The abrupt shifts of 2020 also came with opportunities for entrepreneurs looking to solve new business challenges surfaced by the pandemic — especially in tech-heavy industries like SaaS, healthcare and finance.

Defined by new business opportunities, bullish investor outlooks and positive signs of an economic rebound, 2021 is shaping up to be an extraordinary year for startups seeking VC fundraising.

But just because investors are hungry for promising startups doesn’t mean fundraising will come easily. Even in a frenzied marketplace, startup founders still face an uphill battle to differentiate themselves.

To drive more transparency into the process and give founders a leg up in their own fundraising, we created the DocSend Startup Index (DSI) to track pitch deck interest and engagement in the startup community. By analyzing the data collected through our secure document sharing platform, we’re able to map out the shifting VC landscape based on key indicators of founder and investor engagement. The data is released weekly, and so far this year we’ve uncovered three clear trends every founder should use to guide their fundraising efforts.

Competition Is High, but Demand Is Even Higher

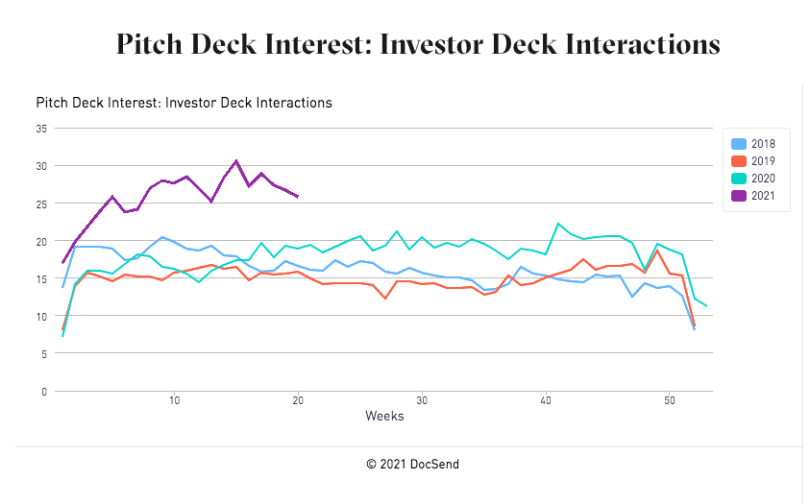

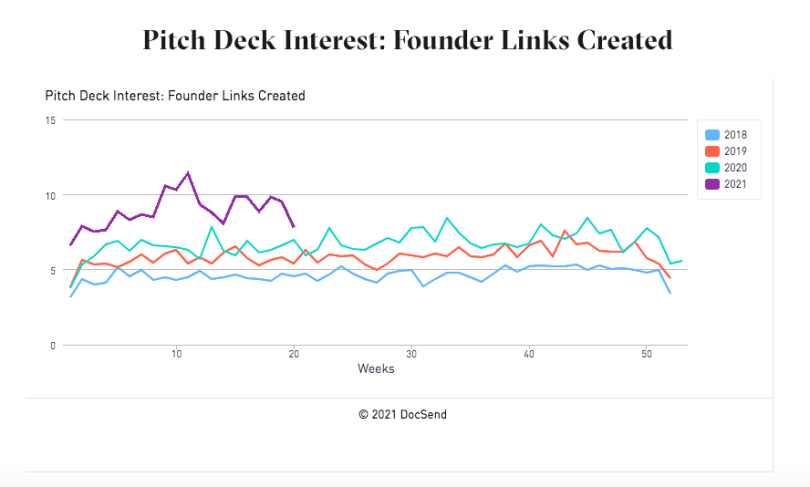

By nearly all indications, 2021 is one of the best times to be seeking venture fundraising in history. According to the latest data, investor demand for startup pitch decks is at a record high and shows no signs of slowing down. When comparing Q1 2020 and Q1 2021, overall VC demand — or interest in startups — increased 53 percent faster than the available supply of startup pitch decks (meaning startups actively fundraising).

