GetUpside, a cash back retail technology company, rebranded as Upside Tuesday alongside a $165 million funding announcement. The company’s Series D included $65 million in equity financing and $100 million in debt financing from General Catalyst. This latest funding round brings Upside’s valuation to $1.5 billion, securing the company’s unicorn status.

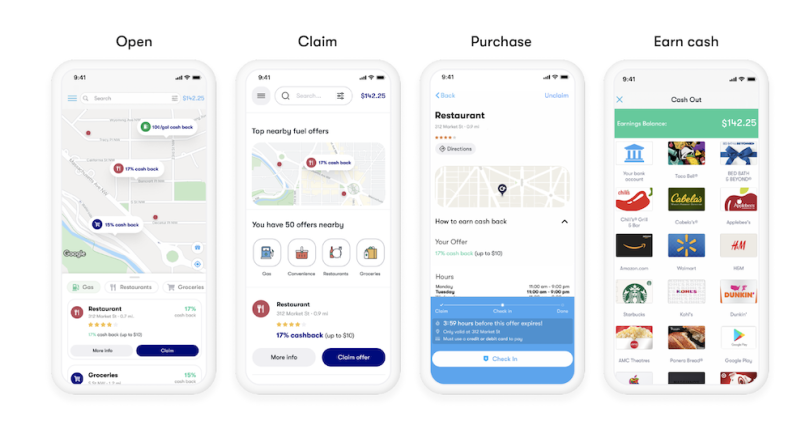

Upside is a two-sided marketplace that both drives traffic for businesses and gives users cash back on common purchases such as gas, meals at restaurant and groceries. The company partners with over 50,000 retailers and has approximately 30 million customers. To date, Upside has driven $550 million back into local economies and committed one percent of its revenue to sustainability initiatives.

“With inflation at a 40-year high, we are at an inflection point right now for brick-and-mortar businesses, consumers and our communities. As businesses look for new ways to profitably grow, consumers are looking for ways to gain more purchasing power on the things they need,” Upside co-founder and CEO Alex Kinnier said in a statement. “We are always focused on the win-win-win and are proud to have built the only product that delivers measurable benefits for all points of brick-and-mortar commerce.”

Upside plans to use its new capital to accelerate user growth, expand its retail categories, invest in product development and expand its team. Currently, the company is hiring 55 jobs in the D.C. area and 77 across its offices in Chicago and Austin.

This news comes after a record year of growth for Upside. Earlier this year, the company announced a partnership with Lyft, which allows drivers to earn up to 32 cents per gallon in cash back on fuel at over 25,000 stations nationwide. The company also announced a similar partnership with Uber last year, giving its drivers 25 cents per gallon in cash back at the pump within the Uber Driver App.