Darryl Breakbill was riding in an Uber the other day when he saw a familiar logo on his driver’s cell phone screen. “I started making small talk,” he recalled recently, “and the driver asked me what I did for work.”

But his job didn’t require much explaining.

“Before I could even say what Stride was, he immediately told me he knew us and used our services,” the head of enrollment operations said, learning firsthand the effect his work for the independent insurance broker has on its users.

It was an interaction that has begun to occur with increased regularity, he explained. “It’s a really great feeling,” Breakbill said of his work educating Stride’s members and overseeing the customer experience. “His genuine reaction to knowing my place of employment reaffirmed that we’re making a meaningful impact in the insurance space.”

Since its founding in 2014, Stride has partnered with more than 100 leading work platforms to give independent workers the same financial security as full-time employees. The fully remote, San Francisco-headquartered insurance recommendation platform is on the front lines of the largest economic shift in recent memory — the rise of the so-called gig economy — establishing itself as a key provider of benefits to a growing class of nontraditional workers by offering better pricing and more comprehensive insurance to its members.

WHAT STRIDE DOES

That means contractors like Breakbill’s Uber driver — one of the roughly 59 million real estate agents, hair stylists, caregivers and consultants in the United States who identify as self-employed, according to Edelman Intelligence and Upwork — have access to a full marketplace of health and wellness benefits and perks, regardless of the type of work or where they do it.

And the shift is only beginning. With the number of Americans who classify themselves as independent workers expected to reach 90 million over the next six years, according to a survey from Edelman Intelligence, the demand for modernizing the provision of healthcare and adapting it to the needs of an increasingly part-time and disparate workforce has never been greater.

“For far too long, people’s most critical benefits have locked them into situations where they felt like they couldn’t leave a job or do something they were passionate about because they didn’t know how they’d get their benefits covered,” Vice President of Product and Design Ash Martin said.

“I’m excited for a future where anyone can do the work they love and feel confident that they’re taking care of their most important assets — themselves and their families — while doing it.”

Built In met with Martin, Breakbill and Product Manager Tary Kaylor to learn about Stride’s portable benefits platform, and how the company is adapting to changes in the healthcare industry to meet the needs of a modern workforce.

What separates Stride from other companies in the healthtech industry?

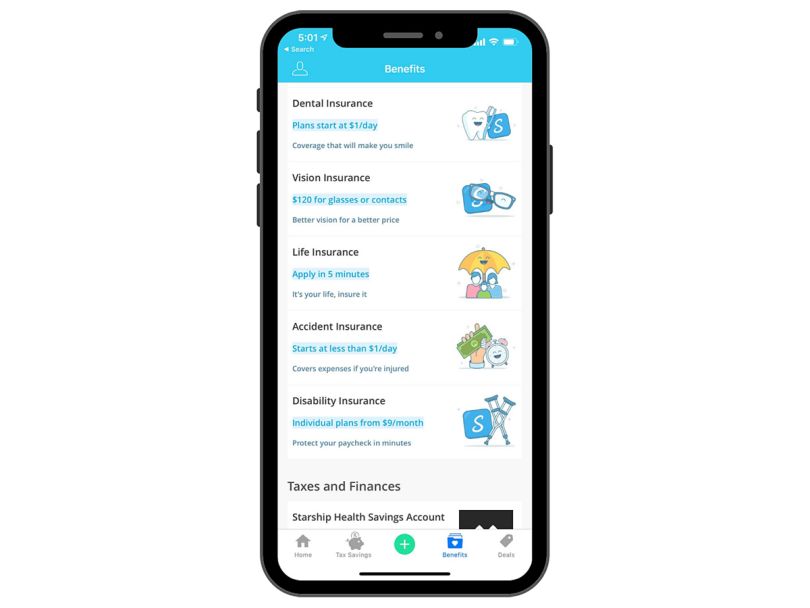

Vice President of Product and Design Ash Martin: Everything we do is centered around our customers. For instance, our entire shopping and enrollment experience was built mobile-first, because the majority of our customers use their phone for work and don’t have access to a desktop computer. We also built the leading mileage tracking and expense management app for 1099s, and we gave it away for free so that members could build good financial habits without having to worry about how to pay for it. Our recommendation engine — and our member experience team — is commission-blind, so we don’t recommend the plan that will make us the most money. We recommend the one that will save our customer the most money, even if we don’t get paid.

