Like millions of Americans, Areiel K. never thought she would be able to afford a home, until she discovered Up&Up.

The concept is simple: what if you could get the financial benefits of home ownership while renting?

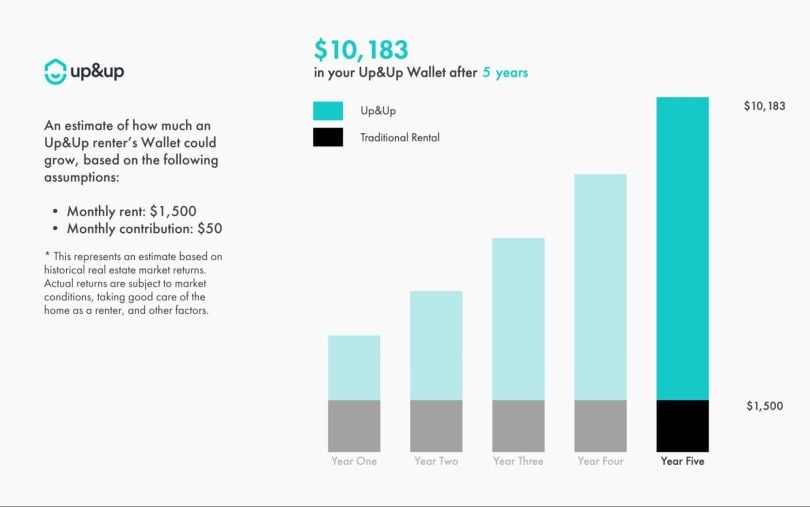

That’s the dream Up&Up is trying to make a reality, and it’s working. On average, renters who have been with Up&Up for over three years have more than doubled the money they’ve contributed to the Up&Up Wallet.

“Our mission is to help renters build wealth,” said Ryan Brown, co-founder and head of business development. “We have a vision of a housing system that allows renters to share in the benefit of homeownership, enabling all Americans to build wealth.”

Homeownership is the single biggest wealth-builder in the United States, but according to mortgage specialists at The Wood Group of Fairway, one in three Americans don’t have access to that portion of the American dream, and 48 percent of renters don’t ever think they’ll be able to afford a home.

“We have a vision of a housing system that allows renters to share in the benefit of homeownership, enabling all Americans to build wealth.”

Home prices are high and it’s especially difficult to qualify for a mortgage with a low credit score. On top of that, the typical down payment of 20 percent is unaffordable for the 54 percent of renters who want to buy a home, according to LendingTree.

Rather than having nothing to show for their rent payments, Up&Up allows renters to build the wealth needed to buy a home while renting.

Reimagining the Real Estate Relationship

So how does it all work? Meet the Up&Up Wallet, which allows renters to reap the benefits of homeownership while renting.

“The mechanics work similarly to if you were a homeowner, but rather than owning a house outright, we give you a share of the rental profits based on how much you contributed to your Wallet,” Arkesh Patel, head of product, said.

Customers use an app to watch their Up&Up Wallet grow as they get a share of rental profits and home price appreciation every month.

When their lease is up, customers have complete flexibility on how to use the wealth they’ve accumulated. They can cash out, put their funds toward a down payment on the home they’re renting, or they can transfer their Wallet to another Up&Up property and continue building wealth.

When Areiel K. first heard of Up&Up, she had just come out of bankruptcy, and she was concerned she wouldn’t be able to rent a home, let alone buy one. Through Up&Up, she rented for two and a half years and contributed to her Wallet each month. It paid off. She made a 46 percent absolute return on the money she contributed, and she had enough money in her Wallet to afford the down payment to buy the house she’d been renting.

“It’s so powerful to think that renting with us enabled her to do something that she could have never imagined,” said Amanda Chan, who leads consumer product and customer experience. “When you hear stories like that, you realize how incredibly impactful the program can be.”

Up&Up Flips The Landlord-Tenant Relationship On Its Head

Up&Up takes the traditional landlord-tenant relationship and aligns the interests of both parties.

When renters benefit financially from the value of the property, they are incentivized to take better care of their home. Brown said that this alignment “makes the property more profitable for both renters and landlords.”

“We really do everything we can to give renters the power to maximize that wealth month over month,” Chan said. “That comes through taking better care of your house, taking ownership of different maintenance and repairs and making contributions toward our program on a regular basis.”

For example, Up&Up is building a tool that helps renters diagnose a maintenance issue themselves, and then provides a quote for the cost to repair it. Customers then have a choice: fix it themselves, or have Up&Up handle the repair and receive less in shared rental profits that month.

By giving renters more options, they can make better-informed decisions, and increase their sense of independence and ownership in the process - a stark contrast to the traditional landlord-tenant relationship.

Looking to scale

Right now, Up&Up is prioritizing markets where they can help the most people achieve their financial goals.

“We have ambitions to go from the thousands of renters we have today to millions,” Patel said. “To do that, we need to build a lot of behind-the-scenes internal tools, systems and data science models to do things at scale that have traditionally been really hard to do.”

Up&Up aims to acquire, renovate and market homes at scale, while preserving the personal touch that is critical to its trusted customer partnership.

“It’s not about a failed widget improving optimization within a marketing engine of a company. This is the lives and pain and the reality of a lot of people.”

Beyond scale, Chan sees Up&Up as a potential partner in people’s lifelong housing journeys, from renting their first apartment to buying their forever home.

“If we don’t achieve success, we don’t work hard, and we don’t get this done, it’s not about a failed widget improving optimization within a marketing engine of a company,” Brown said. “This is the lives, pain and reality of a lot of people like Areiel, and countless others who see home ownership as unattainable.”

“If not us, then who?” he asked. “That’s what gets me up every morning.”