At Northwestern Mutual, we are strong, innovative and growing. We invest in our people. We care and make a positive difference.

We're strong and growing. In a company with such a long and storied history, this may be the most exciting and important time to be a part of Northwestern Mutual. We're strong, innovative, and growing.

We invest in our people. We provide opportunities for employees to grow themselves, their career and in turn, our business.

We care. We make a positive difference in our communities. Nationally, thousands have benefitted from our support of research and programs to fight childhood cancer. Each year, our Foundation, employees and financial representatives donate time, talent and financial support to causes they're passionate about.

What you'll do:

Under the general direction of the manager and specialist, administer the individual initial license and renewal process for Financial Representatives (FRs) and associate FRs; audit listings received from insurance departments for company license/appointment renewals. Accuracy and timeliness are critical to the Financial Representative's ability to continue to represent and sell NM products. A CLR Analyst must be detail-oriented, a fast learner, and an excellent communicator to handle various tasks and escalate concerns as needed.

How you will do it:

Financial Representative Licensing (75%) :

- Analyze, evaluate, and process state insurance applications, investigate, and resolve license problems, within service goals.

- Process/terminate state appointments utilizing SIRCON, State websites, RegEd and other internet tools/resources.

- Obtain FR's FINRA securities status via Internet WEBCRD, registers FRs with state securities departments.

- Validates pre-requisites for licensing in non-resident states which includes resident qualifications, securities registrations, and continuing education requirements. Enters data to update the NMFN database.

- Inputs billing codes to ensure correct chargeback/reimbursement to the field.

- Responds to calls, advising the field on license issues ranging from routine to complex. Uses reference material as a guide but must perform additional research as needed. Calls State Insurance departments for clarification.

Renewals (15%) :

- Receives renewed licenses that show a break in continuity and verifies whether the company appointment needs to be re-established. Communicates with the field regarding when solicitation can resume.

Team Responsibilities/Customer Service (10%) :

- Consistently meets divisional service level goals and performs well in a team environment. Shares knowledge in team meetings and identifies process improvements.

- As business needs dictate, aids with other job functions throughout CLR and participates in special projects. This includes but is not limited to providing back-up support to divisional team members during vacation and/or high-volume work periods.

- Provides a high level of customer service to internal and external customers. Via telephone and e-mail, facilitates the license process for our field customers.

Bring Your Best! What this role needs:

- High School Diploma or equivalent.

- Minimum of 2 years customer service experience in a professional environment.

- Past work experience demonstrating strong personal organization, self-motivation and follow through with the ability to multi-task and effectively identify and establish priorities.

- Proficient data entry and keyboarding skills.

- Proven ability to oversee confidential information in a fast paced, high volume work environment with a high degree of accuracy.

- Strong written and verbal communication skills.

- Initiative and critical thinking skills.

- Ability to work independently or as part of a team and adapt to changing priorities.

- A record of consistently good attendance.

Career Path:

CLR Analyst, Sr CLR Analyst, CLR Team Lead, CLR Specialist, CLR Consultant (Standards & Governance Team), CLR Manager

Benefits:

Great pay package, 401K, company sponsored retirement plan, educational assistance, performance-based incentive pay, medical, dental and vision insurance, parental leave, caregiver time off....and more!

#LI-Onsite

This position has been classified as an Associated Person under NMIS guidelines and requires fingerprinting and completion of required form.

Required Certifications:

Non-Registered Fingerprinted - FINRA

Compensation Range:

Pay Range - Start:

$19.71

Pay Range - End:

$29.57

Northwestern Mutual pays on a geographic-specific salary structure and placement in the salary range for this position will be determined by a number of factors including the skills, education, training, credentials and experience of the candidate; the scope, complexity as well as the cost of labor in the market; and other conditions of employment. At Northwestern Mutual, it is not typical for an individual to be hired at or near the top of the range for their role and compensation decisions are dependent on the facts and circumstances of each case. Please note that the salary range listed in the posting is the standard pay structure. Positions in certain locations (such as California) may provide an increase on the standard pay structure based on the location. Please click here for additional information relating to location-based pay structures.

Grow your career with a best-in-class company that puts our client's interests at the center of all we do. Get started now!

We are an equal opportunity/affirmative action employer and all qualified applicants will receive consideration for employment without regard to race, color, religion, gender identity or expression, sexual orientation, national origin, disability, age or status as a protected veteran, or any other characteristic protected by law.

If you work or would be working in California, Colorado, New York City, Washington or outside of a Corporate location, please click here for information pertaining to compensation and benefits.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and commitment to diversity and inclusion.

- Flexible work schedules

- Concierge service

- Comprehensive benefits

- Employee resource groups

What We Do

You’ll Like It Here

At Northwestern Mutual, we believe that our lives and our work matter. And that doing what’s right is good for everyone. We follow through by designing tech that improves the community and cultivating creative ways to make finance accessible anywhere. These guiding principles have allowed our company to grow for more than 160 years.

Here, you’ll be with a team who emphasizes integrity and prioritizes security to design experiences that better everyone. You’ll work in cross functional teams to create optimal solutions that are rooted in innovative strategy and thoughtful execution. And you’re provided development tools and opportunities to become a leader all with the support of a collaborative team. You’ll be surrounded in a culture that values innovation and works to always evolve to stay ahead of trends and client needs.

We are intentional in seeking out team members who will challenge us. Our employees choose us for the career opportunities, commitment to philanthropy and desire to have a meaningful impact in the lives of our clients. You have career passions and goals. We have ambition and opportunity for you to grow your future in tech. Discover today: https://careers.northwesternmutual.com/

Why Work With Us

We invest in our people. We know careers are about choices, so we provide intentional opportunity. Here you can build creative ways to make finance accessible anywhere and revolutionize traditional processes. As a mutual company, our focus is our people — whether professional development or investments in the community.

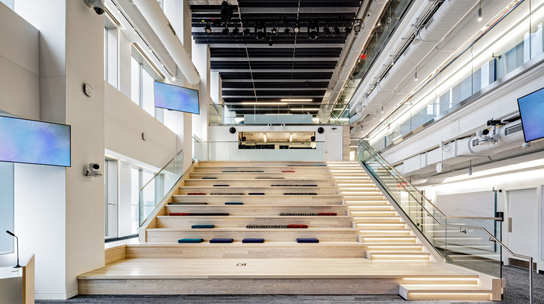

Gallery

.jpg)

.jpg)

.jpg)

.jpg)

Northwestern Mutual Offices

Hybrid Workspace

Employees engage in a combination of remote and on-site work.

We offer a flexible, hybrid approach for our employees . Teams are in the office a few days a week and work from home the others.