Top Charlotte, NC Fintech Companies (57)

Don't see your company?

Create a company profileHometap is on a mission to make homeownership less stressful and more accessible. Our home equity investment product provides homeowners with a fast, simple, and straightforward way to access the equity in their home without taking out a loan or having to sell. By investing alongside homeowners, Hometap offers debt-free cash in exchange for a share of their home’s future value — all without any monthly payments over the life of the investment. And its digital platform, the Home Equity Dashboard, empowers homeowners to make informed financial decisions about their home and take action on those decisions with confidence, speed, and ease. Through a combination of financial innovation and best-in-class customer service, Hometap enables people to get more from homeownership so they can get more from life.

TransUnion is a global information and insights company that makes trust possible by ensuring that each consumer is reliably and safely represented in the marketplace. We do this by having an accurate and comprehensive picture of each person. This picture is grounded in our legacy as a credit reporting agency which enables us to tap into both credit and public record data; our data fusion methodology that helps us link, match and tap into the awesome combined power of that data; and our knowledgeable and passionate team, who stewards the information with expertise, and in accordance with local legislation around the world. Because of our work, organizations can better understand consumers in order to make more informed decisions, and earn their trust through great, personalized experiences, and the proactive extension of the right opportunities, tools and offers. In turn, consumers can be confident that their data identities will result in the opportunities they deserve. We make trust possible, so businesses and consumers can transact with confidence and achieve great things. We call this Information for Good®—it’s our purpose, and what drives us every day.

Capco, a Wipro company, is a global technology and management consultancy specializing in driving digital transformation in the financial services industry. With a growing client portfolio comprising of over 100 global organizations, Capco operates at the intersection of business and technology by combining innovative thinking with unrivalled industry knowledge to deliver end-to-end data-driven solutions and fast-track digital initiatives for banking and payments, capital markets, wealth and asset management, insurance, and the energy sector. Capco’s cutting-edge ingenuity is brought to life through its Innovation Labs and award-winning Be Yourself At Work culture and diverse talent. Our approach is tailor-made to fit with each client’s problem with an emphasis on building long-term strategic partnerships that foster collaboration and trust. We have the people, the vision, and the passion. Capco is committed to providing clients with practical solutions. We offer a globally integrated service with offices in leading financial centers across the Americas, Europe and Asia Pacific.

Initially built to take the pain out of peer-to-peer payments, Cash App has gone from a simple product with a single purpose to a dynamic app, bringing a better way to send, spend, invest, borrow and save to our millions of monthly active users. With a mission to redefine the world's relationship with money by making it more relatable, instantly available and universally accessible.

Founded in 2014, Opendoor’s mission is to empower everyone with the freedom to move. We believe the traditional real estate process is broken and confusing. It often comes with unexpected costs, the added burden of coordinating multiple third parties and the uncertainty of a transaction falling through. Our goal is simple: build a digital, end-to-end customer experience that makes buying and selling a home simple, certain and fast. We have assembled a dedicated team with diverse backgrounds and talents across engineering, operations, design, operations, mortgage, finance, legal, and more to deliver strong results. More than 85,000 customers have selected us as a trusted partner in handling one of their largest financial transactions.

Want to feel truly valued at work? Check out Q2! Our unique company culture and super-hero employees, are what sets us apart. We know how to get it done and still have fun! Q2 builds the leading mobile banking software platform serving Credit Unions, Banks (large and small), Community Banks and Financial Institutions. Our mission is to build stronger and diverse communities by strengthening their financial institutions. Q2 prioritizes innovation, collaboration and celebrating our employees who make our mission successful. Q2 is a national "Best Place to Work" Award winner 3 years running! Join our "Circle of Awesomeness"! #Q2Peeps

With $93.77 billion in assets, City National Bank provides banking, investment and trust services through 65 branches, including 22 full-service regional centers, in Southern California, the San Francisco Bay Area, Nevada, New York City, Nashville, Atlanta, Washington, D.C., and Miami.* In addition, the company and its investment affiliates manage or administer $94.49 billion in client investment assets. City National is a subsidiary of Royal Bank of Canada (RBC), one of the world’s leading diversified financial services companies. RBC serves more than 17 million personal, business, public sector and institutional clients through offices in Canada, the United States and 27 other countries. For more information about City National, visit the company’s website at cnb.com. *City National Bank does business in Miami and the state of Florida as CN Bank.