Anecdotally, as pitching moved fully virtual, VCs are now meeting with 60 to 80 founders per month to satiate their need for new investment opportunities. While founders should still tailor their pitch decks to target VCs, pitching multiple investors at once rather than one at a time is crucial to tilting the odds in your favor.

Although investor demand for pitch decks is unprecedented, competition for startups still remains high. The latest data shows there are more fundraising startups in 2021 than ever before.

One explanation for the surge could be that startups conceived during the depths of the pandemic are now seeking funding in full force and that they are confident in their chances of securing term sheets. Additionally, the wave of activity could also represent the pent-up demand from more conservative founders who were waiting for positive signs of economic recovery before taking their startups to the next stage.

Use Your Deck to Tell a Genuinely Compelling Story

If you look at the record-high number of pitch decks being created and circulated by founders this year as a proxy for supply, demand on VCs’ time becomes a major factor to consider when designing your pitch deck. In Q1 of this year, the average time investors spent reviewing decks (having them open on their device, clicking through the slides) was down 17 percent year-over-year and down more than 3 percent from the previous quarter.

This means that when investors choose to open a pitch deck, they’re spending less time scrutinizing the information and are coming to a conclusion on whether they want to meet with founders more quickly. While it’s true this trend may be influenced in part by VCs being more willing to schedule a Zoom call to meet with promising founders rather than a face-to-face meeting, in practice, it means decks need to tell a compelling and succinct story.

In the pre-seed round, for example, the latest data shows VCs are hyper-focused on sections of pitch decks that address a startup’s business positioning. During the pandemic, investor review of startups’ “Competitive Landscape” section increased by 51 percent on average — suggesting that a clear view of where a startup can compete and how it plans to monetize are key.

The stakes are apparent when you consider how much money is riding on every second of an investor’s attention. In the pre-seed round, VC’s spend an average of 35 seconds on the “Competitive Landscape” section, which equates to more than $77,000 in potential funding on the table.

Shorter Virtual Meetings Will Remain the Norm

In the before times, founders needed to budget considerable time and money for their in-person fundraising efforts. Whether they were flying across the country to knock on doors on Sand Hill Road or scheduling coffee meetings to warm up to investors in New York, in-person meetings were vital to successful fundraising.

Since the start of the pandemic, however, founders and VCs alike have adjusted to virtual meetings and should expect them to remain a fixture of fundraising. For founders, this means more opportunities for those based outside of traditional hubs like Silicon Valley and NYC. During the pandemic, every region in the U.S. saw an increase in representation for pre-seed founders, opening the doors to a much larger pool of startups.

More readiness to accept virtual meetings means intro calls are now much shorter than traditional face-to-face ones were. Founders would be well served to condense their verbal pitches to get their startups’ value across quickly.

That’s been our experience, too. "In the last year, due to the virtual nature of fundraising, I have met with more founders than ever before,” Kyle Lui, general partner at DCM and a DocSend board member, told me. “These virtual meetings are now much quicker — from an hour down to 30 minutes, usually. The pitch deck is what gets founders a foot in the door, but they also must utilize their time wisely when in these shortened meetings."

This means that while access to VCs now comes more easily, so does competition. Practice a condensed pitch with your co-founder(s) or peers so you can deliver a compelling story to investors when the time comes. A good rule of thumb is to keep your verbal pitch crisp and succinct enough so that the partner you first met with is able to summarize your company to their colleagues in one or two sentences.

Remember: Particularly in early-stage fundraising, the goal of every meeting is to secure another meeting.

Keeping Tabs on Recovery and the Year Ahead

If you’re a founder in search of VC funding, I recommend you move quickly to capitalize on this frenzied marketplace. Investors are more likely than ever to take meetings and are ready to move on promising companies.

That said, you still need to make sure your fundraising pitch process is buttoned-up so you give yourself every chance to succeed. If you’re a founder looking to fundraise a pre-seed, seed or Series A, consider applying for the DocSend Fundraising Network (DFN). Our complimentary service can connect you with targeted and committed VC funds who can issue term sheets (i.e. lead your round).