Before a presentation on The Great Gatsby to his college rhetoric class, Nico Aguilar suffered an anxiety attack so severe that he had to leave the room. Determined not to let that happen again, Aguilar read books on the subject and got coaching to become more comfortable with public speaking.

Determined to help others overcome similar difficulties, he came up with Speeko, an AI-powered tool that helps users improve their public speaking skills. He and his co-founders, all engineers, built an algorithm that measures one’s speaking voice and then offers tips for improvement. The team had the algorithm down pat, but the business approach? “We were completely lost there,” Aguilar said.

They turned to their mentors at tech incubator Techstars and the Polsky Center for Entrepreneurship and Innovation at University of Chicago for help in writing that critical document: a business plan.

3 Business Plan Examples

- An operating plan. This sketches out a business’ trajectory for the next 12 to 24 months. The plan includes staffing, revenue, projections, inventory and other factors necessary to running a business. Operating plans should be updated constantly as the business and market evolve.

- A financial plan, which examines the business from a cash-flow perspective. Take this plan, which takes a conservative view of your business’ finances, to the bank if you’re planning to get a loan.

- An opportunity or a vision plan. That’s the kind entrepreneurs present to potential equity investors. This plan should be aggressive, optimistic, and show how you will use your investors’ money to grow your business. It represents what’s possible if lack of capital is not holding you back.

The plan, written with the help of a tool called Business Model Canvas (more on that soon), included Speeko’s value proposition, its market, customers and predicted use. The plan went through multiple iterations and took several months to write. “It’s a big process to put together facts and figures,” Aguilar said. Their efforts paid off when Speeko won Polsky Center’s 2020 Alumni New Venture Challenge, a prize that comes with a $175,000 investment.

Brimming with enthusiasm, entrepreneurs tend to stuff business plans with everything from detailed finances to long-term projections. Avoid overstuffing by deciding what kind of business plan to write before putting pen to paper, said Waverly Deutsch, adjunct professor at the University of Chicago Booth School of Business. Deutsch teaches the Global New Venture Challenge course, a venture launch competition for the executive MBA program.

If it’s a new business, then write an opportunity or vision plan to take to potential equity investors. This plan should be “highly optimistic” and not at all conservative, Deutsch said. “It’s what you can do if you raise the money you want to raise,” she said.

Gather Material

The opportunity or vision plan must show investors that your business presents a real opportunity, demonstrate that you can build the company you propose to build, and show investors how their money will help you build your company.

To prove the opportunity, outline your competitive differentiation in the marketplace. Show what problem your product solves for which market, the size of that market, and that customers are willing to pay for your product. If your product is what Deutsch calls “fundamentally different,” along the lines of Airbnb or Uber, “there’s a reason for customers to choose you,” she said, but those types of startups are rare.

“Most businesses are evolutionary, not revolutionary,” Deutsch said. New businesses not offering a radically different solution can differentiate on quality, service, business model, go-to-market approach, positioning in the market or other factors.

Your plan also must prove that you can build the company you propose to build. Details about arrangements with potential suppliers, any intellectual property involved in your business, and the status of the product, be it a demo or a prototype, are critical parts of an opportunity plan.

Another critical part: Your and your partners’ experience and knowledge as they pertain to launching a business. Avoid simply pasting your traditional job-seeking resume into the business plan. Instead, examine it carefully and draw solid lines between your past experience and the skills your new business will require. “It’s your job to sell your and your team’s experience to the investor,” Deutsch said, adding that entrepreneurs shouldn’t underestimate this portion of the plan. Lacking a tangible product and real-time market experience, “it all comes down to the people,” she said.

The third element: Your plan for creating inroads and a beachhead in your market. “De-risk the business for investors,” Deutsch said. Offer a detailed operating plan, complete with compelling milestones, for the next 12 to 24 months. Show them that their money will help create a repeatable, scalable sales process and a robust product truly valuable in the marketplace, she said. Show them that their money will help your startup get to the next round of funding. “Investors are always looking at that next round,” she said.

Prepare to Pivot

It is entirely possible that you’ll start writing and soon figure out that your big idea isn’t so big after all. “That’s good to learn early,” said Bob Bridge, executive director and founder of SWAN Impact Network, an angel investing organization with branches in Austin and Dallas, Texas. “Companies often pivot, especially when they start testing their ideas with customers.”

