The financial services industry has changed dramatically in the 70 years since the credit card was invented. Companies like PayPal and Stripe enable businesses to accept payments from customers around the world, while Square’s Reader has turned countless tablets and smartphones into payment-processing devices. Mobile payments are also on the rise, although adoption in the United States has been slower than in India and China.

But credit card companies aren’t sitting on the sidelines as technology firms reshape the financial services industry. Mastercard, American Express and Visa are all actively monitoring the trends and technologies in fintech and experimenting with their products and features to ensure they meet the needs of digitally native consumers and companies. We recently spoke with leaders at these companies to learn more about the trends and tech making the biggest impacts on their businesses.

Major Credit Card Companies to Know

- American Express

- Mastercard

- Visa

Mastercard

To keep a finger on the pulse of fintech trends and technologies, Mastercard has plugged directly into the global fintech startup ecosystem. Since 2014 the company has run Start Path, a startup engagement and corporate innovation program. According to Mastercard, 220 companies have completed the program since it launched, with alumni raising a collective $2.6 billion in funding.

The six-month program receives over 1,500 applications a year from fintech startups all over the world. Casting such a wide net gives Mastercard “a unique global lens to trends and hotspots in the fintech space,” according to Amy Neale, senior vice president at Mastercard and head of Start Path.

Neale said Mastercard is noticing a trend toward broadening financial inclusion that is manifesting in three distinct ways: “infrastructure designed to allow any company to enable financial services, startups focused on small and medium-sized businesses and a renewed focus on financial inclusion for those who don’t currently have access to financial products and services.”

Neale has also noticed a “continued appetite” for partnerships between growth-minded fintech companies and traditional financial institutions in search of new digital solutions. Along with industry shifts, she is also closely monitoring the progress of fintech companies founded by women.

Just 15 percent of VC fintech investments went to companies with one or more women founders in 2018, according to a report by PitchBook. Neale acknowledged the disparity but said she’s excited to see what some of Start Path’s women alumni can accomplish in 2020.

“While the narrative has focused on how these companies receive less funding than male-only teams, we’re excited to see some tremendous female-founded fintech companies come to the fore in 2020, including Ellevest, Goalsetter, Leal and Kasha,” Neale told Built In.

American Express

Like Mastercard, American Express has also established its own innovation lab. Amex Digital Labs was launched in 2017 to ideate and test new products and features. While their work is a closely-guarded secret, VP and Head of Emerging Strategic Partnerships Stephanie Schultz said there are three key trends and technologies guiding the team’s work in a 2019 interview with Tearsheet.

First, Schultz said American Express has formed partnerships and adapted its app to offer more mobile payment options to card holders.

“We’ve partnered globally with top mobile wallets like Apple Pay, Google Pay and Samsung Pay,” Schultz told Tearsheet. “We’re also experimenting with our own mobile payments solutions — we recently launched QR payments in the Amex mobile app for card members in Singapore.”

In addition to mobile payments, Schultz said the company is also focused on the devices that people use to make purchases.

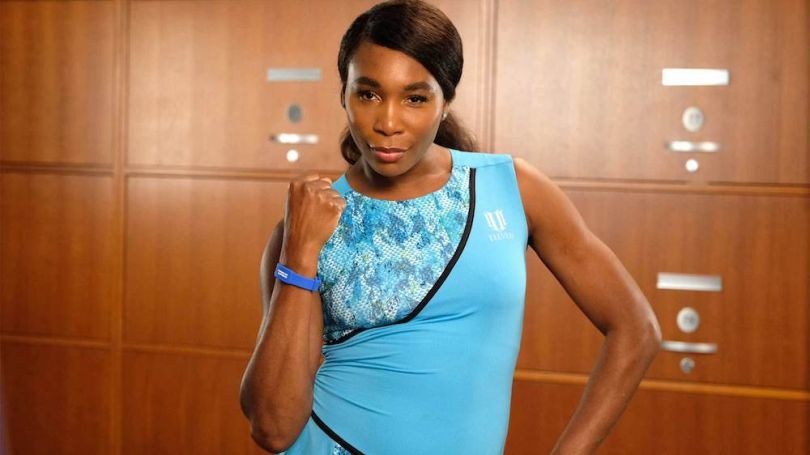

“We’re [also] seeing continued innovation across payment form factors,” Schultz told Tearsheet. “We’re exploring how this can help enhance the customer experience to improve speed, ease and seamlessness of payments. At last year’s U.S. Open tennis tournament, we introduced the Amex Band, a contactless payment wristband.”

On the subject of smart devices, Schultz also said American Express is investing in new ways for consumers to interact with the company through their smart devices.

“Customers expect better and faster answers and want to engage across a wider breadth of channels,” Schultz continued. “For example, we developed a skill for Amazon Alexa that allows us to give card members access to information using voice commands.”

Visa

Like many companies, Visa is extremely bullish on artificial intelligence and machine learning. But in a blog post last year, Rajat Taneja, Visa’s president of technology, wrote that it’s not just a buzzword for the company.

Taneja wrote that since he joined Visa in 2013, “AI and machine learning have become increasingly embedded in our products and infrastructure.”

“Our cybersecurity team uses neural networks to categorize and search petabytes of data every day, giving us actionable insights to protect our network from malware, zero-day attacks and insider threats,” Taneja wrote. “Meanwhile our operations team uses machine learning models to predict disruptions in our hardware and software systems, giving our engineers the insights they need to fix bugs before they impact our ability to process payments.”

According to Taneja, Visa will still be invested in AI and machine learning long after the tech industry has found a new technology to transform into a buzzword.

“This is just the beginning,” Taneja wrote. “We have a team of data scientists in our research group exploring new applications of machine learning for the payment industry and beyond, from recommendation systems to new models for risk and fraud management.”

Despite being founded decades before the term “fintech” was coined, Mastercard, American Express and Visa are all taking a more active role in shaping the industry’s future through their work with startups and emerging technologies.