Get the job you really want.

Maximum of 25 job preferences reached.

Top Finance Jobs in Phoenix, AZ

Artificial Intelligence

Assist in financial modeling, market analysis, budgeting, and finance strategy as part of an unpaid internship for finance students.

Top Skills:

ExcelMicrosoft Office Suite

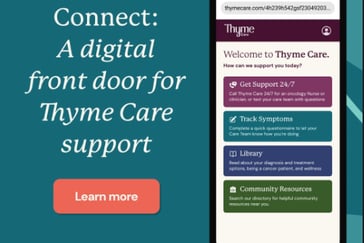

Healthtech • Telehealth

The Head of Finance will manage budgeting, forecasting, and financial modeling, collaborate with business leaders, and communicate financial trends to leadership, supporting strategic decision-making.

Top Skills:

ExcelLookerNetSuite

Information Technology • Software • Consulting

The Head of Finance will oversee all financial actions, manage financial planning, risk management, and provide strategic input to senior management.

Top Skills:

Accounting SoftwareFinancial ReportingGaap

Healthtech • Information Technology • Other • Social Impact • Software • Telehealth

As a Finance Manager, you'll enhance financial operations, oversee FP&A processes, manage financial models, and collaborate cross-functionally to provide insights for executives.

Top Skills:

Excel

New

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Top Companies in Phoenix, AZ Hiring Finance Roles

See AllPopular Phoenix, AZ Job Searches

Tech Jobs & Startup Jobs in Phoenix

Remote Jobs in Phoenix

Content Jobs in Phoenix

Customer Success Jobs in Phoenix

IT Jobs in Phoenix

Cyber Security Jobs in Phoenix

Tech Support Jobs in Phoenix

Data & Analytics Jobs in Phoenix

Analysis Reporting Jobs in Phoenix

Analytics Jobs in Phoenix

Business Intelligence Jobs in Phoenix

Data Engineer Jobs in Phoenix

Data Science Jobs in Phoenix

Machine Learning Jobs in Phoenix

Data Management Jobs in Phoenix

UX Designer Jobs in Phoenix

Software Engineer Jobs in Phoenix

Android Developer Jobs in Phoenix

C# Jobs in Phoenix

C++ Jobs in Phoenix

DevOps Jobs in Phoenix

Front End Developer Jobs in Phoenix

Golang Jobs in Phoenix

Hardware Engineer Jobs in Phoenix

iOS Developer Jobs in Phoenix

Java Developer Jobs in Phoenix

Javascript Jobs in Phoenix

Linux Jobs in Phoenix

Engineering Manager Jobs in Phoenix

.NET Developer Jobs in Phoenix

PHP Developer Jobs in Phoenix

Python Jobs in Phoenix

QA Jobs in Phoenix

Ruby Jobs in Phoenix

Salesforce Developer Jobs in Phoenix

Scala Jobs in Phoenix

Finance Jobs in Phoenix

HR Jobs in Phoenix

Internships in Phoenix

Legal Jobs in Phoenix

Marketing Jobs in Phoenix

Operations Jobs in Phoenix

Office Manager Jobs in Phoenix

Operations Manager Jobs in Phoenix

Product Manager Jobs in Phoenix

Project Manager Jobs in Phoenix

Sales Jobs in Phoenix

Account Executive (AE) Jobs in Phoenix

Account Manager (AM) Jobs in Phoenix

Sales Leadership Jobs in Phoenix

Sales Development Representative Jobs in Phoenix

Sales Engineer Jobs in Phoenix

Sales Operations Jobs in Phoenix

All Filters

Total selected ()

No Results

No Results