From Coco Chanel’s little black dress to Karl Lagerfeld’s watershed H&M collaboration, there are plenty of rejoinders to the age-old criticism that high fashion is largely unattainable. More recently, fashion blogs and Instagram have brought haute couture to the masses, if only in words and pictures. The industry’s own internal mechanics, however, often conspire to keep apart a must-own design and even the most dedicated fashionista.

One reason for that is the enormous power retailers traditionally have held. Plenty of cool new collections haven’t gone to market because retailers guessed they wouldn’t sell well. It probably goes without saying, then, that the most groundbreaking and fashion-forward designs often are dismissed out of hand.

LUXURY FASHION, MADE TO ORDER

Working at the intersection of tech and fashion, Moda Operandi is helping to remedy this industry shortcoming. Shoppers at its trunk shows can order custom-made runway pieces before a line goes into production. What might have otherwise sparked a fleeting moment of frisson while browsing fashion show recaps can now end up in your closet.

Considered en masse, those purchases also provide invaluable data for designers with which Moda partners so they can make more informed production choices.

“The trunk show model allows designers to showcase their runway collections online and we’re the only place they can do that,” says Akshat Thanawala, chief product officer for Moda Operandi. “It really allows them to understand what customers are looking for and the trends in the marketplace, so they can take that data back and drive a lot of their efforts as they go into the season.”

Predictive Power

Moda’s trunk shows, it turns out, are great indicators of future fashion season trends. The company also sells a curated inventory of clothing, and styles that sell well in trunk shows, according to Thanawala, go on to sell at ten times the rate of those that don’t.

“And it’s a huge predictor of trends,” he adds, “not just of specific items.”

Indeed, many of the current season’s most ubiquitous fashion sightings — zebra and leopard prints, headbands, capes, shades of green, grey and pink — were spotlighted by Moda as likely fall/winter trends way back in February, when the company released its first-ever season forecast based on internal analysis of trunk show data. A spring/summer projection will be released in October.

Driven by Data

Any time a retailer deals with a high-dollar product like luxury fashion, inventory management is crucial. If sellers stock more high-end designs than consumers demand, the profit margin quickly shrinks. In order to strike the best balance, Moda leverages data analysis that encompasses more than just trunk show sales.

“We have a sophisticated set of models that we use to basically predict and plan what we buy based on the data,” says Thanawala. “And that’s not just purchase data, but also browsing data and other signals. We have a significant number of customers who come to our site just to browse and find out about fashion trends are, so we collect and harness that data to drive our decisions.”

Another important data-driven process is supply chain management.

“There’s the issue of, Where should we be placing the inventory?” Thanawala says. “Should we be putting it in our European warehouse? Should we house it in our U.S. warehouse?”

The team’s advanced data capture, coupled with machine learning analysis, helps answer those questions.

THE TECH IN FASHION MARKET

More than ever, technology is having a massive impact on how people browse and buy (or borrow) clothing. In addition to fashion’s burgeoning sharing economy, there has also been a proliferation of resale sites and digital-forward retail spaces.

Here are a few companies using technology to help make luxury fashion more accessible.

RENT THE RUNWAY

HAPPY TO SHARE

Just as successful designers must contend with knockoff brands, fashion-rental juggernaut Rent the Runway is spawning a host of imitators. But it’ll be hard for the copycats to replicate the kind of loyalty Rent the Runway has fostered with its simple-yet-transformative concept: a subscription service that allows users to rent designer clothes and accessories. The model helps level one obvious barrier to high-end fashion — it ain’t cheap — by leveraging the public’s now-ingrained comfort with both subscription-based consumption and the sharing model of companies like Uber and Airbnb. Rent the Runway loyalists are extremely active in rating and reviewing items, which provides data that informs the company’s machine learning-enriched data science approach and advanced tech stack.

