San Francisco-based crypto trading platform CoinList announced Tuesday that it raised $100 million in fresh financing. The Series A round, co-led by Accomplice and Agman, solidifies the company’s status as a unicorn with a valuation of $1.5 billion.

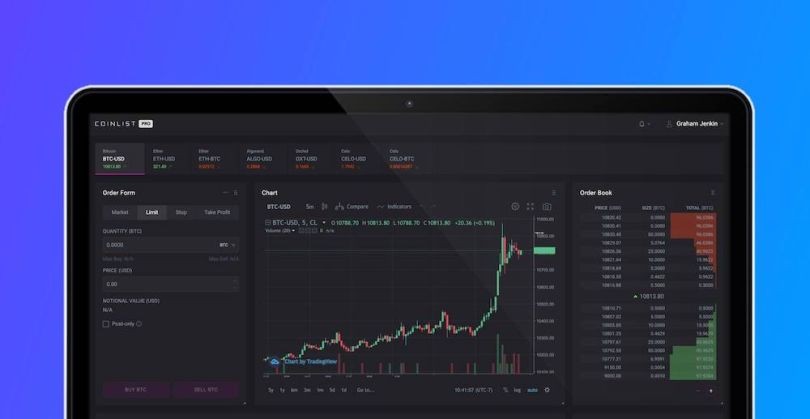

CoinList’s trading platform is used by digital asset companies to run their token sales. The platform facilitates sales for a long list of crypto giants including Solana, Dapper Labs and Blockstack.

“Unlike other centralized crypto finance platforms, we’re not here to build a bank or a brokerage. We’re building the platform for people who are passionate about moving crypto forward,” the company said in a statement.

The fresh injection of capital couldn’t have come at a better time for the platform, which has taken off as the crypto craze continues to sweep the globe. Just over the last 12 months, CoinList’s user base increased 42x. Not only that, but monthly trading volume on the platform increased to $1 billion over the course of 2021 alone, while CoinList’s number of average monthly traders increased 8x.

CoinList will use the additional capital to accelerate the adoption of crypto worldwide as it continues to scale. The trading platform’s massive user base currently spans over 170 countries.

CoinList’s user base isn’t the only thing expanding, the company is also hiring. The 75-person company is looking to double its headcount over the next 12 months, CoinList CEO Graham Jenkin told The Block. The trading platform is currently searching for over 20 fresh faces to join its sales, operations and product teams, to name a few.

CoinList has raised $119.2 million in venture capital financing to date, according to Crunchbase.

Additional investors HashKey Capital, Access Ventures and Alphemy Capital participated in the round, among others.