What does the world run on? Money. And thanks to advancements in the Fintech industry, that money is flowing around the globe quicker and safer than ever before.

What does money run on? People. It’s the hard working employees at all of these growing Fintech companies that are making the money move, bringing convenience and security to millions of individuals and companies.

In order to hire the best people to do the job, you need to know what sectors of Fintech are expanding and the roles within them that are most competitive. To help you understand the Fintech industry and how to recruit for it, we've broken everything down in this guide with a combination of expert data mixed with some of our own findings. Feel free to click the links below or read on.

See how your employer brand is performing in AI tools like ChatGPT and Google.

Table of Contents

FINTECH INDUSTRY BREAKDOWN

While brick and mortar banks are still fairly common, nowadays, more than 60% of people use online banking tools for their financial needs. Why? Because it’s safer and infinitely more convenient than cashing a check or transferring money in person.

FINTECH EXPANDS GLOBALLY

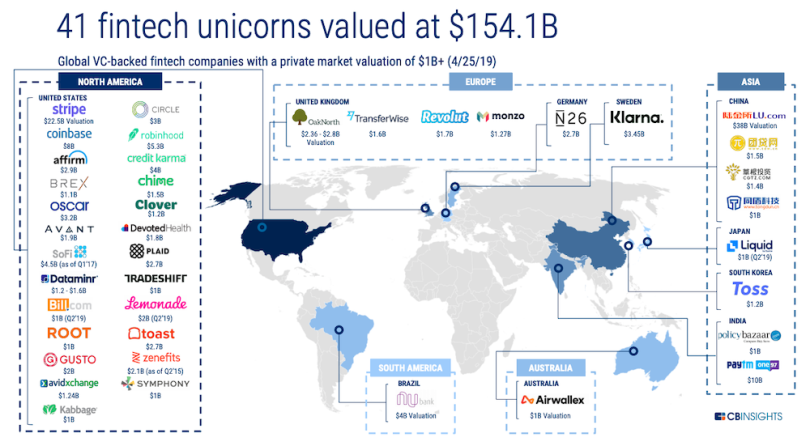

Of the 41 Fintech unicorns in the world, 25 are based in North America, followed by eight in Asia and six in Europe. You can see below the lay of the Fintech land thanks to this graphic courtesy of CB Insights.

While these unicorns may be the top dogs of the VC-backed Fintech world, they don’t tell the entire story. First of all, these numbers are not a direct correlation to the global Fintech user base. While China may have fewer Fintech unicorns, they have the highest percentage of Fintech users, followed by India. Additionally, of the top seven Fintech hubs, four are in China, two are in the US and one is in the UK.

FINTECH FUNDING BRINGS IN THE BIG BUCKS

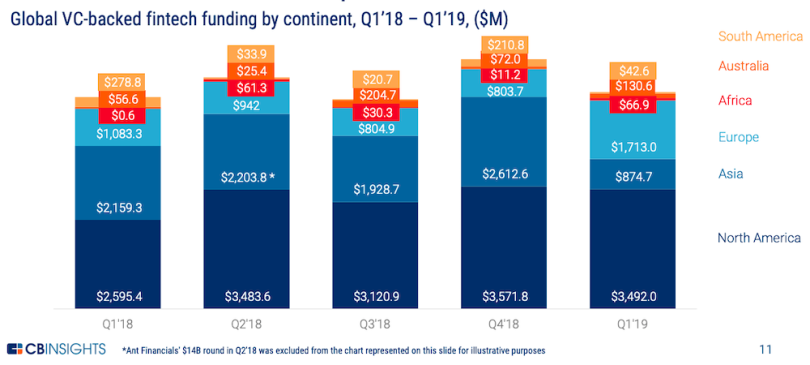

While there have certainly been fluctuations quarter-over-quarter in the Fintech funding arena, year-over-year the industry is steadily growing. From Q4 2018 to Q1 2019, Fintech deals were up 4%, but funding dropped by 13%.

Additionally, when looking at year-over-year funding growth between Q1 2018 and Q1 2019, Insurtech (up 802.9M) and Wealth Management (up 231.2M) stood out among the rest with the highest amount of growth in overall funding.

- Insurtech - Up 802.9M

- Wealth Management - Up 231.2M

- Digital Banking - Down 30.2M

- Regtech - Down 47.3M

- Capital Markets - Down 156.8M

Additionally, Q1 2019 saw a significant rise in early stage funding deals, making up 54% of the quarter’s rounds, which follows a similar trend from Q4 of 2018. This large amount of early-stage funding shows that there is still a lot of growth to come as these early-stage companies expand and therefore need to recruit top talent to excel during this stage of growth.

