Online gaming platform Roblox’s path toward its public debut has pivoted in recent months. The company’s anticipated plans for an initial public offering in the fourth quarter of 2020 have shifted to plans for a direct listing instead, according to Bloomberg reports.

The tech world will be watching closely. The ability for a tech company to raise cash through this route could have far-reaching implications for the sector, because direct listings “allow companies to save a significant chunk of money that is usually paid to investment banks in a traditional IPO,” as the Wall Street Journal explains. That’s significant, considering many tech companies burn through cash before going public and commonly continue to burn cash for several years after becoming a public entity.

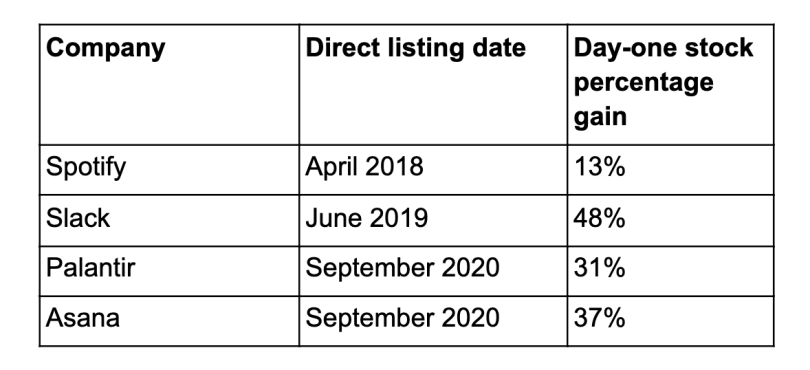

There are pros and cons to both IPOs and direct listings, and the outcome of Roblox’s direct listing could open the door for more tech companies to take this route for going public. Four prominent companies have gone public via direct listing, as noted in the table below:

While most games within Roblox’s platform are free, the company earns a majority of its revenues by having consumers purchase Robux (its own virtual currency) which are then used to enhance the gaming experience. The company’s highly anticipated public debut has been postponed twice following the staggering success of both Doordash and Airbnb, which each doubled in share price after their first day being public. As Bloomberg reported in early January, Roblox CEO David Baszucki wrote in a December memo to employees: “We’ve decided to take this opportunity to work with our advisors to see how we can make such improvements [to the IPO process].”

By changing its strategy, Roblox was able to raise $520 million in a Series H funding round, effectively increasing the company’s valuation from $8 billion (when it was originally planning on an IPO) to $29.5 billion.

To put this in perspective, Epic Games, creator of both Fortnite and the Unreal gaming engine — which powers many AAA gaming titles such as Final Fantasy VII, Borderlands 3, and Hellblade — was recently valued at about $17.9 billion during its last round of funding, which included a $250 million investment from Sony.

Easy Money for Tech Companies

Capital for tech companies is more accessible now than ever before. From young startups to larger, high-growth companies, businesses have a myriad of fundraising options including venture capital, private equity, an exchange market IPO and special purpose acquisition companies (SPAC), also known as blank-check companies.

Investors deployed nearly $150 billion in venture capital in 2020, according to PitchBook data, and one out of five private equity deals last year were tech-related. In 2020, SPACs raised a historic $83 billion, and the number of SPAC IPOs set a new record at 247.

The Gaming Surge

Roblox and other gaming companies find themselves at the potentially lucrative intersection of this free-flowing tech capital environment and a surge in the popularity of video gaming when much of the world was isolated in 2020 as the pandemic took hold. Twitch streaming hours doubled from an average of 2.5 billion hours in the second quarter of 2019 to more than five billion during the second quarter of 2020. Roblox alone jumped from 3.7 billion hours of engagement to 8.7 billion hours from January through September of 2020.

The gaming sector is growing so rapidly that video game analyst company Newzoo revised its forecast for global video gaming revenue during 2020 from $159 billion to $175 billion, representing over a 20 percent YoY increase. Esports has now emerged into a $1 billion industry as its popularity surges amid the pandemic. Chipmakers AMD and NVIDIA, gaming hardware companies Corsair and Razer and even gaming chair companies all saw increases in sales in 2020. The pandemic has lifted video gaming overall “to make more money than movies and North American sports combined,” according to MarketWatch.

Even more impressive are new ecosystems that have cropped up at the intersections of media and entertainment. Video games are no longer just devices intended to engage users to play games but are becoming conduits for a range of other functions. Take, for instance, virtual concerts: A Travis Scott concert on Fortnite drew nearly 46 million viewers, and a Lil Nas X show on Roblox drew 33 million viewers, according to the Verge. The fact that Roblox is poised to potentially be the latest company to go public via direct listing will surely add even more excitement to the market about what is possible through these platforms.