Without adequate capital, a startup is doomed to fail. In fact, a recent study by CB Insights found that the most common reasons for startup failure were a lack of financing or investors, followed closely by running out of cash.

How Does Venture Debt Fit Into a Startup’s Funding Lifecycle?

Venture debt consists of loans typically made to Series B through Series D revenue-producing companies that can service debt payments, interest, fees, and ultimate repayment of the loan principal. Venture debt can be a cheaper, minimally dilutive alternative to equity financing.

For startups to survive, founders must have a clear understanding of their funding needs and the various financing options that will be available to them over the lifecycle of the business. This is easier said than done. Securing funding for a startup is an intricate and daunting process, particularly for founders who lack a background in finance or come from underrepresented groups.

Funding a company through its lifecycle can feel like navigating through a dense, foggy forest to reach a far-off treasure without falling into a ravine or getting mauled by a bear. By gaining knowledge and expertise in startup financing, predators can be avoided, the fog can be lifted and the path to securing funding can become clearer.

In previous articles, I provided an overview of venture debt and how it supports diverse founders and how founders can prepare to raise a venture debt round. This article aims to make the different stages of startup funding easier to grasp so that founders better understand their funding options.

Funding Stages

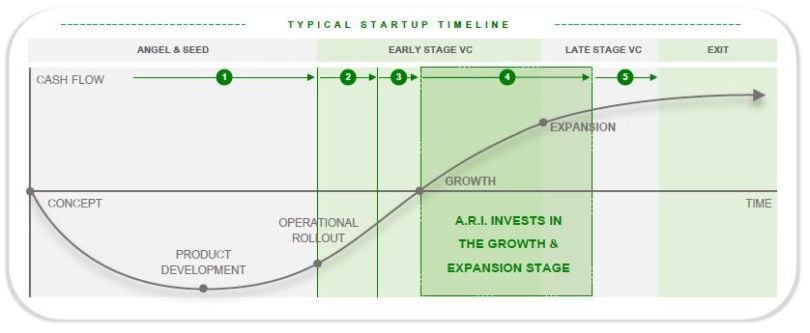

Funding stages are typically defined by time frames and funding sources. The number of stages can vary, depending on who you ask. Generally, market participants agree on the major equity-funding stages as: Angel and Seed, Early Stage (Series A and B), Late Stage (Series C and D) and Growth Stage (Series E to Exit). Venture debt is most often utilized by Series B through Series D startups.

Angel and Seed Funding

These rounds occur before a startup is generating revenue or has a finished product. The capital is typically used to develop the concept, perform market research, create the initial product (usually the minimum viable product, known as MVP), establish the leadership team and prepare for operational rollout.

Most founders initially fund themselves with their savings. This runs dry quickly and from there the hunt for outside capital begins. In exchange for giving up a piece of ownership through a direct equity stake or a convertible note, which can be converted into equity in the company at a later date, founders progressively work to raise larger sums of capital from friends and family, groups of wealthy individuals who invest their own money (known as angel investors) and eventually venture capital firms that specialize in this stage of investing.

These funding rounds have grown significantly larger over the past few years, with typical angel investments in the $500,000 to $1 million range and seed funding typically between $1 million and $5 million.

Early-Stage Funding

Early stage begins with the Series A round, which refers to a company’s first significant round of venture capital funding, and includes the subsequent Series B, which is the next major venture funding round. As with previous rounds, the majority of early-stage capital is raised by selling equity in the company.

For companies that are generating sufficient revenue, debt funding becomes an option for the first time. Startups use this funding to develop their product further, generate traction in the market and begin to scale their business. Early-stage funding rounds vary greatly in size, with a median of approximately $10 million and a mean of close to $15 million.

Late-Stage Funding

The late stage includes the Series C and D rounds and marks the transition phase for startups from small, early-stage companies to larger, more established businesses.

Most companies in this stage have five to seven years of operating history, proven product-market fit, a solidly established customer base and a clear path to profitability.

Venture debt becomes a very attractive funding option for these companies. It is usually provided three to nine months after an equity raise to revenue-generating companies that can service debt. For example, A.R.I.’s Venture Debt Opportunities Fund typically seeks a minimum annual revenue of $10 million with annual growth rates of greater than 50 percent for its investments.

Venture debt complements equity and is typically used to raise 15 percent to 25 percent of a company’s capital in a funding round. The borrower benefits from less ownership dilution while reducing its average cost of capital because debt financing is typically less than half the cost of equity financing in A.R.I.’s analysis of thousands of deals over the past two decades.

These rounds of funding are often much larger than early-stage funding rounds and can range from millions to hundreds of millions of dollars, with the larger cluster in the range of $25 million to $35 million.

Growth-Stage Funding

Growth stage refers to Series E and beyond as companies begin to exit via a sale, IPO, SPAC, or becoming a standalone business with positive cash flow and profitability. Approximately 90 percent of exits are via acquisition or buyout with a little more than half valued at more than $100 million.

Preparing for the Future

As Yogi Berra quipped, “If you don’t know where you are going, you might wind up someplace else.” Most likely in a place you do not want to be.

Securing funding is essential for the success of any startup. Startups need to understand the different funding stages and financing options available to them to navigate the funding lifecycle. While the process can seem daunting, gaining knowledge and expertise in startup financing can help founders avoid pitfalls, clear the fog and plan effectively to secure funding.

Future articles will provide startup founders with practical advice and proven tips to achieve capital raising success at each funding stage to increase the probability of long-term success.