TAMARA MELLON

HIGH-END FOOTWEAR FOR ALL

Tamara Mellon brings a similar democratizing impulse to footwear, selling high-design, Italian-made pumps, flats and other shoes for less. Her namesake e-commerce company controls costs by going direct-to-consumer, giving the boot to industry-standard markup rates that exclude so many would-be shoppers. Investors are on board, too: The brand recently raised $50 million in a Series C funding round, one of the most lucrative ever for a female-founded fashion company.

THE BLACK TUX

A BETTER WAY TO RENT FORMALWEAR

Fashion-rental brands like Rent the Runway have likened their concept to the long-established tuxedo rental industry, but the men’s formalwear industry also needed a trip to the tailor. The vision for The Black Tux came into focus after its co-founders rented polyester wedding tuxes from Men’s Wearhouse — and loathed them. The company rents fashion-forward tuxes made from quality fabric for up to $45 less on average than other rental places charge. Like Rent the Runway, they keep prices down by handling cleaning and tailoring in-house. Aside from standout e-commerce UX, one of the company’s notable tech tools is its sophisticated fitting algorithm, which can predict measurements based on info like height, weight, age and shoulder width.

FARFETCH

THE STORE OF THE FUTURE

You can think of this London-based powerhouse as a designer aggregator of sorts: Farfetch sells wares by several hundred fashion brands and boutiques under one URL. The site organizes layout as much by designer as product category. It brick-and-mortar spaces are even techier. Farfetch’s stores, or “retail operating systems,” are lined with RFID-chipped clothing racks by which shopper’s can add items to a browse list on their app. Dressing rooms are tricked out, too, sporting digital mirrors that display a shopper’s wishlist and allow them to request different styles and sizes from associates with just a click. The operating system also effectively serves as a platform upon which brands can build their own third-party applications.

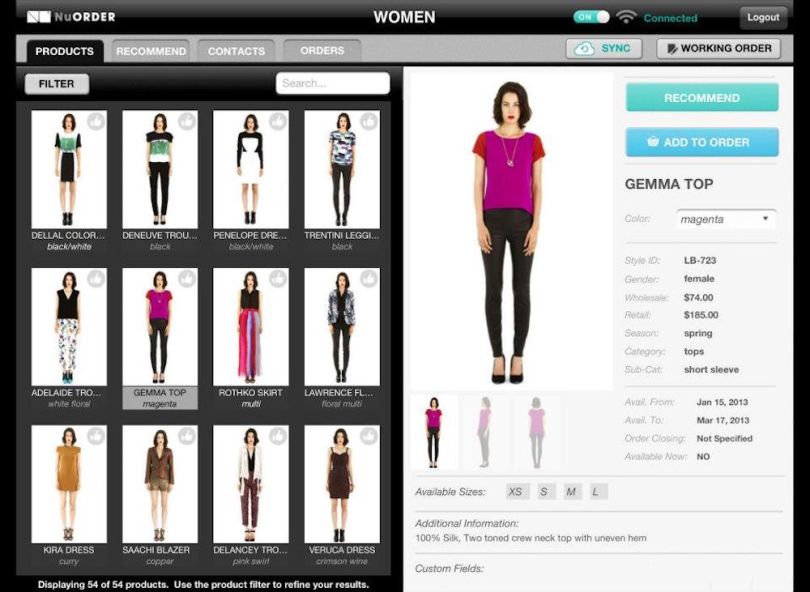

NuORDER

THE LINE SHEET, UPDATED

Line sheets are the connective tissue of the fashion industry. They’re like Cliffs Notes catalogs of a producer’s garments, that one can use to market to wholesalers and retailers. They were also long outmoded, relying on pen and paper or printed PDFs that couldn’t be easily or neatly updated after new changes rolled down. NuORDER is one of the B2B companies making that process better with tech. The Hollywood-based startup developed custom digital line sheets that connect the various parties within the fashion ecosystem, boast crisp visuals and work across mobile devices. The platform also lets users track sales and inventory and fulfill orders.

