Last year’s pursuits to go public got off to a crawling start, but by year’s end, 2020 proved record-breaking.

Companies that were highly anticipated to go public in the early part of 2020 — Airbnb, DoorDash and Asana — paused plans amid COVID-19 concerns.

That all changed in early summer. The market turned, and a goldrush of IPOs followed, including the three aforementioned companies.

By the end of December, 480 companies went public, a 106 percent increase over 2019’s tallies.

Additionally, more IPOs last year doubled in value during their opening days than any year since 1999. In September, Snowflake made history, clocking in the largest software IPO of all time, and Airbnb continued its trend as a tech darling, raising $3.5 billion in its public debut.

As experts look to what is likely to be another marquee year for tech IPOs in 2021 — see Roblox, Nextdoor and Instacart, among others — Built In reflects on 2020’s notable tech IPO wins.

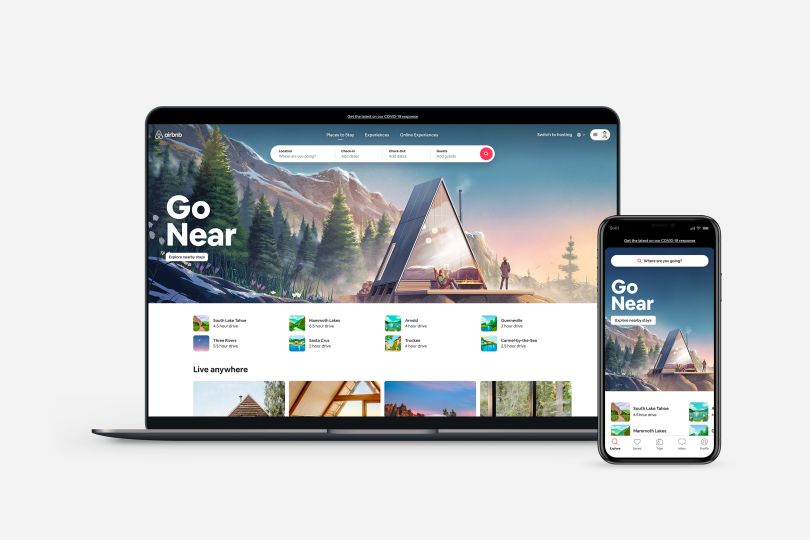

Airbnb’s IPO marked the largest of 2020, coming in at $3.5 billion raised. The global accommodations reservation platform includes 4 million hosts, 800 million guests and locations available in 100,000 cities. It’s the biggest of the short-term rental marketplaces.

Founded: 2008

IPO: Dec. 10; Raised $3.5B

NASDAQ: ABNB

A note from the CEO: In a recent interview with CNBC, CEO Brian Chesky said the company anticipates an increase in hosts on their platform as people look for alternative sources of income. “We want to help unlock hosting all over the world and continue to make our product much easier to use,” Chesky told CNBC. Additionally, Chesky said they will focus on “inspiration” and matching renters with “the perfect home experience.”

After surpassing GrubHub as the country’s leading digital food delivery service in 2019, DoorDash went public at the end of 2020 and set one of the largest IPOs of the year. DoorDash stock surged over 80 percent of its initial offering within hours of going live.

Founded: 2013

IPO: Dec. 9; Raised $3.4B

NYSE: DASH

A note from the CEO: In an interview with The New York Times, CEO Tony Xu said the company would be proceeding cautiously after a hot start on the market. “I recognize the significance of the milestone and the moment, but it is one day on this multi-decade journey,” Xu said.

Snowflake

Snowflake’s exploration into the public space led to the largest IPO ever for a software company. Its stock doubled in value by the time it went live on the NYSE and its valuation climbed five times what it was in February 2020. Snowflake’s cloud-based data platform, which competes with services offered by Amazon, Microsoft and IBM, hosts and connects data lakes and warehousing to enable data engineering, data sharing and data science modeling.

Founded: 2012

IPO: Sept. 16; raised almost $3.4 billion

NYSE: SNOW

A note from the CEO: In a December statement announcing the company’s Q3 FY 2021 results, CEO Frank Slootman said, “We are pleased with our performance this first quarter as a public company. The period was marked by continued strong revenue growth coupled with improving unit economics, cash flow, and operating efficiencies. Our vision of the Snowflake Data Cloud mobilizing the world’s data is clearly resonating across our customer base.”

