edition vinyl copy.

Compared against a forecast of the band’s annual earnings — Kings of Leon reportedly earned about $138,000 in 2021, and roughly $60,000 in 2022 — the album has done quite well. As of last March, the album had generated more than $2 million dollars from NFT sales. But earnings are somewhat elusive with NFTs. The album was sold on the Ethereum blockchain, meaning the album’s estimated U.S. dollar earnings at the time of the purchase, similar to stocks, are relative to market fluctuations.

But regardless of cryptocurrency’s ephemeral value, the fact that many platforms now allow account holders to pay with credit cards has dramatically expanded their potential to attract users. On YellowHeart, once a registered user has downloaded a wallet from YellowHeart, or linked to a wallet on a crypto exchange like MetaMask or Coinbase, they can click a buy button, enter their credit card information (or pay with Ethereum) and the digital asset is added to their wallet.

“Not many people have cryptocurrency,” Katz said. “It’s less than 1 percent of the population. So, using credit cards, this allows for the mass adoption of purchasing NFTs.”

Of course, other music NFT sites operate differently. On Royal.io, launched as a beta, musicians can determine a percentage of their streaming royalty rights they wish to share with fans and collectors. Investors become partial owners of the song, while earning income and curated benefits.

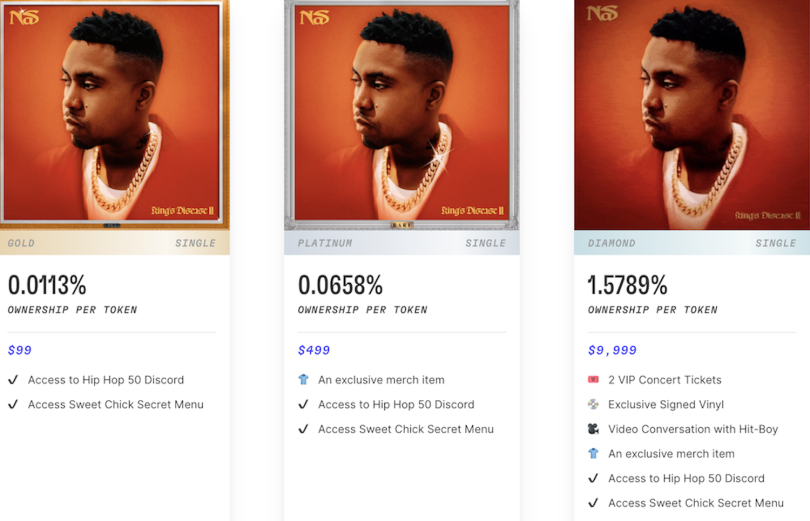

Three tiers of tokens for Nas’s “Rare,” a single off the album King’s Disease, are now sold out. But while available, for $99 and a 0.0133 percent ownership stake in the streaming royalties, users could buy or bid on a token, via a Royal.io link to OpenSea. The token included access to a Hip Hop 50 Discord channel and other perks. A more expensive package, for $9,999 and 1.5789 percent ownership, included two VIP concert tickets, a signed vinyl copy of the single and a video conversation with Nas. Thus far, according to the website, 50 percent of the streaming ownership has been sold for $369,000.

“The first wave of NFT ownership was sort of viewed as [rights to] a collectible, an art piece or an autograph that you might get from a creator ... But the thinking now is that NFTs can represent a lot more.”

Then there’s OurSong, a mobile app developed by Our Happy Company, a software firm co-founded by musician John Legend. The app lets registered users build profiles, upload assets to mint as NFTs, host chats, and buy and sell music with Ethereum or OneSong Dollars — a rough U.S. dollar equivalent that includes a nominal fee — and follow and connect with likeminded artists.

These platforms and their users represent an evolution of NFT ownership, according to Frisch. “The first wave of NFT ownership was sort of viewed as [rights to] a collectible, an art piece or an autograph that you might get from a creator,” he said. “But the thinking now is that NFTs can represent a lot more.”

“They can serve as a ticket or entry point into a community, like access to a permissioned Discord channel, or a fan group,” he added. “They could represent a right to obtain physical things, like apparel, or access to special events.”