STITCH FIX

MACHINE LEARNING IS IN FASHION

Stitch Fix helped pioneer a now-popular clothes-buying model: the brand semi-regularly ships customers new clothing items, chosen by a company stylist and based on the user’s provided style preferences, and the recipient keeps or sends back as many of the items as they desire. The binary yes-or-no nature makes the model a data-rich one, but Stitch Fix takes its data science further, relying on artificial intelligence for everything from recommendation systems to warehouse management to style development. Users can even opt in to share their social media activity — like Pinterest pins — to fine-tune the AI-assisted recommendation engine.

TRADESY

A NEW WAY TO SELL USED

Another partial blow to luxury fashion’s pricey barrier of entry? The nascent boom of clothing resale platforms, like Poshmark, thredUp and Tradesy. The latter sells lightly used clothing, shoes and accessories from designers like Balenciaga, Tory Burch, Vince and Alexander Wang. Think of it as eBay’s fashionista counterpart. Tradesy’s rapid growth — including nearly $75 million in total funding — was reportedly fueled by some advanced product descriptions that linked up description keywords with similar products, creating an SEO snowball that improved as inventory expanded. The re-commerce leader eventually expanded to include menswear, finding enough footing that a recent leaked guidebook provided to NFL players recommends they consider selling some clothes through the site in the event of a work stoppage.

GRAILED

A STREETWEAR COMMUNITY

The now-solidified union between the luxury and streetwear realms has helped make high-end fashion more approachable to the masses, but it’s also had the counterproductive effect of escalating street fashion prices. Grailed is arguably the single most prominent peer-to-peer streetwear marketplace. It attempts to counter so much buy-and-flip markup culture with its Designer Deals spotlight, which gathers together the site’s most popular high-fashion options listed under $500.

DIA&CO.

TAKING ON FASHION’S PLUS-SIZE PROBLEM

“Today’s designers operate within paradigms that were established decades ago, including anachronistic sizing,” wrote Tim Gunn in a widely shared 2016 Washington Post op-ed that took to task the fashion industry’s entrenched and economically inexplicable sizeism problem (more focus on plus sizes is good for profits). Dia&Co. upends that paradigm and caters to that overlooked market with fashion-forward plus-size clothing, using data to drive operations. The try-at-home outfitter — which offers personal styling and free shipping — applies data analytics and machine learning to build out product roadmaps and bring their designs to life. And it keeps things transparent in terms of software development and data science.

FASHION, TECH AND SUSTAINABILITY

Slowing Down the Excesses of Fast Fashion

Ease of access is hardly fashion’s only challenge; it also has a serious waste problem. The fashion industry is on pace to consume a quarter of the world’s carbon budget by 2050, according to the United Nations Environment Programme. It’s responsible for more than 10 percent of all carbon emissions and 20 percent of the world’s wastewater. The industry’s most notorious poor steward is fast fashion, the sector that spits out quickly and cheaply produced clothing that often ends up piled in massive textile landfills.

In Fashionopolis: The Price of Fast Fashion and the Future of Clothes, fashion writer Dana Thomas points to technology as a promising tool in counterattacking fast fashion’s wasteful ways. She cites both Moda and Rent the Runway as emblematic, despite having different approaches. Moda co-founder Lauren Santo Domingo told Thomas that the company’s made-to-order, anti-impulse model means shoppers actually keep what they purchase at far greater rates than when they shop elsewhere. Moda’s return rate is 35 percentage points lower than that of conventional fashion e-commerce sites, and 58 percentage points lower than return rates on pre-orders through department stores, she told Thomas.

Thanawala agrees that Moda is keenly aware of its role in fostering sustainability. The traditional fashion retail model leads to gluts of unsold, unwanted garments piling up in liquidation. Now, when designers make better manufacturing decisions with the help of Moda’s data insights, “not only are we helping the designer from a business perspective, but we’re driving efficiency within the entire space.”

Photos via company sites and social media. Illustration via Shutterstock.