Learn all the tips, tricks, shortcuts, functions and formulas you need to be an Excel power user. This course is designed specifically for Excel users who are performing professional financial analysis and financial modeling. We cover…

Financial Analyst

- FAQ

- Courses

- Certifications

- Careers

- Jobs

- Companies

- Skills

- Articles

What Is a Financial Analyst? How to Become One, Salary, Skills.

Financial analysts use data analytics to review financial performance and suggest expense decisions for a business. Here’s what to know about a financial analyst’s salary, needed skills and how to become one.

What Is a Financial Analyst?

Financial analysts conduct financial analysis to guide a company’s investment strategies and evaluate financial outcomes. They often keep up-to-date on current market and economic trends and may inform companies when to buy and sell investments.

What Do Financial Analysts Do?

Financial analysts review financial reports, identify investment opportunities and forecast potential financial trends for a company.

Financial Analyst Responsibilities

- Collect and organize financial data for analysis.

- Analyze and assess finances in comparison to industry standards.

- Develop financial forecasting models to assist in planning and budgeting.

- Create reports and present on investment recommendations.

Day-to-Day Responsibilities of Financial Analysts

- Pull data from historical financial reports, stock information and accounting records.

- Analyze metrics like return on assets, return on equity and year-over-year growth rates.

- Make spreadsheets and models in Microsoft Excel or Google Sheets.

- Conduct forecasting with regression analysis and other statistical methods.

Financial Analysts Within a Company

Financial analysts tend to be part of a finance team within a company. They may report to a senior financial analyst or finance manager.

Importance of Financial Analysts

Financial analysts can spark decisions that affect the budgeting of different departments and a company as a whole. Their work largely helps to minimize business risk and prepare ahead for uncertain market environments.

What Skills Are Needed to Be a Financial Analyst?

Qualifications to Be a Financial Analyst

- Internship or applicable experience in financial analysis, operational analysis or similar roles.

- Ability to analyze and draw insights from quantitative data.

- Ability to use tools to model and manipulate financial data.

- Proficiency in Microsoft Excel and statistical analysis methods.

Financial Analyst Prerequisites

- Bachelor’s degree in finance, economics, statistics or related field.

Financial Analyst Hard Skills

- Expertise in financial modeling and management software.

- Experience with data analysis tools and techniques.

- Familiarity with business valuation methods.

- Accounting and financial literacy skills.

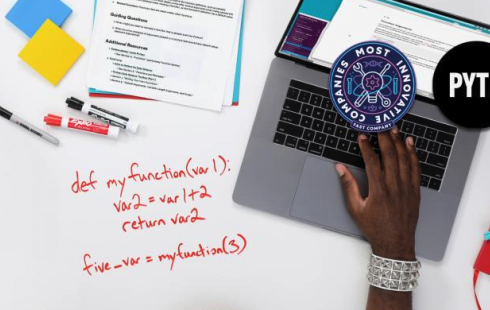

- Knowledge of programming languages and relational databases.

Financial Analyst Soft Skills

- Analytical skills.

- Critical thinking skills.

- Problem-solving skills.

- Verbal and written communication skills.

Tools and Programs Financial Analysts Use

- Bloomberg Terminal

- Google Sheets

- Microsoft 365

- Microsoft Excel

- Microsoft Power BI

- Oracle Financials

- Python

- QuickBooks

- R

- SAP

- SQL

- Tableau

How to Become a Financial Analyst

Financial Analyst Education and Experience

Financial analysts often earn a bachelor’s degree in finance, economics, statistics or a similar field.

Financial analysts will also need to obtain an internship or applicable experience in financial analysis, operational analysis or similar roles. Knowledge in data analysis, financial modeling and forecasting, business valuation, accounting and spreadsheet tools like Microsoft Excel are recommended.

Financial Analyst Certificates and Courses

- Bookkeeping Basics #1: Understand the Fundamentals

- Excel Crash Course: Master Excel for Financial Analysis

- The Complete Financial Analyst Course

- The Complete Financial Analyst Training & Investing Course

Financial Analyst Career Path

After experience as a financial analyst, professionals can move into a senior financial analyst role. From here, professionals may progress into management roles like finance manager, director of finance and eventually chief financial officer.

Financial Analyst Salary and Job Outlook

Financial analysts are in demand, as jobs for the role are expected to grow 9 percent by 2031.

The full compensation package for a financial analyst depends on a variety of factors, including but not limited to the candidate’s experience and geographic location. See below for detailed information on the average financial analyst salary.

Expand Your Financial Analyst Career Opportunities

Improve your daily performance by honing your finance skills through Udemy’s online courses.