NFT Music vs. the U.S. Securities and Exchange Commission

But parsing shared digital asset rights can get legally complicated, Frisch told me. Agreements that divvy up streaming royalty rights among many users have come under scrutiny by federal agencies like the U.S. Securities and Exchange Commission and the Commodity Future Trading Commission for running afoul of securities laws, or, at least, testing their boundaries.

While Frisch said much of the law in this area is “untested” and “unclear,” the U.S. Supreme Court’s SEC v. W. J. Howey Co. case outlines a four-part test that has been adopted by the courts to determine whether a digital asset meets the definition of a security. The test was initially applied to the Howey Company, which sold land tracts in a 500-acre Florida orange grove to the public, along with a contract to service the groves and sell the produce to foreign investors.

“The idea was that the proceeds of the sales of the oranges would help it to finance additional development for the groves: buying more water, infrastructure and whatever else they’re selling,” Frisch said. “The SEC sued and said, ‘You didn’t register these securities.’”

Now, that 1946 battle over communal orange rights is being reanimated in the context of digital music. To be considered a security, Frisch said an asset has to meet the four prongs of the Howey test, involving (1) “the investment of money” in a (2) “common enterprise” (3) “with a reasonable expectation of profits” that is derived from (4) “the entrepreneurial or managerial efforts of others.”

Single-edition music NFTs, like those sold on the marketplace Catalog, fall clearly outside this definition. And, for artists, who own copyright to their work under U.S. copyright law, they can be quite lucrative. Cooper Turley, a Los Angeles-based advisor to Audius, stated on Twitter that major artists, on average, earn “7.5 times more from music NFTs than a year’s worth of streams” on Spotify.

“Some of these are structured as investments, and some aren’t. When you structure it in such a way as to make it impossible to earn a return, then it’s almost, by definition, not a security. And that’s one way to avoid these complications with U.S. securities laws.”

But for platforms that share streaming royalty rights, what is and isn’t a security is far less clear. To avoid being treated as securities, which would require registration requirements, fees and financial disclosures many young companies would rather sidestep, streaming royalty agreements are often cleverly structured.

Take, for instance, the one created for Nas’ NFT sale of the single “Rare.” As reported by Samir Patel, an associate at Holland & Knight law firm, in an article titled “If NFTs Ruled the Word: A New Wave of Ownership” published in the International Journal of Blockchain Law, Nas was an investor in the $55 million Series A funding round for Royal.io. He sold 50 percent of his streaming royalties from digital service providers — such as Spotify, Apple Music, and Youtube Music — on the platform. The song was released four months prior to the NFT sale, and purchasers received no publishing royalties or money from TV, radio, video game or movie plays.

Most crucially, Patel noted, NFT holders received only a small fraction of the streaming royalties. For each stream, Nas gets $0.0008 from Apple Music and $0.00318 from Spotify. A gold-level NFT holder, by comparison, nets $0.0000009 from Apple Music and $0.00000036 from Spotify. That’s a lot of zeros before cents, and, in some ways, that’s the idea. As of March 2022, the “Rare” NFT was played almost 12 million times, well short of the 275 million times a gold NFT holder would need to break even.

“It was structured in a way, whereby it was basically impossible for the purchaser to get a real return to make their money back on their investment,” Frisch said. “Some of these are structured as investments, and some aren’t. When you structure it in such a way as to make it impossible to earn a return, then it’s almost, by definition, not a security. And that’s one way to avoid these complications with U.S. securities laws.”

Other companies attempt to satisfy the requirements of the Howie test through airdrops — sending free tokens to communities to encourage adoption (negating the first prong of the Howie test) — or by arguing that a song’s value, much like a bar of gold, is intrinsic and not tied to managerial efforts (negating the fourth prong of the Howie test). In an age of social media, micro-influencers and hype beasts, this might be a harder argument to swallow, but if you consider the enduring popularity of a song like “Imagine,” whose 2010 remastered version had more than 450 million streams on Spotify as of this writing, compared to, say, 931 million or Adele’s “When We Were Young,” it may have some merit.

At least one company, Opulous, sells NFTs as securities under Regulation Crowdfunding, a lower-bar securities offering which provides exemptions from SEC registration requirements for crowdfunding sales up to $5 million. The company, which allows artists to obtain decentralized finance, or DeFi, loans against up to 12 months of predicted streaming royalty revenue, claims on their website their tokens “will generate ongoing royalty income and increase in value as an artist’s career progresses. So when artists you invest in earn money — you do too!”

