At Northwestern Mutual, we are strong, innovative and growing. We invest in our people. We care and make a positive difference.

Northwestern Mutual's Public Investment Department seeks a Quantitative Analyst Intern to join us for the summer of 2025 and play a pivotal role in building out tools and conducting analysis that help shape our investment processes. We manage over $125 billion in fixed income assets, and you will collaborate directly with Portfolio Managers, Traders, and Credit Analysts to develop cutting-edge solutions.

Principal Responsibilities:

You'll have the opportunity to leverage your unique strengths and interests within a flexible role that spans data, modeling, visualization, and applications. Your activities will center around driving investment performance through innovative improvements to our investment processes, such as relative value analysis, portfolio construction, trading tools, risk measurement, and more.

- Build & maintain data models: Collaborate with data engineers to onboard new data sources, design and implement dbt SQL models for data cleaning and integration, and write robust data quality tests to ensure data integrity.

- Develop interactive data visualizations: Create insightful dashboards and applications using Tableau and Streamlit to effectively communicate data and model outputs to the department's investment professionals.

- Design and implement machine learning models: Utilize state-of-the-art machine learning and AI techniques to develop predictive models, optimize model parameters, research new signals, and deploy models into the Snowflake production environment.

- Apply quantitative methods: Leverage quantitative methods such as portfolio optimization, Monte Carlo simulation, risk measurement, and backtesting to enhance various aspects of the investment process.

- Collaborate effectively: Work closely with Portfolio Managers, Traders, and Credit Analysts to better identify attractive investment opportunities through efficient data delivery, advanced models, and intuitive dashboards.

Job Requirements:

- Progress towards a Bachelor's degree in a quantitative field (e.g., Quantitative Finance, Computer/Data Science, Finance, Mathematics).

- Strong development skills in languages such as SQL, Python, Streamlit, dbt, etc.

- Excellent data manipulation and data visualization skills.

- Experience with software development practices such as version control and CI/CD pipelines is preferred.

- Experience using Bloomberg and BlackRock Aladdin is a plus.

Interpersonal Skills

- Passion for the art and science of investing.

- Effective oral and written communication skills.

- Demonstrated analytical and problem-solving ability.

- High degree of self-motivation, passion, and a drive to learn.

About the Internship Program

Internship candidates can expect a fulltime onsite internship program, running from June 2025 to August 2025. Carefully selected from universities across the country, our interns bring distinctive ideas and perspectives to our organization. Our employees are passionate about building our emerging talent and future leaders. In addition to their day-to-day tasks, interns participate in professional development workshops, senior leadership Q&A's, volunteer initiatives, networking/social events, and more!

About the Public Investment Department

Northwestern Mutual's Public Investments Department manages over $125 billion in investment grade and high yield fixed income assets backing NM's General Account insurance products and retirement plan assets, and oversees about half of the company's total General Account assets. The team actively manages these assets with a goal of generating long-run total returns in excess of benchmarks to drive policyholder value. This role will be within the Quantitative Research & Analytics team.

#LI-Hybrid

Required Certifications:

Compensation Range:

Minimum:

$16.50

Midpoint:

$23.25

Maximum:

$30.00

Pay rates for internships are determined based on academic tenure and major.

Northwestern Mutual pays on a geographic-specific salary structure and placement in the salary range for this position will be determined by a number of factors including the skills, education, training, credentials and experience of the candidate; the scope, complexity as well as the cost of labor in the market; and other conditions of employment. At Northwestern Mutual, it is not typical for an in dividual to be hired at or near the top of the range for their role and compensation decisions are dependent on the facts and circumstances of each case. Please note that the salary range listed in the posting is the standard pay structure. Positions in certain locations (such as California) may provide an increase on the standard pay structure based on the location. Please click here for additiona l information relating to location-based pay structures.

Build a strong career foundation with a best-in-class company that puts our client's interests at the center of all we do. Get started now!

We are an equal opportunity/affirmative action employer and all qualified applicants will receive consideration for employment without regard to race, color, religion, gender identity or expression, sexual orientation, national origin, disability, age or status as a protected veteran, or any other characteristic protected by law.

If you work or would be working in California, Colorado, New York City, Washington or outside of a Corporate location, please click here for information pertaining to compensation and benefits.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and commitment to diversity and inclusion.

- Flexible work schedules

- Concierge service

- Comprehensive benefits

- Employee resource groups

Top Skills

What We Do

You’ll Like It Here

At Northwestern Mutual, we believe that our lives and our work matter. And that doing what’s right is good for everyone. We follow through by designing tech that improves the community and cultivating creative ways to make finance accessible anywhere. These guiding principles have allowed our company to grow for more than 160 years.

Here, you’ll be with a team who emphasizes integrity and prioritizes security to design experiences that better everyone. You’ll work in cross functional teams to create optimal solutions that are rooted in innovative strategy and thoughtful execution. And you’re provided development tools and opportunities to become a leader all with the support of a collaborative team. You’ll be surrounded in a culture that values innovation and works to always evolve to stay ahead of trends and client needs.

We are intentional in seeking out team members who will challenge us. Our employees choose us for the career opportunities, commitment to philanthropy and desire to have a meaningful impact in the lives of our clients. You have career passions and goals. We have ambition and opportunity for you to grow your future in tech. Discover today: https://careers.northwesternmutual.com/

Why Work With Us

We invest in our people. We know careers are about choices, so we provide intentional opportunity. Here you can build creative ways to make finance accessible anywhere and revolutionize traditional processes. As a mutual company, our focus is our people — whether professional development or investments in the community.

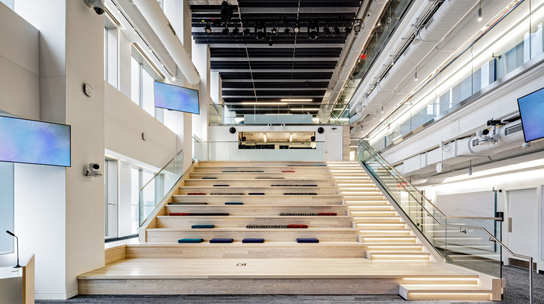

Gallery

.jpg)

.jpg)

.jpg)

.jpg)

Northwestern Mutual Offices

Hybrid Workspace

Employees engage in a combination of remote and on-site work.

We offer a flexible, hybrid approach for our employees . Teams are in the office a few days a week and work from home the others.