The NYSE’s first-ever “virtual bell ringing” occurred at the September IPO bid of Unity Technologies. This event included a 75-minute live webcast featuring Unity leaders at its San Francisco headquarters, as well as an appearance from CTO Brett Bibby, who joined the call from Copenhagen. Unity’s platform helps creators design and monetize video games and real-time 3D (RT3D) content.

Founded: 2004

IPO: Sept. 17; $1.3B

NYSE: U

A note from the CEO: Unity management took a different approach to its IPO by selecting which investors would receive shares instead of the investment bankers making that call. CEO John Riccitiello called it a “UPO.” “We wanted to select investors we were proud to partner with,” Riccitiello said in a presentation.

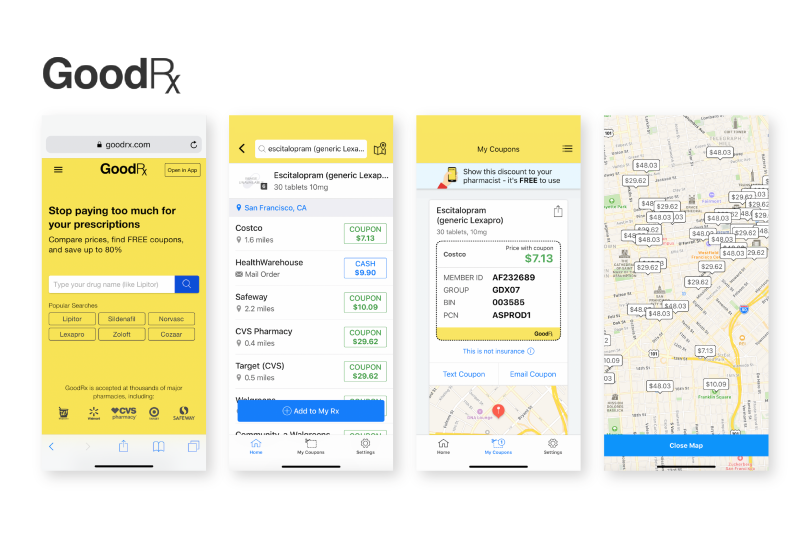

GoodRX has helped Americans without health insurance save $20 billion on prescriptions, the company reported. Its app has also earned the top downloaded medical app across Apple and Google’s stores. As part of the company’s exit from the private sector, GoodRX announced it will dedicate more than 1 million shares from its IPO to its philanthropic program that provides medications to citizens in need.

Founded: 2011

IPO: Sept. 23, Raised $1.1B

NASDAQ: GDRX

A note from the CEOs: On a company blog posted the morning of GoodRX’s first day public, co-CEOs Doug Hirsch and Trevor Bezdek said, “As a public company, we hope to provide even more services that help people get the healthcare they need at a price they can afford. To our employees, our families, and the everyday Americans who have turned to us for help: Thank you for supporting our mission to provide every American the affordable and convenient healthcare they deserve.”

ZoomInfo’s summer IPO marked the highest public offering at the time for a tech company in 2020. Its subscription service gives sales teams access to its growing database of contacts and company info to improve prospecting efforts. More than 15,000 companies spanning all industries have added ZoomInfo’s AI platform to their sales and marketing strategies.

Founded: 2000

IPO: June 4; Raised $935M

NASDAQ: ZI

A note from the CEO: CEO Henry Schuck told Forbes that ZoomInfo recorded its highest opening month of a sales quarter just two months before going public. “The business proved pretty resilient through the pandemic,” Schuck told Forbes. “Coming out of that, investors said, ‘we’re ready.’”

GoHealth set the summer record for the highest IPO in healthcare, after raising more than $913 million on the NASDAQ. The Chicago-based online insurance broker initially led the industry in health insurance enrollments by way of the Affordable Care Act, according to Chief Strategy Officer Brandon Cruz. In 2016, however, the company pivoted to Medicare Advantage plans. Cruz told MedCity News that they hope to gain better brand recognition by going public.

Founded: 2001

IPO: July 15; Raised more than $913M

NASDAQ: GOCO

A note from the company: “The proportion of the population that is age 65 and older increased from 13 percent in 2010 to 15 percent in 2016 and is expected to reach 17 percent by 2020, according to the United States Census Bureau,” the company said in its SEC filing. “As a result, Medicare enrollment is growing steadily, with the number of Medicare enrollees expected to grow from 59.9 million in 2018, to approximately 68.4 million in 2023 and 76.7 million by 2028.”

Instead of weighing factors like marital status, zip code and demographic to determine car insurance rates, Root Insurance uses individual driving patterns. When drivers show they continuously drive safely, as measured by Root’s mobile app, they are rewarded with better rates. This unique model contributed to Root’s $1 billion valuation in 2018 and its successful exit in 2020.