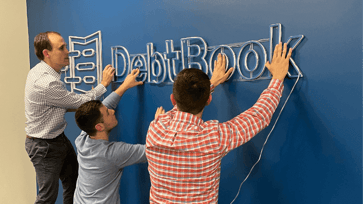

Based in Charlotte, DebtBook helps finance teams in local government, higher education, and healthcare manage their debt, leases, and subscriptions in the cloud, driving efficiency, collaboration, transparency, and informed decision-making within their organizations. Built by the industry and for the industry, DebtBook enables organizations to easily implement new accounting standards, such as GASB 87 and GASB 96, and maintain ongoing compliance.

BB&T and SunTrust formed Truist with a shared purpose—to inspire and build better lives and communities. With our combined resources, collective passion, and commitment to innovation, we’re creating a better financial experience to help people and businesses achieve more. With 275 years of combined BB&T and SunTrust history, Truist serves approximately 12 million households with leading market share in many high growth markets in the country. The company offers a wide range of services including retail, small business and commercial banking; asset management; capital markets; commercial real estate; corporate and institutional banking; insurance; mortgage; payments; specialized lending; and wealth management. Headquartered in Charlotte, North Carolina, Truist is the sixth-largest commercial bank in the U.S. Truist Bank, Member FDIC.

We are a community of 30 million who think – and feel – differently about investing. Together, we’re changing the way the world invests. Since our founding in 1975, helping our investors achieve their goals is our sole reason for existence. With no other parties to answer to and therefore no conflicting loyalties, we make every decision—like keeping investing costs as low as possible—with only your needs in mind. Vanguard is one of the world's largest investment companies, offering a large selection of high-quality low-cost mutual funds, ETFs, advice, and related services. Individual and institutional investors, financial professionals, and plan sponsors can benefit from the size, stability, and experience Vanguard offers. As of April 30, 2019, we managed more than $5.6 trillion in global assets. In addition, we have 189 funds in the United States and 225 funds in global markets. For Commenting Guidelines & Important information, visit here: http://vanguard.com/linkedin Vanguard Marketing Corporation, Distributor.

Financial advice is changing, and at LPL Financial, we’re at the forefront. We’re building a future where advisors can—with no friction or complexity, as simple as turning the dials—pick the business model, services, technology, and product mix that best meet their clients’ needs. With one platform, one sign-on, and one team to call, you can take your business anywhere you want it to go. There are no limits to your growth, and we’ll partner with you every step of the way. Your greatness is our goal. LPL Financial is a leader in the retail financial advice market and the nation’s largest independent broker/dealer*. We serve independent financial advisors and financial institutions, providing them with the technology, research, clearing and compliance services, and practice management programs they need to create and grow thriving practices. LPL enables them to provide objective guidance to millions of American families seeking wealth management, retirement planning, financial planning and asset management solutions. LPL.com Securities and Advisory Services offered through LPL Financial. A registered investment advisor, Member FINRA/SIPC.

Barings is a $382+ billion* global investment manager sourcing differentiated opportunities and building long-term portfolios across public and private fixed income, real estate, and specialist equity markets. With investment professionals based in North America, Europe and Asia Pacific, the firm, a subsidiary of MassMutual, aims to serve its clients, communities and employees, and is committed to sustainable practices and responsible investment. *Assets under management as of 6/30/21

As one of the oldest and largest financial services firms in the United States with a history dating back to 1828, we’re committed to providing solutions and expertise that support our customers, clients, colleagues, and communities in what’s next on their own unique journey. We invest in the humans who build the logic, ideas, and innovations that bring new technologies to life. Investments in AI, cloud computing, machine learning and automation provide our engineers the tools that enable us to remain competitive and win in today’s environment. At Citizens, we recognize that the journey to accomplishment is no longer linear and that individuals are made of all they have done and all they are going to do. Whether you’re considering banking with us or looking to work with us, you’ll find a customer-centric culture and a supportive, collaborative workforce at Citizens. You’re made ready and so are we. #MadeReady

We're on a mission to empower hard-working Americans to achieve greater financial resilience; arming them with the products and support they need to create healthy financial habits.

