Nearly one year ago, the investment team at 500 Startups watched with nervous anticipation as the impact of the COVID-19 pandemic rippled through its portfolio of early stage startups.

Each day brought new uncertainties, like when an India-based freight forwarding startup was forced to go on lockdown for two weeks. As the future swirled into a state of uncertainty, the investors started asking themselves how they should even be evaluating new businesses.

“Those times were definitely a little nerve-wracking,” recalled Amit Bhatti, who’s the principal at 500 Startups.

But if there’s one lesson to take away from the past year, it’s that tech and VC funding are nothing if not resilient.

By June of 2020, 500 Startups had adapted to the events and continued investing as before, only now, it’s added a “COVID[-19] lens” to its startup evaluation framework, Bhatti said. It now takes into account startups that may be benefiting from a short-term, pandemic-related boost, in addition to those that are part of a long-term technological shift, like remote work tools.

“It was a validation of what we were anecdotally seeing.”

500 Startups wasn’t alone in those adjustments. The investment firm recently released a survey of 122 investors (the majority of which were angel investors) analyzing the impact of COVID-19 on early stage investment in 2021. The results found that investors are now increasingly relying on virtual networking to source deals and that their appetite has only grown for startups in industries like healthcare, remote-work solutions and e-commerce.

More than anything, however, the survey confirmed what Bhatti knew to be true — valuations remain steady and VC firms have no plans to slow down investing in 2021.

“It was a validation of what we were anecdotally seeing,” he said. “By Q4 and the first couple months of this year ... it felt like things were really picking up.”

VC Trends During the Pandemic

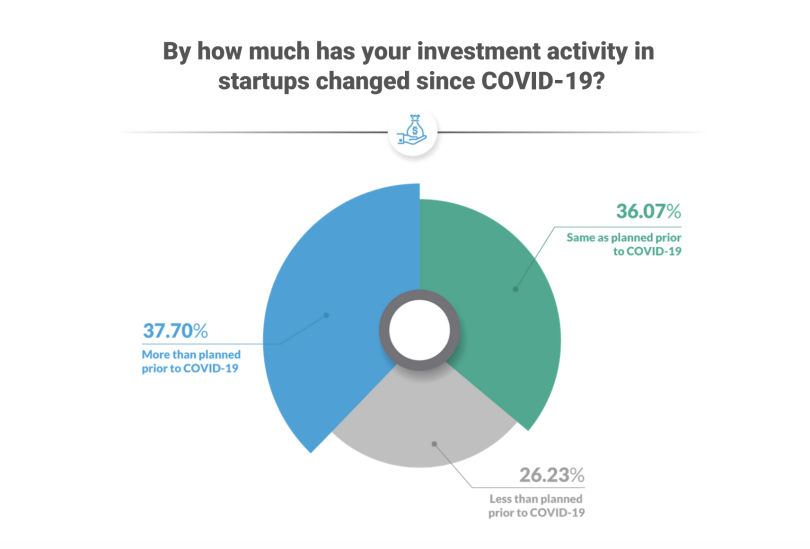

One of the most promising findings in 500 Startups’ survey was that the majority of investors reported their investment activity has either remained the same or increased during the pandemic.

Driving this momentum is the success tech companies have experienced in the public market, Bhatti said. In particular, cloud and SaaS companies that have gone public thrived over the last six months. Those successes have given early stage investors the confidence to keep looking toward the future, rather than worrying about the immediate uncertainty.

“It gives people more confidence to say, ‘I’m going to take the risk to invest in what the next generation of this [technology] might be.’”

In fact, the survey found that about 33 percent of VC firms polled plan to make more than 11 investments this year. More promising, nearly half of investors reported that company valuations were higher than expected.

“It gives people more confidence to say, ‘I’m going to take the risk to invest in what the next generation of this [technology] might be,’” Bhatti said.