Founded: 2015

IPO: Oct. 28; Raised $724.4M

NASDAQ: ROOT

A note from Root: “The way we design and deliver insurance is not a simple tweak to the traditional insurance model,” the Root IPO filing said. “We are fundamentally reinventing insurance through technology, data science and a maniacal focus on the customer.”

Businesses continue to outsource IT operations to save costs and operate more efficiently. As a result, services that support managed service providers (MSPs), like Datto, are also on the rise. As of 2020, Datto supported 17,000 MSPs with data protection backup and recovery services, as well as collaboration tools and server security.

Founded: 2007

IPO: Oct. 21; Raised $594M

NYSE: MSP

A note from the CEO: “Please know that being a public company will not change Datto’s core. We are excited to expand our investor base and champion the MSP ecosystem,” CEO Tim Weller said in a statement to Datto’s MSP partners. “Our MSP-first culture is deeply rooted in technology innovation through your eyes, in our shared recurring revenue business models designed for you to capture profitable growth and build the value of your business, and in our 24/7 direct-to-human support as an extension of your team.”

Duck Creek Technologies counts Geico, AIG and Liberty Mutual as users of its suite of solutions aimed to help property and casualty and general insurance companies navigate the market. In the fourth quarter alone, the Boston-based company reported a 54 percent growth in subscription revenue and closed out the year 85 percent higher than 2019’s annual recurring revenue.

Founded: 2000

IPO: Aug. 14; raised $405M

NASDAQ: DCT

A note from the CEO: “The success of our recent IPO was the latest important milestone for Duck Creek. We are at an exciting time in our history with the global P&C insurance industry at what we believe is the early stages of a generational shift to cloud technologies for their core systems,” CEO Michael Jackowski said in a statement announcing the company’s Q4 and 2020 fiscal year financial results.

Chicago-based Oak Street Health provides a network of care centers and 24/7 digital support for adults on Medicare. Its model assumes the financial risks of its patients’ costs by taking a monthly per-patient payment from insurers. On the company’s first day on the NYSE, Oak Street’s stock price jumped 102 percent.

Founded: 2012

IPO: Aug. 6; Raised $328M

NYSE: OSH

A note from the CEO: In an address reviewing Oak Street’s third quarter results, CEO Mike Pykosz said, “Since the end of the third quarter, we have opened four additional standalone centers, including our first locations in New York City and Mississippi, as well as the first of three Walmart pilot locations in Texas. Looking ahead, we continue to be excited by the ample opportunity to drive continued de novo expansion across both new and existing markets, as well as the complementary growth opportunities presented by our Walmart collaboration and CMS’ Direct Contracting program.”

Sumo Logic

Sumo Logic’s first quarter as a public company proved a success. The big data platform, which continuously collects and analyzes data from applications, infrastructure, security and IoT devices, reported Q3 revenue close to $52 million, a YoY increase of 28 percent. The company has north of 2,100 customers.

Founded: 2010

IPO: Sept. 17, Raised $326M

NASDAQ: SUMO

A note from the CEO: In a press release outlining Sumo Logic’s third quarter numbers, CEO and President Ramin Sayer said, “Sumo Logic is the pioneer of continuous intelligence, enabling organizations to accelerate their shift to cloud computing and modern application architectures. With new use cases continuing to emerge across operational intelligence, security intelligence and business intelligence, we see a long horizon of growth ahead of us.”

Lemonade

Less than four years after it was founded, employees of Lemonade celebrated the insuretech startup’s first day on the NYSE. The NYC company is one of the largest providers of renters insurance in the country and uses AI and smart contract technologies built on blockchain to usher fast claim payouts. Lemonade wrapped 2020 by welcoming its 1 millionth active customer.

Founded: 2015

IPO: July 2; Raised $319M

NYSE: LMND

A note from the COO: “We’re proud to hit the 1 million customer mark so early in the life of the company,” said Shai Wininger, co-founder and COO, in a statement. “With every new customer, our system grows smarter, our underwriting gets better, and our prices become more accurate and fair. At Lemonade, 1 million customers translates into billions of data points, which feed our AI at an ever-growing speed. Quantity generates quality.”

Schrödinger is making waves in biopharma by using AI to accelerate drug discovery and materials for industrial, government and academic organizations, as well as its own internal drug programs. Its simulation models, which are used by the top 20 pharmaceutical companies in the world, digitally replicate a pharmaceutical chemist’s work to predict a drug’s potency, solubility and selectivity.

