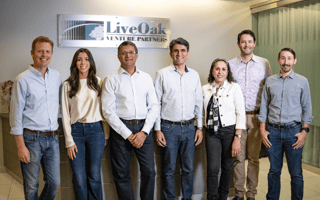

Austin-based LiveOak Venture Partners, a well-known VC firm investing in early-stage startups, announced it secured $210 million in an oversubscribed funding round. In total, the firm now has nearly half a million in funds for its Fund III and is planning to invest in more Texas-based startups.

The VC firm hoped to raise $150 million for Fund III but surpassed that goal, Krishna Srinivasan, LiveOak co-founder and partner, told Built In. Two previous funds in years prior raised $105 million each, making this raise the company’s biggest yet. This is the largest Texas-focused, early-stage VC fund raised in the past decade, according to a statement.

“We are delighted to announce the final close of LiveOak III — a $210 million [round]. This is a significant step up from our prior funds and a testament to the strength of strategy, results, duration and market,” Srinivasan told Built In.

Key factors that increased investor interest in LiveOak are the company’s dedication and respect when pitching entrepreneurs. According to Srinivasan, the process from pitching to closing a deal with entrepreneurs takes LiveOak three and half months. Other VCs usually take six months to close an agreement. According to the Entrepreneur’s Bill Of Rights published on LiveOaks’ website and written by Srinivasan and co-founder Venu Shamapant, entrepreneurs get a minimum of 90-minutes to pitch their idea and business to LiveOak and are kept in the loop throughout the entire process.

LiveOak has also been able to form a diverse group of investors. VC funding for previous rounds came from university endowments, public pensions funds and several foundations. The capital raised for Fund III came predominantly from institutions and about 40 percent came from first-time investors.

“Fund III will continue its familiar theme of being lead investors in disruptive tech startups headquartered in Texas’ four largest tech hubs: Austin, Houston, Dallas and San Antonio,” Srinivasan said.

LiveOak will continue to back early-stage startups with “world-class category leaders” that pitch innovative ideas, Srinivasan added. It will begin with initial investments ranging from $1 million to $5 million and possibly scaling to $15 million over the lifecycle of the company.

Although LiveOak is based in Austin, it has funded several Dallas startups that are showing great potential. In the VC’s last round, it invested in Mavenir and Take Command Health.

LiveOak also participated in AmplifAI’s $18.5 million Series A round last month. AmplifAI, a Plano-based company, creates software that uses artificial intelligence to monitor employee performance and creates personalized training courses to improve employee output.

Since 2012, LiveOak has invested in approximately 50 Texas-based startups, many of which have reached unicorn status or have gone public.