At Northwestern Mutual, we are strong, innovative and growing. We invest in our people. We care and make a positive difference.

Summary

Assist with management of investment products (Mutual Funds, ETFs, SMAs, Alternatives, etc.) platform, including design and implementation of new or existing products, promotional strategies, overall execution of the product strategy and day-to-day product line management to advance sales, servicing and competitiveness. Understand the products the role is responsible for and analyzing/developing solutions for complex Legal/Regulatory/Competitive issues that may arise. Work extensively with third-party product sponsors to understand and align on products offered, and continually evaluate NM Wealth's own product strategy.

Primary Duties and Responsibilities

- Interprets field/customer desires, needs, and feedback and is a go-to product expert that can explain and translate product or program features and functions to internal and external business partners.

- Translates product strategy into product design details, implements changes, and tests that products are performing as designed.

- Develops expertise of investment products and technology platform offerings to analyze, implement and test platform updates.

- Understands profitability of assigned products via assets under management, sales growth, net cash flow, sound product design and manageable expenses.

- Research product design of competitive offerings, models, changes to pricing and rates, and makes recommendations based on this information, as necessary.

- Understands the strategic role NM's Wealth & Investment Management division plays in the NM enterprise and how investment products integrate with insurance products and financial planning platforms.

- Provides investment product subject matter expertise to support ongoing product evolution including coordinating and driving efforts with technical, operational, compensation, investment and regulatory experts (both internal and external to NM).

- Understands impact of regulatory compliance on assigned investment products and participates in project teams to implement necessary changes to products, programs or processes.

- Builds leadership skills and may informally mentor others on small projects, teams or committees.

Qualifications

- Bachelor's degree or equivalent in business, finance, economics or related field or equivalent experience. Masters/MBA a plus.

- Minimum of 5 years of experience in financial services, and industry relationships a plus.

- Demonstrated knowledge of the Wealth Management space, including but not limited to: product, pricing, due diligence, regulatory environment, compliance, and field & customer concerns/preferences.

- Strong organizational and follow-through skills, with demonstrated ability to work on multiple priorities & projects simultaneously, within deadlines.

- Ability to participate as a subject matter expert in departmental or cross-departmental initiatives.

- Ability to anticipate and analyze impact of business decisions, future consequences and trends.

- Demonstrated analytical skills and comfort working with large datasets, primarily via Excel or using dashboard/business intelligence tools (e.g. PowerBI).

- Ability to build rapport with and foster strong internal and external networks, and leverage resources within or sourced-from these networks.

- Very strong verbal and written communication skills and ability to make effective formal presentations to internal and external firm's leadership.

- Professional certification - (CLU, ChFC, CFA, CFP, CPA or similar) beneficial, but not required. Designation costs, as applicable, are typically covered by NM.

- FINRA - Series 7 (or ability to obtain within first 6 months of employment)

Skills - Proficiency Level:

Data Analysis & Financial Modeling - Intermediate

Field Force - Intermediate

Investment Product Management - Intermediate

Investment Strategy - Basic

Product Communications - Intermediate

Product Development - Intermediate

Product Implementation - Intermediate

Product Planning - Intermediate

Product Pricing - Intermediate

Product Development Research - Intermediate

Profitability Management - Basic

Regulatory Compliance - Intermediate

System Platforms - Intermediate

Vendor Management - Intermediate

This position is classified as a Registered Representative under NMIS guidelines and requires fingerprinting.

Required Certifications:

Series 7 - FINRA, SIE - FINRA

This position has been classified as a Registered Representative under NMIS guidelines and requires fingerprinting.

Required Certifications:

Series 7 - FINRA, SIE - FINRA

Compensation Range:

Pay Range - Start:

$82,670.00

Pay Range - End:

$153,530.00

Northwestern Mutual pays on a geographic-specific salary structure and placement in the salary range for this position will be determined by a number of factors including the skills, education, training, credentials and experience of the candidate; the scope, complexity as well as the cost of labor in the market; and other conditions of employment. At Northwestern Mutual, it is not typical for an individual to be hired at or near the top of the range for their role and compensation decisions are dependent on the facts and circumstances of each case. Please note that the salary range listed in the posting is the standard pay structure. Positions in certain locations (such as California) may provide an increase on the standard pay structure based on the location. Please click here for additional information relating to location-based pay structures.

Grow your career with a best-in-class company that puts our client's interests at the center of all we do. Get started now!

We are an equal opportunity/affirmative action employer and all qualified applicants will receive consideration for employment without regard to race, color, religion, gender identity or expression, sexual orientation, national origin, disability, age or status as a protected veteran, or any other characteristic protected by law.

If you work or would be working in California, Colorado, New York City, Washington or outside of a Corporate location, please click here for information pertaining to compensation and benefits.

FIND YOUR FUTURE

We're excited about the potential people bring to Northwestern Mutual. You can grow your career here while enjoying first-class perks, benefits, and commitment to diversity and inclusion.

- Flexible work schedules

- Concierge service

- Comprehensive benefits

- Employee resource groups

Top Skills

What We Do

You’ll Like It Here

At Northwestern Mutual, we believe that our lives and our work matter. And that doing what’s right is good for everyone. We follow through by designing tech that improves the community and cultivating creative ways to make finance accessible anywhere. These guiding principles have allowed our company to grow for more than 160 years.

Here, you’ll be with a team who emphasizes integrity and prioritizes security to design experiences that better everyone. You’ll work in cross functional teams to create optimal solutions that are rooted in innovative strategy and thoughtful execution. And you’re provided development tools and opportunities to become a leader all with the support of a collaborative team. You’ll be surrounded in a culture that values innovation and works to always evolve to stay ahead of trends and client needs.

We are intentional in seeking out team members who will challenge us. Our employees choose us for the career opportunities, commitment to philanthropy and desire to have a meaningful impact in the lives of our clients. You have career passions and goals. We have ambition and opportunity for you to grow your future in tech. Discover today: https://careers.northwesternmutual.com/

Why Work With Us

We invest in our people. We know careers are about choices, so we provide intentional opportunity. Here you can build creative ways to make finance accessible anywhere and revolutionize traditional processes. As a mutual company, our focus is our people — whether professional development or investments in the community.

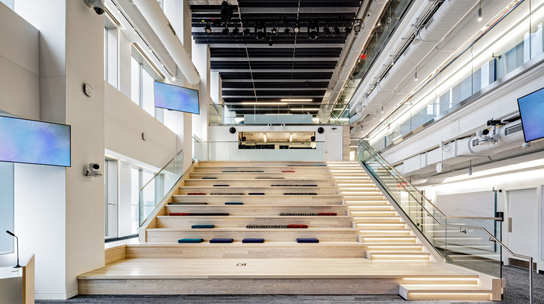

Gallery

.jpg)

.jpg)

.jpg)

.jpg)

Northwestern Mutual Offices

Hybrid Workspace

Employees engage in a combination of remote and on-site work.

We offer a flexible, hybrid approach for our employees . Teams are in the office a few days a week and work from home the others.