Let’s see if you can relate to this scenario: Your startup has less than 10 employees. You personally wear many hats — founder, CEO, CFO, HR, operations ... the list goes on. You’re up at 2 a.m. trying to figure out a discrepancy in Quickbooks Online. Sleep is minimal.

If you’ve ever helped build a startup, you know what I’m talking about. Early on, you must fulfill many roles, because, well, you can’t afford not to. However, there comes a point where you start moving and grooving, and you must pass on some of your duties. It’s one of the hardest things a founder or early team member must do.

I know this because I used to be a VC, and I watched many founders go through this exact, strenuous process. Specifically in regard to accounting and finance.

Even when a startup is small, it needs CFO and controller oversight. Somebody managing the books and helping you see into the financial future of your business. If you plan on raising future rounds, taking on a line of credit, staying compliant, or simply growing as a business, you’ll need clean books and financials that tell a story. However, there often just isn’t “40 hours per week” worth of work for a CFO and/or controller at an early startup, so the cost of a full-time hire is hard to justify.

There is typically this void early on at a company where you need the support of a real CFO or controller, but you can’t afford one. That’s where fractional accounting comes in.

I’m sure you’ve heard some of your founder friends talk about how they’ve outsourced their accounting or finance function to a firm. I’ve watched this tactic become more and more popular over the years, so much so that I shifted from being a VC back into the world of accounting. I now run a fractional accounting firm focused on startups called Graphite. Recently, this tactic has become very popular in the startup ecosystem because it’s simply a smart financial and operational move. Let’s discuss why.

What Is Fractional Accounting?

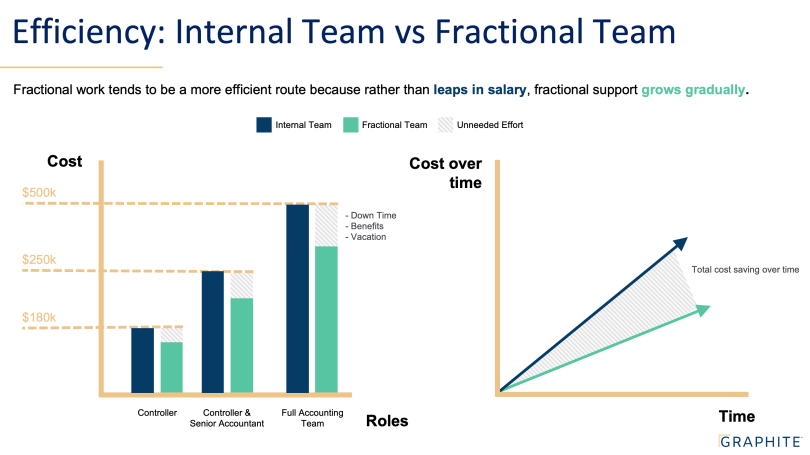

Fractional accounting is when you hire a firm or an individual to manage your finances on a fractional basis ... meaning they aren’t full-time, and they only provide the exact hours required to fulfill your specific needs. This contrasts to hiring an individual full-time. Even if you don’t have 40 hours worth of work per week to give a full-time employee, you’re still paying them their full salary, vacation time and benefits.

Why Are So Many Startups Outsourcing Their Accounting?

Startups benefit from fractional accounting because it allows them to receive extremely high-quality support without having to pay an arm and a leg to get it. Plain and simple, it makes financial sense. Actual effort needed tends to fall much below anticipated effort (i.e. an employee’s salary), so fractional work can save you money and time, which can be reallocated toward strategy and growth.

Additionally, even as companies grow and perhaps hire a CFO internally, it often makes sense to continue to outsource the controller function.

What Is It Like Working With a Fractional CFO/Controller?

All firms are different. The goal is to find a firm that provides quality support and has the references to prove it. One benefit of working with a firm is that they’ve worked with hundreds of startups and bring that knowledge back to you. With a solid firm, using fractional support typically just feels like an extension of your team. Many are nervous they will only hear from a fractional firm once a month when they send over a financial package. However, as long as you find a quality firm, you’ll be surprised at how much it feels like they are part of your team. They work within your slack, or however you communicate. You speak with them every other day. You pull them into your board meetings. It truly is just like an internal team.

What Are the Pros of Working With a Fractional Accounting Firm?

- Typically less expensive than hiring internally.

- You receive the entire knowledge base of a firm who has worked with hundreds of startups, compared to working with an individual who has only held so many roles.

- The support is flexible, and can grow or shrink as you need it to.

- It is self-managing, so it allows you to focus on your core competencies as a business, compared to having to hire, train and develop an accounting team.

What Are the Cons?

- It is difficult to compare firms on an apples to apples basis — “bookkeeping” does not equal “accounting” and all the functions that come along with it.

- This concept is fairly new, so you may simply be used to having and working with a team in-house.

How Do I Hire a Fractional CFO/Controller?

Here are a list of things you should consider when hiring an outsourced accounting firm:

- References, references, references. The firm should be able to provide multiple references who can speak to the quality of work they provide.

- Would you like the team you work with to be U.S. based? It’s important to ask where the firm’s accounting team members are located.

- An expertise in early stage startups is important. There are nuances to early stage accounting, especially if you are a SaaS, eComm or InsurTech startup. Make sure the firm you work with specializes in startups and the specific industry you operate in.

- Flexible cost structure. If right off the bat and without digging into your business, a firm says, our cost is $500/mo, be suspicious. As with everything in life, if it seems too good to be true, it probably is. Every startup is different, which means the type of support each startup needs varies drastically. Find a firm that offers custom pricing based on your needs, so you can ensure you get the exact support your specific business requires.

- Ask around! You’ll be surprised at how many of your colleagues have used fractional accounting support. I’m sure you can get a ton of recommendations just from your network alone.

I’m always happy to connect with founders and startups, so if you have any specific questions about your accounting, feel free to reach out to me. I’m [email protected].