He suggested avoiding the “trap” of using feedback from 100 potential customers to decide whether a business is a go. When presented with an idea, “people, wanting to be helpful, will say that the idea sounds interesting, that it could work for them,” Bridge said. “The CEO hears this and it’s confirmation bias saying, ‘I think I have my first customer.’”

Instead, approach potential customers to see if they have the problem your business wants to solve, then ask for more information on that problem. “Ask questions and start peeling the onion and become the world expert on that problem,” he said. If you have the solution for exactly that problem, then discuss the budget with these potential customers, and confirm that your solution is a must-have, not a nice-to-have for them.

“Then you understand that there’s a problem to solve and people are willing to pay for the solution,” Bridge said. “That’s what we like to hear, that entrepreneurs have validated the business with real customers,” he said. “And when we do due diligence, before we would invest, we’d ask to speak to those customers and ask them if this is a nice-to-have or a must-have.”

Choose a Medium

“Nobody writes a 20-page Word document and I promise you no investor ever reads one,” said Bridge. He offers Business Model Canvas, a tool readily available online, as one option to the traditional prose document.

Business Model Canvas breaks down a business into nine parts: Key partners, activities and resources; value propositions; customer relationships and segments; channels; cost structure and revenue streams. The tool shows how all the parts connect, and via whiteboard, can be reconfigured and workshopped. Business Model Canvas “helped us try out 10 ideas before committing to one in the business plan,” said Aguilar of Speeko. The format “forces your business to be simple, which is a really good thing when you’re starting out,” he said.

A PowerPoint deck also works and is a must when presenting to investors. Bridge recalls driving to VC appointments on Silicon Valley’s Sand Hill Road. After every meeting, he’d pull over to revise his pitch deck. “On any given day, that PowerPoint may have been tweaked three or four times to make it more investable,” he said. “You’re always learning and improving your pitch, and it’s easy to do that with a PowerPoint slide.”

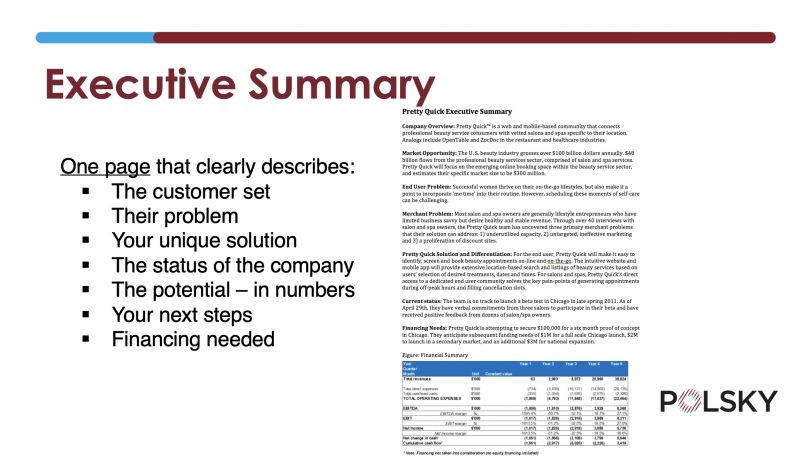

Deutsch, a proponent of telling a story in a business pitch, recommends a combination of media to present the story most effectively. “You need to have multiple communication tools available to you,” she said. She advised thinking along the lines of 10 pages of text, 10 pages of charts and data and more detail, and a one-page executive plan. Two decks, one light on text, for the presentation, and another more detailed leave-behind complete the business-plan package.

Deutsch said that every founder needs to be involved in the business plan, with each contributing their own area of expertise. The team member who’s the best writer should be responsible for making sure the plan is written in a unified voice, and that it is free of grammatical and spelling errors. She also suggested having an advisor read the plan to spot unanswered questions. There will be many, she said, and that’s not a cause for concern. “Don’t let perfect be the enemy of good,” she said. “You will never answer all the questions about your business until you’re actually executing on your business.”

Bridge agrees. “It takes twice as much time and twice as much money to hit milestones,” he said. “We know that and we’re comfortable with it.”