All Eyes on Healthcare, Remote Work and Productivity Tech

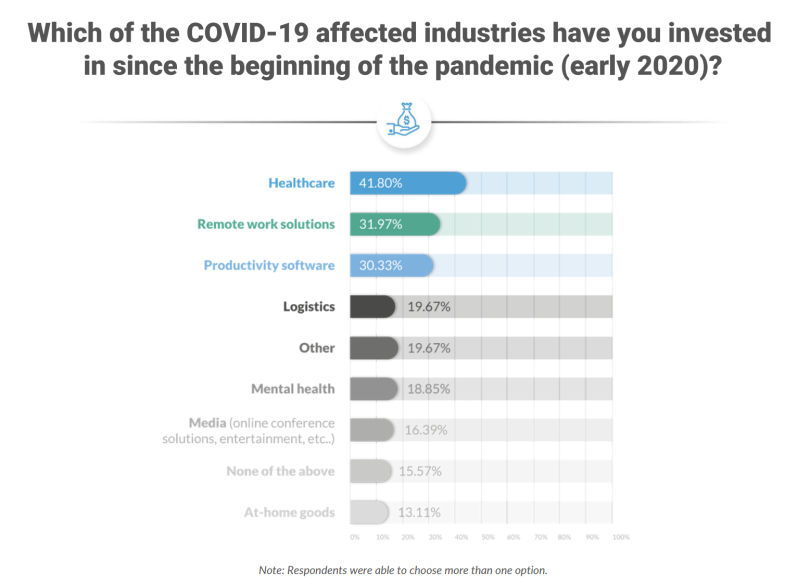

It may come as no surprise, however, that early investor trends have shifted toward funding startups in healthcare, remote-work solutions and productivity software.

In New York City, for instance, there was a record number of investments in healthcare tech in 2020, including Optum’s acquisition of the virtual therapy provider AbleTo. On the other side of the country in San Francisco, employee mental health and wellness startup Modern Health doubled its revenue and became a unicorn with its latest funding round.

Meanwhile, remote tech jobs have doubled since May, according to Built In’s report. As a result, companies are on the lookout for tools beyond Zoom and Slack to make remote work more productive and flexible, such as asynchronous communication tools like Twist and Threads.

While investors reported the most interest in those industries, the fields have become crowded with startups, making it more difficult to find a winner at the early stages of investing, Bhatti said. The key is to find a company that has a unique insight into what’s missing in a particular industry.

For healthcare, he’s keeping his eyes on products and services that target the patient experience.

“There’s been so much healthcare investment, but the patient experience hasn’t gotten much better,” Bhatti said. “Biotech has been booming because we’ve seen amazing things happening on the vaccine front, like the ability to develop drugs faster, but as far as you and I interacting with our doctors, like yes, it’s great we can use telemedicine, but that’s not a technology breakthrough.”

Of course, COVID-19 has led to innovations in several other industries that are seeing increased investor interest, like real estate tech and e-commerce. Bhatti is most excited about the development of social commerce, where creators can leverage their social media followings to sell their products. He also thinks tech solutions around travel and live events will bounce back this year, while virtual events may dwindle as their pandemic-related boost wanes.

“I hope [tech industry trends turn toward] climate solutions. We have plan A of places that humans can live, and we don’t have a plan B.”

But since early stage investors are focused on the future, he has his eyes set on problems unrelated to COVID-19 — particularly food tech (think lab-grown meat) and climate solutions.

“I hope it’s climate solutions,” Bhatti said of what industry he hopes booms in 2021. “We have plan A of places that humans can live, and we don’t have a plan B.”