THE FINTECH JOB MARKET

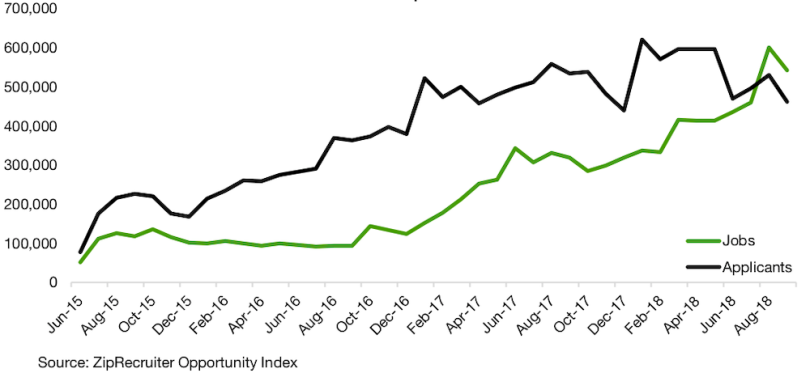

It should come as no surprise that as Fintech companies are gaining funding, they are also expanding job opportunities. Over the past several years, the Fintech job market has exploded from below 100,000 jobs in mid 2015 to nearly 600,000 in late 2018. Given the rise in funding during Q1 of 2019, we can expect these trends to continue in the upcoming years as Fintech expands its horizons and takes over from traditional financial institutions and services.

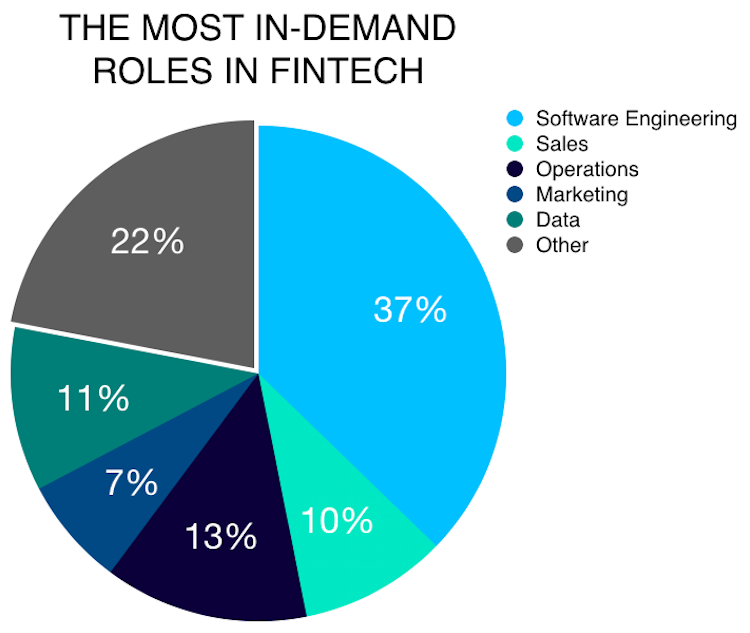

THE MOST IN-DEMAND ROLES IN FINTECH

To optimize your recruiting efforts in the Fintech industry, you first need to understand the lay of the land. What’s trending, who’s hiring for what, etc. Now that you have that base, we’re going to delve into the most in-demand roles in Fintech. We gathered in-depth information about specific Fintech jobs from our seven local communities to better understand the trends of Fintech recruiting.

In the breakdown below, we found that 78% of roles fell under five different categories: Software Engineering, Operations, Data & Analytics, Sales and Marketing. These are the candidates you’ll have the highest competition to attract and hire because everyone else in the industry is also vying for their attention.

Software Engineering

Fintech companies require the best of the best when it comes to building their online platforms and services. Our research shows that at the time of publication, 37% of open roles in the Fintech industry were for Software Engineering.

Software Engineers, however, are not a one-size-fits-all breed. They each have their own unique skill set and knowledge of coding languages that qualify them for different open roles. To see which types of Software Engineers are most sought after among the Fintech industry, we also calculated the most in demand programming languages as indicated by the percentage of job descriptions that listed them as a requirement:

- Javascript - 37.27%

- Python - 29.02%

- Linux - 18.63%

- Ruby - 19.61%

- Java - 28.86%

Operations

Not surprisingly, operations ranks as the second most in demand role in Fintech, accounting for roughly 13% of all job openings. It takes a lot of coordination to keep those Software Engineers building products on time and on budget and to ensure customers are happy.

Within operations, the top three roles are:

- Customer Success - 35%

- Information Technology - 31%

- Customer Support - 19%

Data + Analytics

What is Fintech if not loads and loads of numbers and data? In order to organize and translate all that data into tangible information, Fintech companies are hiring Data and Analytics experts to help bring meaning to the madness. These positions make up roughly 11% of all open Fintech roles.

Sales

While Sales only accounted for around 10% of open roles in Fintech, they certainly play a major role in the success of the industry. Without a strong sales team to sell and manage a product, the Fintech industry would not be as successful as it's become.

Within this category, the most in demand roles break down as follows:

- Sales Development Representative - 42%

- Account Executive - 25%

- Account Manager - 11%

- Sales Operations - 8%

It also makes sense that SDRs are the top open roles. Because the industry is still fresh and growing, there is a lot of prospecting to be done, which is where SDRs come into play.