Founded: 1990

IPO: Feb. 6; raised $232M

NASDAQ: SDGR

A note from the CEO: In a statement announcing its Q1 financial results, CEO Ramy Farid, Ph.D., said that the company’s IPO “is a credit to our employees and our commitment to advancing the science underlying our platform.”

The retail industry was already moving online, but the pandemic shifted this trend into hyperdrive. Businesses without digital stores turned to services like BigCommerce to get online quickly. Today, its platform hosts more than 90,000 digital stores. BigCommerce’s IPO was not the biggest of the year, but after its stock jumped 201 percent on its market debut, it was the largest IPO burst for a VC-backed tech company in 2020.

Founded: 2009

IPO: August 5; Raised $216.5M

NASDAQ: BIGC

A note from BigCommerce: “We believe we are well-positioned to continue to benefit from the macro-economic shift to e-commerce that COVID-19 has accelerated, but revenue may be more variable in the near-term as a result,” BigCommerce said in its IPO filing.

fuboTV

The exodus from cable subscriptions to streaming services lives on. After initially launching as a sports streaming platform, fuboTV expanded its subscriptions this past year to include news and entertainment by merging with entertainment company Facebank Group. This move contributed to a 58 percent increase in subscribers from Q3 2020.

Founded: 2014

IPO: Oct. 14; Raised $183M

NYSE: FUBO

A note from the CEO: “We ended the quarter with an all-time high of 455,000 paid subscribers,” David Gandler, co-founder and CEO of fuboTV, said in a press release. “A heavy sports calendar, busy news cycle and Hollywood’s fall entertainment season delivered many viewing options for consumers. We continued to grow fuboTV’s premium personal viewing experience with the launch of new product features and new programming including Disney Media Networks (ABC, ESPN, many more), MLB Network, NBC News Now and more.”

Asana

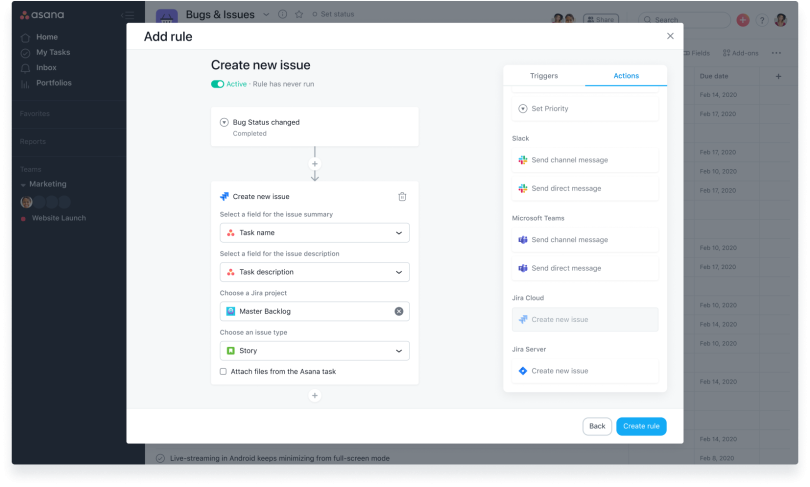

Mark Zuckerberg’s former college roommate and Facebook Co-Founder Dustin Moskovitz helped lead Asana through its public debut in the fall. The work collaboration and project management platform borrowed a move from Slack by filing through a direct listing.

Founded: 2008

IPO: Sept. 30, Direct listing

NYSE: ASAN

A note from the CEO: In a company all-hands the day Asana went public, CEO Dustin Moscovitz said, “We built Asana because the work people do together matters. We’re proud of how often teams tell us that Asana gives them the clarity to make their work today more effortless, and we’re just getting started.”

Palantir

Following Spotify’s and Slack’s IPOs, Denver-based Palantir completed a direct listing on the NYSE by having investors sell shares in place of raising capital through stock sales. Palantir’s big data engines support enterprise and government agencies and have been used for AI and machine learning, auto racing, financial compliance and more.

Founded: 2004

IPO: Sept. 30; Direct listing

NYSE: PLTR

A note from the CEO: CEO Alex Karp shed light on the timing of Palantir’s IPO, which took place 17 years after launch. “Over the years we’ve been skeptical about listing for lots of reasons. We reached a base where our company is very significant, and we believe being in the public space will help us with our clients and help us grow,” Karp said. “And quite frankly, I believe the people at Palantir, who have helped us build this company over 17 years, deserve liquidity.”

Header image by VideoFlow/Shutterstock