To Source Opportunities, Investors Must Get Creative

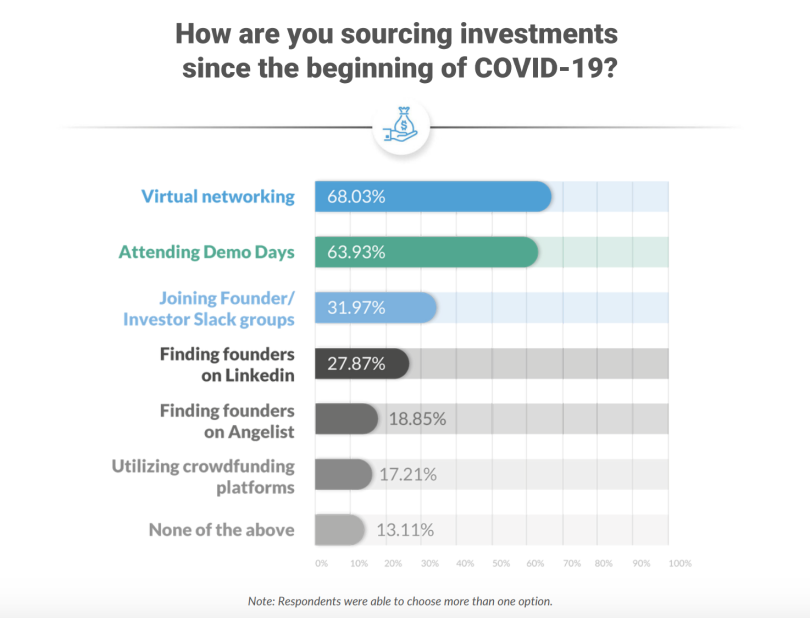

While it took a few months to adjust, investors have found new ways to source and connect with potential portfolio companies.

With in-person meetings and networking events on hold, the survey found that virtual networking has become the most popular way investors are sourcing their opportunities. But the pandemic has also led to more creative efforts to connect with startups. Investors have turned to forming founder-investor Slack groups and connecting with founders on apps like Clubhouse.

“People have found different ways to try to replicate networking or find a community from the investor side throughout the last year.”

The virtual sourcing process has always been a part of 500 Startups’ strategy as an international venture fund. Still, the pandemic required a mentality shift, forcing investors to spend more time networking online and sourcing startups through their social media profiles.

“People have found different ways to try to replicate networking or find a community from the investor side throughout the last year,” Bhatti said.

While the shift into a digital-first strategy does open investors to connect with more companies around the globe, he doesn’t see it changing the fundraising process much for founders. They still need to be targeted in their outreach to investors and have connections in the industry they’re building in.

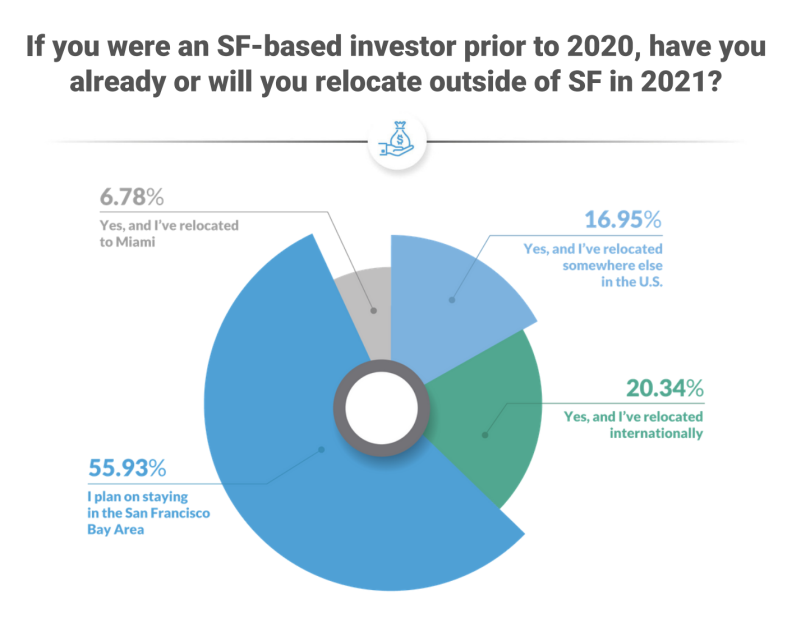

Meanwhile, don’t expect a new city to entirely supplant San Francisco as a VC hub, Bhatti said. While SF-based companies are flocking to cities like Austin and Miami, 56 percent of the 122 investors surveyed reported that they plan to stay in San Francisco.

Still, Bhatti remains optimistic about the rise of tech hubs outside of the Bay Area, including cities like Denver, Miami, D.C., Atlanta and Nashville, to name a few.