NFT Music Is About Patronage and Intimate Connections With Artists

Most advocates, though, will tell you that, at least for consumers, ownership of music NFTs is not about getting rich. It’s about helping musicians boost their exposure and momentum in exchange for rare and sentimental collectibles, access to an exclusive online community and a chance to forge deeper connections with artists.

To some extent, this is why Lennon decided to dip his toes into NFTs: He wanted to communicate with his audience in a deeper, more intimate way.

“I felt that if I could personalize [the NFT collection] and make it be more of a communication with the audience, or the people that were considering buying this stuff, that was the way forward for me,” Lennon said. “That made it more of a personal deal, rather than just, ‘Hey, we’re selling this.’”

To that point, the ownership structure of the Lennon Connection NFT collection is intriguing. It lets Lennon retain full rights to the collection’s physical mementos, while sharing their digital replicas — and the stories he chooses to tell about them in audio clips and artworks — with fans and investors.

In some ways, Lennon cautious steps into the world of NFTs encapsulates the grand vision of Web3: giving creators a greater share of ownership and control over the products and services they make and, in turn, giving consumers direct access to these offerings in the communities they belong to.

As Frisch put it: “Rather than artists and consumers being beholden to centralized entities, like Spotify, who sits in the middle and takes a cut long term, these things that allow artists to control their own destiny and users to directly interact with artists … I think that’s the future. That’s the real ethos of what Web3 is all about.”

Can NFT Tickets Combat Scalping?

Of course, digital recordings and artist memorabilia are only part of the story. The online event ticketing market is projected to reach $68 billion by 2025, according to Grand View Research. And as YellowHeart continues to draw artists like Lennon to the platform, they are banking on NFTs to lay claim to a growing share of this windfall.

In June, as part of the annual industry showcase NFT.NYC, the blockchain company partnered with Tao Group Hospitality, one of the world’s largest club operators, to offer NFT tickets for three nights of DJ performances at the Marquee club in New York City – the first release of NFT tickets at such a large-scale New York venue.

Like many digital tickets, NFT tickets provide concertgoers access into venues through a unique QR code. But they also do something else, Katz said, opening a path to ongoing fan engagement and ensuring a secure record of ownership that can be traced to the blockchain and help deter scalping and piracy.

“When you leave Coachella, imagine your ticket opened up local perks from sponsors, from partners. Essentially, it’s a living ticket.”

According to a report from CNBC, the U.S. ticket resale market is a $5 billion industry. On fan-to-fan marketplaces like StubHub, TickPick and SeatGeek, human scalpers and bots can easily gobble up tickets in mass and resell them at a mark up, leading to quickly sold out shows and grossly inflated prices. While there is no federal law against scalping and state laws are loosely enforced, NFT tickets can theoretically ferret out opportunists who may be pricing out loyal fans.

“A blockchain is transparent to everyone, nothing is hidden,” Katz said. “So you can essentially see if somebody bought 12 tickets, didn’t use any of them, then resold them for more money. And bad actors are very quickly identified.”

And by offering tickets as digital vouchers tied to a user’s account, there’s also the chance to stay in touch with fans long after they move through the turnstiles — and, yes, sell them more stuff.

“Look at Coachella,” Katz said. “Coachella is one of the most recognized brand names in the world, especially around music and lifestyle. And they only monetize six days a year. When you leave Coachella, imagine your ticket opened up local perks from sponsors, from partners. Essentially, it’s a living ticket.”

For all the potential advocates see in NFT music, however, the financial horizon for NFTs remains murky. Sales volume sank to a daily average of 19,000 tokens in early May, down 92 percent from their peak of 225,000 in September, according to the Wall Street Journal. And whether fans will be eager to embrace NFTs as an alternative or adjacent to streaming platforms like Spotify and Apple Music — especially if files can only be accessed as digital downloads — remains to be seen.

Still, proponents like Katz believe NFT music holds tremendous promise, offering a way to correct a lopsided market that for too long has shortchanged artists.

“For years, music has been devalued to the point where most people think it’s free,” Katz said. “And what NFTs do is put value back into the music where people actually have to buy it again.”