HOW STRIDE GENERATES REVENUE

Head of Enrollment Operations Darryl Breakbill: Our willingness to jump in and help our teammates. In my experience, many employees have a “that’s not my job” approach to their work. We have a shared goal here at Stride, and we all want to contribute to our success and help our customers. We collaborate a lot more than I ever have at other companies. I think that makes us stand out in the industry.

Product Manager Tary Kaylor: For me, it’s the company’s culture. I felt more welcome and included before my first day here than in any previous job I’ve had. There’s a soul in this company — a drive to do what’s right for the employees and for our customers. It starts at the top and trickles down to all employees.

“There’s a soul in this company — a drive to do what’s right for the employees and for our customers.”

How does Stride effectively respond to changes in the industry?

Martin: Adaptability is our superpower here at Stride. We work with some of the largest gig workforce platforms in the country, and these partners have evolved a ton over the past 10 years, so we need to evolve alongside them. We’re constantly evolving to ensure we have the best products and the most seamless experience available for our members. It isn’t just about building something that will stand the test of time but building to evolve with time as well.

STRIDE’S WORK-PLATFORM PARTNERS

- Uber

- DoorDash

- Instacart

- Amazon

- Lyft

- Gopuff

- Fiverr

- GrubHub

- Etsy

- Patreon

- Rover

- Task Rabbit

Stride offers the rare opportunity to work in the private sector while doing public good. How nice is it to have your work have such a positive impact on the customers you help?

Martin: Knowing that what we’re doing is not only solving an interesting technology and product problem, but that we’re also making an impact on the lives of millions of Americans, is literally the reason why I took the job. Every time I find myself navigating a challenging situation, I just go over to our #user_feedback channel in Slack and scroll through all of the incredible comments we have from our customers about the impact we’re having on their lives. We hear customers tell us things like, “Thank you for making the experience of figuring out the right health plan feel like magic,” or, “I haven’t been able to see a dentist for 10 years, I’m so glad I found Stride.” This is my fuel to keep working hard on solving these problems.

Why is working toward this mission so important to you?

Kaylor: Having worked in health insurance for years, I’ve watched deductibles increase while premiums increase, making the safeguard for healthcare unattainable for so many Americans. In my role, I can help break that old perception — and help people understand that healthcare really can be within their reach. Especially for people with ongoing healthcare needs, this is one of the most important decisions people make every year. We help them find the most robust plan they can afford, and it’s often better than they think.

MAKING AN IMPACT

Martin: I grew up in a lower-middle class household, and while we were fortunate enough to always have a roof over our head, I saw firsthand the impact that explosive credit card debt could have on a family’s finances. Medical debt is one of the leading causes of bankruptcy in the United States, and we’re doing our part to ensure people get access to coverage that would otherwise go uncovered so they can avoid that kind of life-ruining debt.

“Medical debt is one of the leading causes of bankruptcy in the United States, and we’re doing our part to ensure people get access to coverage so they can avoid life-ruining debt.”

What is your vision for the company? What will it take for you to see it to fruition?

Breakbill: I just want us to help everybody obtain the coverage they need — and I believe we’re on the right track to do that. Currently, we’re working on process improvements to make sure the consumer experience is efficient and meaningful to the population we serve. We’re also looking at enhancing internal tools to make sure we can effectively enroll consumers into their plan of selection while maintaining compliance. I think we have what it takes to achieve our goals, because we have an awesome group of people dedicated to achieving it.