Marketing

Marketing roles account for roughly 7% of all open roles in the Fintech industry. Marketing teams play a crucial role in getting the right information to specific target audiences. This is especially crucial in an industry like Fintech, where the audiences tend to be fairly niche — not everyone is searching for the latest in advancements in Insurtech and Wealth Management. Many Fintech products are used by everyday people to complete basic banking and investment transactions, making mass consumer marketing critical.

9 Fintech RECRUITMENT EXAMPLES

Now you know who you're competing for, let's brainstorm some ideas for how you're going to attract and retain top Fintech talent. We gathered 10 examples from Fintech companies across the country to see what they're doing to connect with the best candidates.

Aspiration Talks the Talk and Walks the Walk

Many companies talk about being mission driven and community oriented, but Certified B Corporation Aspiration is seriously walking the walk. Candidates interested in working for a company that holds such high standards can find them on the Certified B Corporation website, where users can search for companies by industry and location.

AffiniPay Highlights Unique Team's Culture

AffiniPay created a series of videos highlighting each of their different teams within the company. This video shares individual stories from employees in the marketing department. This helps candidates gain a better understanding of the specific team they are interested in joining to better determine if it’s a good fit for them.

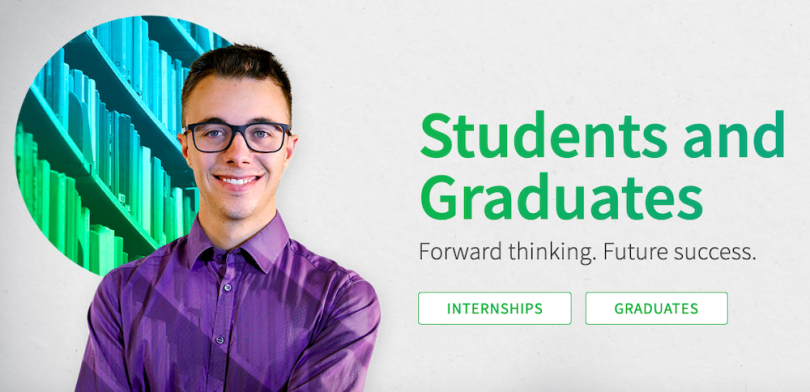

IHS Markit Digital Helps Students Find Their Career

IHS Markit Digital is eager to recruit students and recent graduates, encouraging them to join the company early in their career. They created a dedicated section on their careers website to provide additional information about their internship program. Here, they inform interested candidates on how to apply and what to expect throughout the recruitment process — an experience that is often unfamiliar and intimidating for people new to the workforce.

IntraLinks Wants To Meet Candidates Early On

IntraLinks encourages candidates to meet their team before they even submit an application. On their careers page, they provide a link for candidates to check out upcoming events and meet their team face-to-face — a rare opportunity for most applicants.

MineralTree Embraces the ChatBot

MineralTree keeps up with the latest in recruiting trends, providing anyone who lands on their website or careers page with a chatbot to answer any questions they may have about the company or industry they work in. This is a great way to make initial touch points and answer questions with candidates as they explore career opportunities.

PieInsurance Builds a Talent Community

PieInsurance understands the value of building a talent community no matter what their current hiring needs are. They allow candidates to submit a resume to the email provided even if they aren’t currently hiring for a role that suits the candidate’s interests. This helps the company build a talent pipeline and allows the candidate to remain in touch and informed as new roles open up.

Recurly Goes Deep With Content

Recurly goes above and beyond, creating a company blog that covers everything from important company updates to upcoming events and industry trends. This is a great way to show candidates you’re up-to-date on the latest industry advancements and provide a more in-depth resource for their job seeking needs.

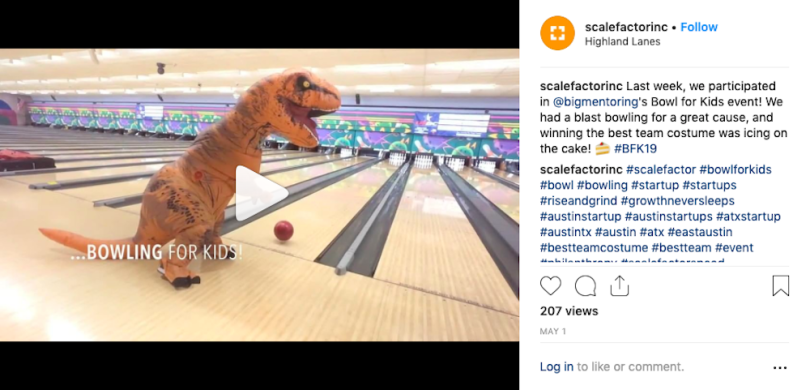

Scale Factor Gets Goofy on Social

ScaleFactor utilizes their Instagram account to provide an insider's look at their company culture. They share everything from charity events (like the one above) to individual employee spotlights, industry facts and trending topics.

TransUnion Supports Candidates At Every Stage

To better help candidates prepare for their interview, TransUnion provides their candidates with a layout of what to expect during the interview process.

They even take it one step farther by offering a few pieces of advice from their very own team members on how to apply, how to prepare for their interview and what to do/not do during the interview.