In February 2005, Amazon Prime launched, offering consumers free two-day shipping and discounted one-day shipping for $79 a year. Across the industry, investments in technology have contributed to an overall rise in e-commerce activity. Since 2005, e-commerce sales have grown from less than 5 percent of total retail sales to more than 14 percent, and the consumer definition of “fast” delivery has shrunk to less than two days.

As e-commerce businesses and legacy brick-and-mortar retailers faced increased shipping needs, startups saw an opportunity to “uberize” the logistics industry by using technology to match companies with carriers looking for freight. New York-based TransFix and Silicon Valley-based TruckerPath both launched in 2013 and were two of the earliest “Uber for trucking” startups. It wasn’t until 2017 that Uber itself got in on the action with Uber Freight.

“Trucking represents an enormous opportunity for Uber.”

Uber Freight operates much like its namesake in that it matches users — i.e., companies with cargo to move — with carriers on demand (or up to two weeks in advance). But unlike Uber proper, the operation is headquartered in Chicago, not San Francisco.

“Chicago fits in so strategically, both because it’s a major logistics hub and because of the growth in tech talent over the past decade,” said Tory Schober, an engineering manager and Chicago office lead at the company. “Over the next five years, we’ll definitely look to play a major role in shaping the industry via technology.

Uber Freight is entering a crowded space. Digital freight brokerages have existed since the mid-2000s, and the well-funded Seattle startup Convoy dubbed itself the “Uber for trucking” a full two years before Uber Freight even launched.

To gain an edge, and ultimately help define what the uberization of the freight logistics industry will mean, the company has gone all-in on Chicago.

Why Chicago?

Chicago’s Old Main Post Office was once touted as the world’s largest, an honor it owed to the city’s thriving mail-order retail business. Fast forward to 1997: mail-order catalogs were beginning to go the way of the dodo and the iconic post office was shuttered. The building remained vacant for almost two decades until it was announced that it would be repurposed as office space.

Today, the refurbished post office features 2.5 million square feet of commercial space, 450,000 of which Uber Freight occupies. The company leased the space to make room for 2,000 new hires, a majority of whom will work on its freight business.

“Trucking represents an enormous opportunity for Uber,” said Uber CEO Dara Khosrowshahi in a statement at the time of the announcement. “Chicago is the heart of America’s transportation and logistics industry, and there is no better place to open our dedicated Freight HQ. Uber has long recognized the incredible history, innovation and talent that Chicago has to offer.”

Uber is making a big bet — the company estimates it’ll spend $200 million annually in the region — on Chicago’s talent pool. While the city has become more of a hotbed for tech talent over the past few years, it’s long had a well of logistics professionals. Illinois’ location at the center of the country and its transportation infrastructure have helped establish Chicago as one of the country’s leading logistics hub.

The city has also become a hub for logistics technology over the past 15 years. Some of the industry’s biggest players were founded in Chicago, such as Echo Global Logistics and Coyote Logistics. The pair created technology that enabled companies to manage their supply chains and book freight shipments online. While the two companies didn’t invent the third-party logistics industry, their tech-driven approaches set them apart among competitors that still relied heavily on email, telephones and fax machines.

“I think we’ve achieved success when we can very clearly show that we brought this industry from one that’s reactive to one that’s proactive.”

Echo and Coyote became two of Chicago’s biggest tech successes, with the former going public in 2009 and the latter selling to UPS in 2015 for a whopping $1.8 billion.

FourKites and project44 are two other notable logistics tech companies that hail from Chicago. FourKites focused on providing real-time visibility into the location of trucks, while project44 developed pricing technology that integrated with existing transportation management systems to provide shipping rates from carriers in real-time based on market conditions and demand. The two companies have since expanded their offerings and have raised $190 million between them.

Uber Freight is hoping to make its own mark on Chicago’s logistics industry, and it’s moving quickly to make up for lost time.

“Our tech presence is going to be growing rapidly,” said Schober. “We’ve already sort of begun to tap into the tech power over the last few months. I’m extremely bullish on the hiring that we planned for into 2020. The team will be growing aggressively, and there’s a lot of momentum behind it.”

