Statewide lockdown orders issued to slow the spread of the coronavirus have led to a surge in online grocery shopping in the United States.

Since the pandemic began, Instacart has announced plans to hire 550,000 additional “shoppers” and has reported that its order volume is up 500 percent year-over-year. In a survey that began March 6 and ended April 7, Acosta, a consumer packaged goods sales and marketing company, found that 51 percent of people placed an online order for groceries in that time frame, with 33 percent of shoppers saying it was their first online grocery order ever.

Prior to the coronavirus, an overwhelming majority of Americans preferred to do their grocery shopping in stores, with a 2019 Gallup poll finding that 81 percent of Americans had never placed an online order for groceries.

But two things can often be true at once. Even though online grocery shopping is growing in popularity in the United States, there’s a good chance that many Americans will return to grocery stores once it’s safe to do so.

Prior to the pandemic, blue chip retailers like Walmart, Costco and Whole Foods were investing in technology to streamline their in-store operations and improve the shopping experience. Walmart and Costco were exploring technology to ensure their shelves were stocked at all times, while Whole Foods was focused on creating a completely contactless payment system.

As far as we know, those initiatives haven’t changed. Grocery stores across the country are currently grappling with the challenge of how to get shoppers through stores as quickly as possible and reduce contact at the cash register. Walmart, Costco and Whole Foods haven’t figured these problems out completely, but they have a healthy head start.

A Walmart Powered By AI

Walmart was built on low prices and seemingly endless stores stocked with, well, just about everything. The Walmart of tomorrow will feature all of these elements — and a healthy dose of artificial intelligence. A preview of that future is available in Levittown, New York, the home of Walmart’s Intelligent Research Lab, or IRL.

IRL is designed to test real-world applications of AI in a fully functional Walmart that spans 50,000 square feet and sells more than 30,000 items. A series of cameras and sensors arranged throughout the store monitors the status of items on the shelves, with the hardware generating a whopping 1.6 terabytes of data per second. IRL has its own data center on full display to customers and houses more than 100 servers.

Mike Hanrahan, CEO of IRL, told the Walmart blog that his team’s initial focus is on ensuring shelves are fully stocked with the freshest products possible. Through cameras, sensors and predictive analytics that estimate demand, Walmart’s goal is to automate much of the restocking process. Instead of having to walk the aisles, store associates receive an alert that lets them know what item needs to be restocked and in what quantity.

AI is also used to notify employees when new checkout lines grow too long and if additional registers need to be opened, as well as when the supply of shopping carts runs low. Hanrahan said his team is moving deliberately with its experiments and is only testing applications of AI that are both scalable and improve the shopping experience.

“You can’t be overly enamored with the shiny object element of AI,” Hanrahan said. “There are a lot of shiny objects out there that are doing things we think are unrealistic to scale and probably, long-term, not beneficial for the consumer.”

Costco Brings Machine Learning to the Bakery

Prior to adopting machine learning, Costco took a low-tech approach to forecasting demand at its bakeries. Managers used a combination of sales data, trend reports, information on upcoming sporting events and holidays, and their instincts to generate weekly demand forecasts. Schedules were created on paper and manually adjusted each day to account for products carried over from the previous day, along with lost and damaged items.

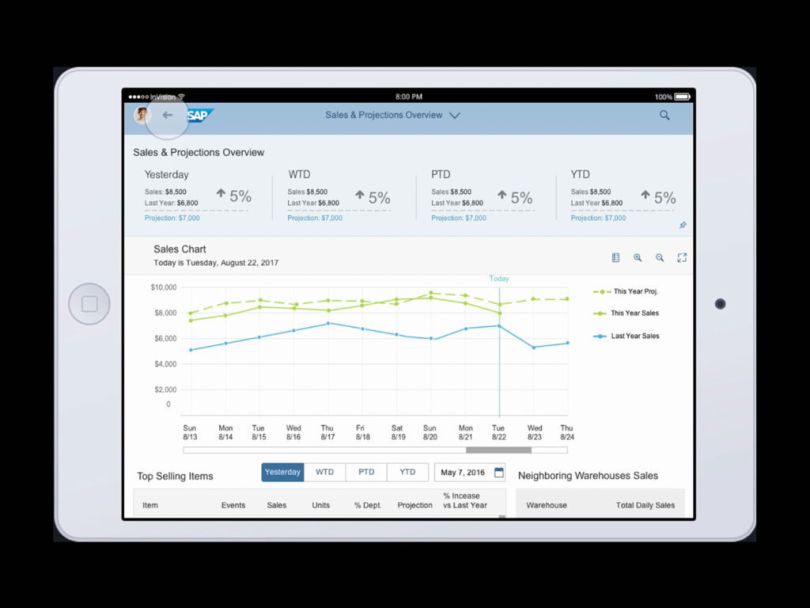

In addition to being labor-intensive, this approach to demand forecasting relied heavily on the individual experience and knowledge of managers, a concept Costco refers to as “tribal knowledge.” If a manager guesses wrong or is out sick, the bakery department risks producing too little product and missing out on sales — or producing too much and having to eat the cost of moldy bread. In 2018, Costco ditched its paper reports for an app developed by SAP AppHaus that uses machine learning to generate demand forecasts.

The app runs on a tablet and was trained using seven years’ worth of sales and promotional data and also takes into account current weather conditions, upcoming sports events and holidays when generating demand forecasts.

Costco piloted the app at a store in San Jose, California, over a three-month period and found that it reduced labor costs and waste. The app has since been rolled out to 500 additional stores. Although it led to a quick win, Jeff Lyons, SVP of fresh foods at Costco, said the company was initially hesitant to embrace technology.

“We resisted putting an iPad back in the bakery department,” Lyons said during a keynote address at the SAP SAPPHIRE Now conference. “We thought it was ridiculous and would ruin the experience, and now look where we are.”

Whole Foods Pilots Palm-Based Payments

Whole Foods received a fresh injection of tech talent when Amazon acquired the organic grocery store chain in 2017 for a whopping $13.7 billion. In the three years since, the e-commerce giant has used technology to reshape the experience of shopping for groceries, albeit at its self-branded Amazon Go stores.

The cashierless stores use a combination of sensors and cameras to track what items shoppers drop into their baskets. Customers scan into the stores using the Amazon Go app and are automatically billed for what’s in their basket upon exiting. While Amazon has been busy launching Go stores across the country, that doesn’t mean the company has forgotten about Whole Foods.

Last fall, the New York Post reported that Amazon engineers in New York were testing a payment system that uses contactless hand sensors to scan a customer’s palm and process payment. Citing unnamed sources, the Post reports that the scanners use a combination of computer vision and depth geometry to scan palms, with the idea being to link palm prints to Prime accounts to facilitate payment. The sources told the Post that the system could possibly be rolled out in early 2021, if it even exists.

When reached by the paper, an Amazon spokesperson said the company does not comment on rumors and speculation. Three months later, another company spokesperson issued a “no comment” to Recode in regard to a patent application filed by Amazon for a “non-contact biometric identification system” designed to scan palms.

If this technology is being developed for Whole Foods, it’s hard to imagine a better time to pilot it. It seems to be a matter of “when” and “where” this technology will be rolled out, and less a question of “if.”