Genesis Global enables financial markets organizations to innovate at speed through a software application development platform, prepackaged solutions and deep expertise in capital markets and financial services. In supercharging developers to rapidly deliver high-performance, resilient and secure applications, Genesis replaces the buy vs. build challenge with a buy-to-build solution. The Genesis platform is designed with flexibility and performance at its core, providing developers with the frameworks, integrations and components required to automate manual workflows, enhance legacy systems and build entirely new applications. Featuring a resilient, real-time service-oriented architecture, Genesis excels across the performance envelope of low-latency, high-throughput and high-scalability, powering mission-critical applications at the world’s leading financial institutions. Strategically backed by Bank of America, BNY Mellon and Citi, Genesis Global has offices in Miami, New York, Charlotte, London, São Paulo, Dublin and Bengaluru.

Credit Karma is focused on championing financial progress for over 110 million members in the U.S., Canada and U.K. While we're best known for pioneering free credit scores, our members turn to us for resources as they work toward their financial goals. This includes tools for credit and identity monitoring, credit card recommendations, shopping for loans (car, home and personal), and growing their savings* -- all for free. We’ve grown significantly through the years, adding more than 70 million members in the last five alone. We currently have more than 1,300 employees spread across offices in Oakland, Charlotte, Los Angeles, and London. Disrupting the financial industry is not an easy task. That’s why we know it’s one worth doing. Our core values of helpfulness, ownership, progress and empathy guide our work and our relationships. Championing financial progress for everyone is a big mission that requires passionate people working together to make a difference in the world. If you’re up for the task, we’d love to have you on our team. Check out our open positions: https://www.creditkarma.com/careers. *Banking services provided by MVB Bank, Inc., Member FDIC

Figure has applied blockchain technology across a series of real-world applications that are delivering real and immediate value to everyday consumers across sectors, including loan origination, private company cap table and fund management, security markets and payments. Figure has and continues to develop innovative products and services that seek to bypass traditional incumbents within the financial services industry. Simply put, Figure is delivering on the promise of blockchain technology. Over $15B in transactions have been conducted on the Provenance Blockchain, a layer 1 designed for financial services, built and deployed by Figure. As one of the first lenders to fully use blockchain technology, Figure is driving adoption across the lending ecosystem and providing stakeholders the benefit of an immutable record of asset ownership on the Provenance Blockchain. Figure’s HELOC product has enabled over 85,000 households across 45 states to unlock a combined $6 billion in equity from their homes. These lines of credit give people the opportunity to fund home improvement projects, secondary education, and more. Figure is a regulatory powerhouse, boasting over 200 lending, servicing and money transmission licenses, SEC approval as an Alternative Trading System, and FINRA approved broker-dealer status. While some fintech companies aim to compete with traditional banks, Figure has stuck to expanding use cases for blockchain in finance and creating tech-enabled solutions for deep financial change in the markets. The company's iterative approach to product development has helped it to meet the evolving needs of its customers.

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial services company and a top 25 U.S. financial holding company offering financial products for consumers, businesses, automotive dealers and corporate clients. Ally's legacy dates back to 1919, and the company was redesigned in 2009 with a distinctive brand, innovative approach and relentless focus on its customers. Ally has an award-winning online bank (Ally Bank, Member FDIC), one of the largest full service auto finance operations in the country, a complementary auto-focused insurance business, a growing wealth management and brokerage platform, and a trusted corporate finance business offering capital for equity sponsors and middle-market companies.

Helping those who help others find confidence in retirement is in our mission. TIAA was founded 100+ years ago to help teachers retire. Today, our reach extends beyond education to healthcare and cultural fields. And we stand hand-in-hand with 5M+ clients to help fortify their money so they can ignite their dreams. For our Terms of Use, please visit http://bit.ly/20jMbbX. Any guarantees under annuities issued by TIAA are subject to TIAA’s claims-paying ability. TIAA-CREF Individual & Institutional Services, LLC, Members FINRA and SIPC, distribute securities products. TIAA is not responsible for the content or privacy policies of third-party sites to which you may link.

Founded in 2016, Better is a digital-first homeownership company whose services include mortgage, real estate, title, and homeowners insurance. We leverage creative technology and innovation to make the homebuying journey more approachable and understandable. Our company is made up of driven, passionate people who bring their unique backgrounds and perspectives to everything we do. We are committed to fostering diversity, multiculturalism, and inclusion. We see the value in each person's perspective and recognize their talents, regardless of what the market says. We believe it's important to nurture a company culture that encourages curiosity and passion—from employee resource groups and learning opportunities to team outings and community outreach.

Work Your Passion. Live Your Purpose.

.jpg)

.jpg)