BEYOND BOOKING AND PRICING

At its core, the uberization of freight logistics is about using technology to automate pricing and booking. The idea is that an algorithm that takes into account current market conditions can more accurately and quickly price loads than a human who calls and emails carriers in their network searching for the best rate. The on-demand marketplace model is designed to cut down on the time it takes to book a load by allowing any carrier with the right truck to accept a job.

“The industry is ripe for change and ready for change,” said Uber Freight Director of Account Management Kate Kaufman. “Transparency and access are the biggest components that need to change. But a lot of people have taken a run at making this change, and there have been a lot of people who have tried and who have not succeeded.”

Uber Freight is looking to differentiate itself from competitors by giving shippers data that can help optimize their operations and using technology to anticipate supply chain breakdowns.

“Our teams use the latest technology — AI, data engines and algorithms — to get in front of failure as fast as possible.”

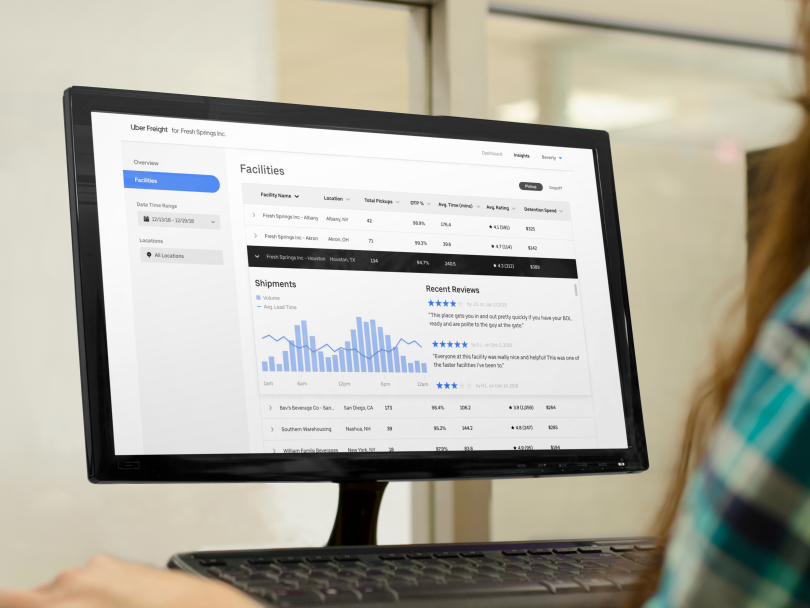

The company collects data from truck drivers about the facilities they pick up and drop off cargo at. Much like the Uber app, facilities are rated from one to five stars. Drivers can also leave a written review and confirm or add information about a facility’s amenities, such as free parking and bathrooms.

For carriers, these reviews can help determine which loads they choose to accept. For shippers, this data is designed to help streamline operations and identify problem areas.

Uber Freight released its first facilities report earlier this year. The report contains national and regional insights around everything from preferred cargo pickup times to favored facility ratings to the impact those ratings can have on the time it takes carriers to accept a load.

“You have to be able to aggregate [the data] and then you have to be able to interpret it,” said Kaufman. “When you’re using lots of carriers and you don’t have one succinct system, you don’t have that data in one place. Uber Freight allows you to aggregate your data into one place so that you can get a holistic view of your transportation and better manage it.”

While shippers can use data to optimize the operation of their facilities, there are still factors they can’t control, like an ice storm that slows highway traffic to a crawl. While Uber Freight can’t control the weather, the company has developed technology that enables its operations team to try and stay ahead of supply chain slowdowns.

“Our teams use the latest technology — AI, data engines and algorithms — to get in front of failure as fast as possible,” said Director of Carrier Operations Sagar Shah. “If something isn’t trending in the right direction we can get ahead of that and call the drivers to see what’s going on and then assess our options from there. But it’s important that we leverage our technology up until that point so that we can raise those red flags and then act upon them.

Prior to opening its new Chicago headquarters, the Uber Freight tech team sat in San Francisco while the operations, sales and account management teams were based in Chicago. By getting everyone in the same building, the company hopes it’ll be able to accelerate the product development process.

While the Uber Freight team was tight-lipped when it came to products and tools currently in development, the company seems to be taking a more practical approach to disruption.

“I think we’ve achieved success when we can very clearly show that we brought this industry from one that’s reactive to one that’s proactive,” said Shah.